Required: Journalize the transactions shown below in the two-column general journal. Note: Round amounts to the nearest cent when applicable. *Note - The rate

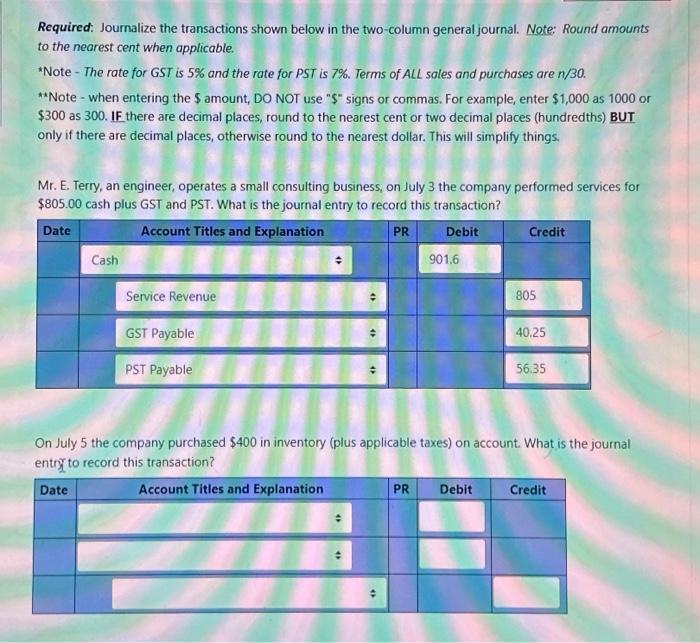

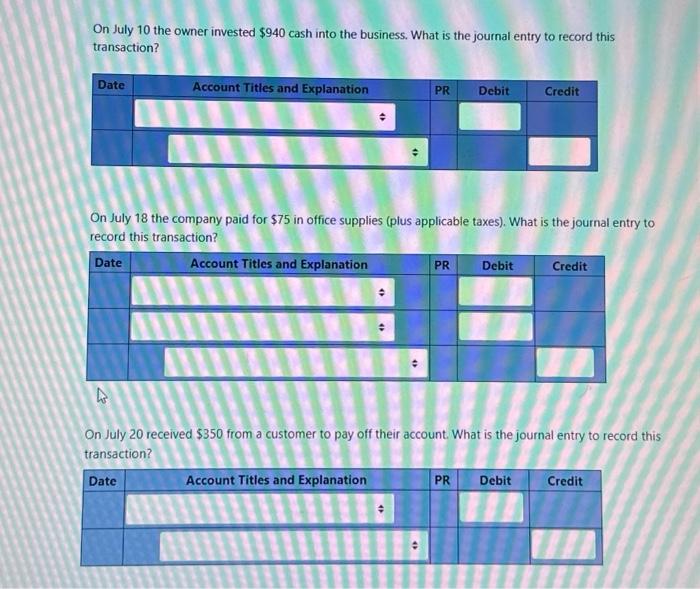

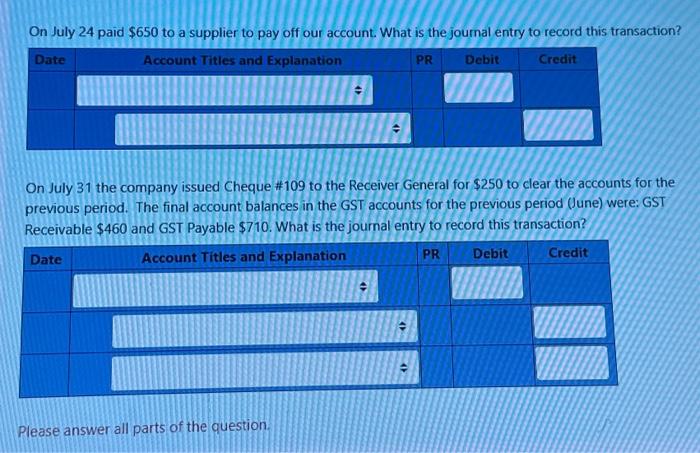

Required: Journalize the transactions shown below in the two-column general journal. Note: Round amounts to the nearest cent when applicable. *Note - The rate for GST is 5% and the rate for PST is 7%. Terms of ALL sales and purchases are n/30. **Note - when entering the $ amount, DO NOT use "$" signs or commas. For example, enter $1,000 as 1000 or $300 as 300. IF there are decimal places, round to the nearest cent or two decimal places (hundredths) BUT only if there are decimal places, otherwise round to the nearest dollar. This will simplify things. Mr. E. Terry, an engineer, operates a small consulting business, on July 3 the company performed services for $805.00 cash plus GST and PST. What is the journal entry to record this transaction? Date Account Titles and Explanation Cash Service Revenue GST Payable PST Payable 4 PR Debit Credit 901.6 805 40.25 56.35 On July 5 the company purchased $400 in inventory (plus applicable taxes) on account. What is the journal entry to record this transaction? Date Account Titles and Explanation 4 4 PR Debit Credit On July 10 the owner invested $940 cash into the business. What is the journal entry to record this transaction? Date Account Titles and Explanation PR Debit Credit On July 18 the company paid for $75 in office supplies (plus applicable taxes). What is the journal entry to record this transaction? Date Account Titles and Explanation PR Debit Credit 4 PR Debit Credit On July 20 received $350 from a customer to pay off their account. What is the journal entry to record this transaction? Date Account Titles and Explanation " On July 24 paid $650 to a supplier to pay off our account. What is the journal entry to record this transaction? Account Titles and Explanation Credit Date PR Debit 47 On July 31 the company issued Cheque #109 to the Receiver General for $250 to clear the accounts for the previous period. The final account balances in the GST accounts for the previous period (June) were: GST Receivable $460 and GST Payable $710. What is the journal entry to record this transaction? Date Account Titles and Explanation Please answer all parts of the question. 4 PR Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started