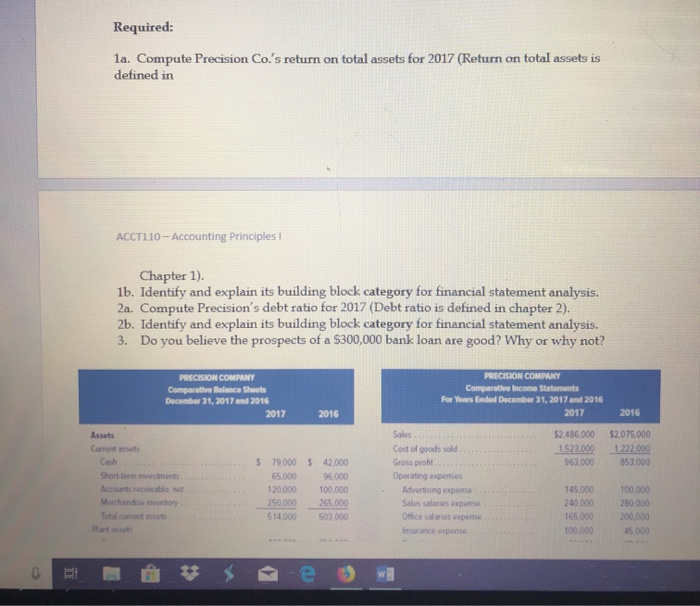

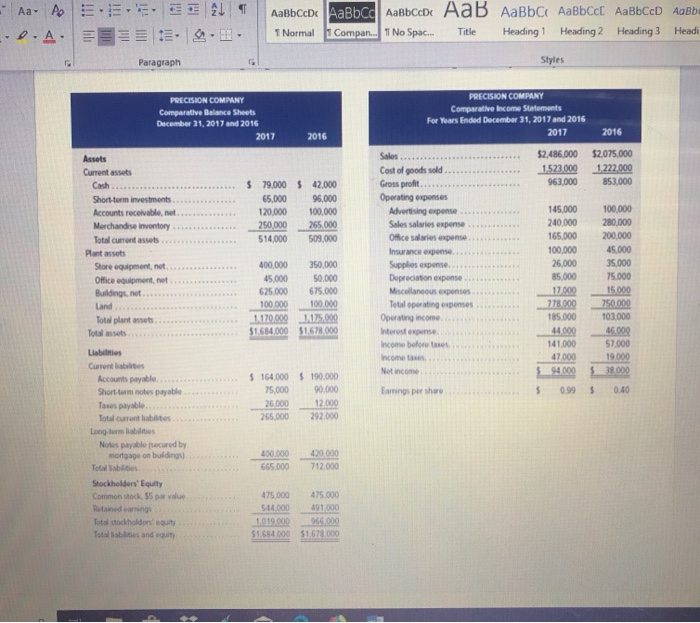

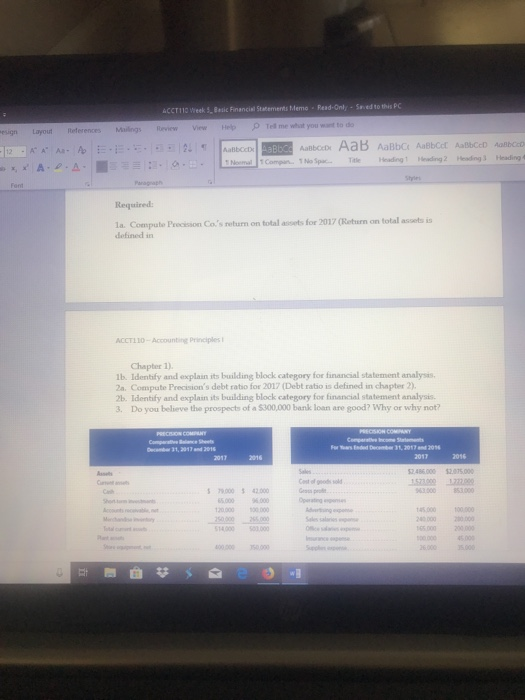

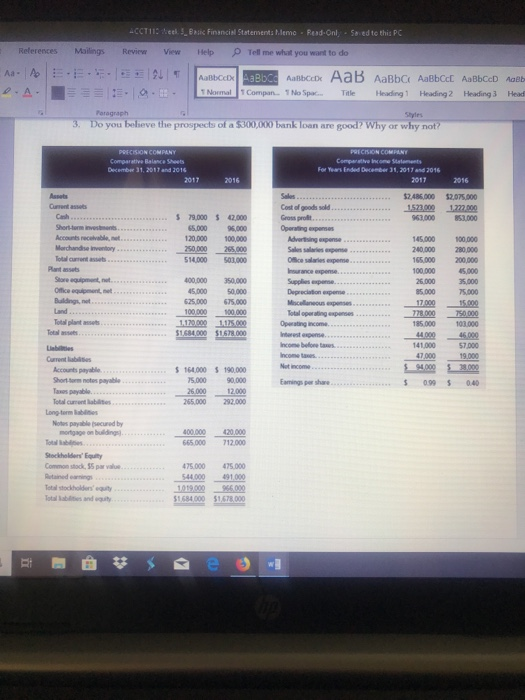

Required: la. Compute Precision Co.'s return on total assets for 2017 (Return on total assets is defined in ACCTI10-Accounting Principles Chapter 1). 1b. Identify and explain its building block category for financial statement analysis. 2a. Compute Precision's debt ratio for 2017 (Debt ratio is defined in chapter 2). 2b. Identify and explain its building block category for financial statement analysis. 3. Do you believe the prospects of a $300,000 bank loan are good? Why or why not? PRECISION COMPANY Comparathe Income Statoments For Years Eaded December 31, 2017 and 2016 2017 Comparative Balance Shoots December 31, 2017 and 2016 2016 2017 2016 2.486.000 $2.075,000 Assets Sales 1523 000 122200 63.000853.000 Current assets Cost of goods sold Gross proft Cash 79,000 $ 42.000 65.00096.000 Short torm investments Operating expenses Accounts toceivable, net Morchandse inventory 120.000 100.000 Advertising exponse 145.000 100.000 250.000 265.000 Sales salaries exponse 40.000280 000 165,000200.000 Totul croit assets 514,000 503,000 Office salaries expense Insurance expense 100000 45.000 aBboDx AaB AaBbCr AaBbCct AaBbCcD AaBlb AZ |||Normal Heading 1 Heading 2 Heading 3 Headi ! :=-12.-1. "No Spac._ Title T Compan .. . . - Paragraph PRECISION COMPANY Comparative Income Statements Comparative Balance Sheets December 31,2017 and 2016 For Years Ended December 31, 2017and 2016 2016 52486,000 $2075,000 1523000 1222,000 963000 853000 Current assets Gross profit Operating exponses $ 79,000 42.000 5,00096,000 Short-term investments.. Accounts recelivable, net 45,000100,000 240,000 280,000 65,000200,000 Advertising expense Sales salaries expense 250,000 265,000 Merchandise inventory otal current assets Plant asset Store equipment, net Office salaries expense Insurance expense 14,000 509,000 00,00045.000 26,000 35.000 85,000 75.000 400,000 350,000 Supplies expense. Dopreciation exponse Miscellaneous expensers Tetal operating expenses 5,00050.000 25.000 675,000 Office equipment, net Buildings, net 100.000 100.000 85.000 103,000 1,170.900 1175 090 684.000$1,678,000 Total plant assets Total assets Interest expense 141,000 $7000 income before tase 7000 ncome taxes Current bablites 94000 38000 Net income 164,000 190.000 5,000 90,000 26,00012.000 65,000 292.000 Accounts payable $ 0.99 040 Earmings per share Short-term notes payable Tases payable Total current habilites Long-term liablibes Notes payable secured by mortgage on buildings 0000042000 4 665.000 712.000 Total Sabilities Stockholders Equity Common stock, $5 par value 475.000 475.000 44000491.000 1019.000965.00 1.684 000 $1.678.000 Retained earning Total stockholdons equty Total Bablites and equit AcCT110 Week s,Baic Finencial Stacements Meme Read-Onl - Sn ed to this PC Tel me what you want to do Help eign Layout ReferencesMailingsReviewView Required la. Compute Peecisson Co's return on total assots for 2017 (Returm on total assets is defined in ACCT11O-Accounting Principles Chapter 1) 1b. Identify and explain its building block category for financial statement analysis. 2a. Compute Precision's debt ratio for 2017 (Debt ratio is defined in chapter 2) 2b. Identify and explain its building block category for financial statement analysis 3. Do you believe the prospects of a $300,000 bank loan are good? Why or why not? 2.486 000 $2.075.000 s7%00 % 4200 3 000530 500096000 200000.00 4500010000 4000020.0 5000200.0 140003000 acceek. 5,Bsic Financial Statements Memo Read-Onl, 5a-ed to this PC ReferencesMailingsRevie View Help Tell me whait you want to do omal Compan. No Spac. TitleHeading1 Heading2 Heading 3 Head Styles you For Years Ended Decenber 31, 2017 and 2016 2016 Sales Cuent assels Cost of goods sold.... Gross prollt Operalting expenses 79,000 s 42,000 5.000 96,000 Cash Shert-orm investments... Accounts recelvabile, et 963000 853.000 45,000 100,000 40,000 280,000 165000 200,000 120.000 00,000 145000 Marchandse inventory 250,000265,000 514000 503,000 Ofice salaries expense. Insurance expense. Supplies expee Depreciation xpene Plant asseb Store equipment, not. Office equipmentet 400,000 350,000 45,00050,000 26,000 35,000 5000 75,000 625,000 675,000 100,000 00000 Land otal plant assets .1170000 $1,684000 $1678.000 185000 103,000 Total ansets Income beloe 141,000 47,000 Current labes Not income 164,000 $ 000 Accounts payable Short-Sorm notes payable Tasos payable 5,00090,000 Earmings per share. 09 040 26,000 12000 Told current latites 265.000 292,000 Long-torm Babes Notes payable (secured by mortgage onbulding 400.000 420.000 65,000 712000 Stockholders Equity Common stock, 35 par vale 75000 475,000 544000491000 1019000966 000 1684,000 $1,678 000 Total stockholders equty otal Sabilities and equity