Answered step by step

Verified Expert Solution

Question

1 Approved Answer

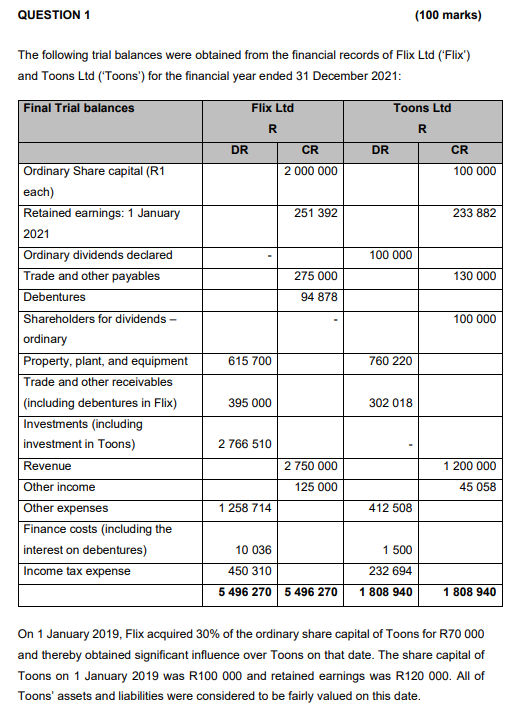

required more time to do - OK The following trial balances were obtained from the financial records of Flix Ltd ('Flix') and Tonns I td

"required more time to do" - OK

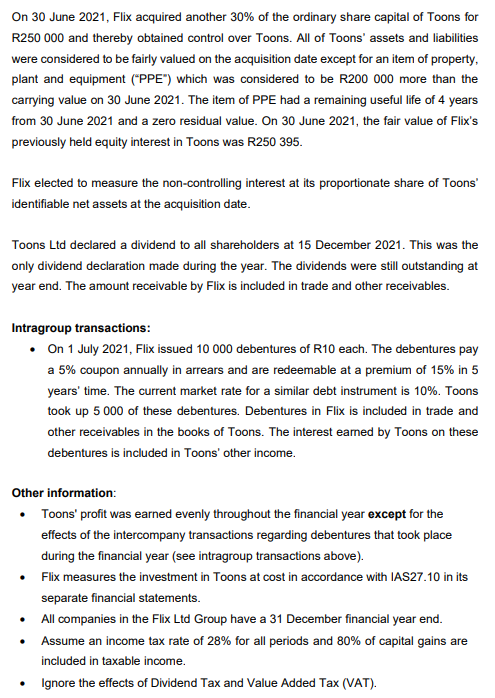

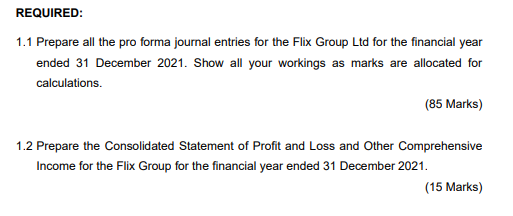

The following trial balances were obtained from the financial records of Flix Ltd ('Flix') and Tonns I td ('Tonns') for the financial vear ended 31 Deremher 2021 . On 1 January 2019 , Flix acquired 30% of the ordinary share capital of Toons for R70 000 and thereby obtained significant influence over Toons on that date. The share capital of Toons on 1 January 2019 was R100 000 and retained earnings was R120 000. All of Toons' assets and liabilities were considered to be fairly valued on this date. were considered to be fairly valued on the acquisition date except for an item of property, plant and equipment ("PPE") which was considered to be R200 000 more than the carrying value on 30 June 2021. The item of PPE had a remaining useful life of 4 years from 30 June 2021 and a zero residual value. On 30 June 2021, the fair value of Flix's previously held equity interest in Toons was R250 395. Flix elected to measure the non-controlling interest at its proportionate share of Toons' identifiable net assets at the acquisition date. Toons Ltd declared a dividend to all shareholders at 15 December 2021. This was the only dividend declaration made during the year. The dividends were still outstanding at year end. The amount receivable by Flix is included in trade and other receivables. Intragroup transactions: - On 1 July 2021, Flix issued 10000 debentures of R10 each. The debentures pay a 5% coupon annually in arrears and are redeemable at a premium of 15% in 5 years' time. The current market rate for a similar debt instrument is 10%. Toons took up 5000 of these debentures. Debentures in Flix is included in trade and other receivables in the books of Toons. The interest earned by Toons on these debentures is included in Toons' other income. Other information: - Toons' profit was earned evenly throughout the financial year except for the effects of the intercompany transactions regarding debentures that took place during the financial year (see intragroup transactions above). - Flix measures the investment in Toons at cost in accordance with IAS27.10 in its separate financial statements. - All companies in the Flix Ltd Group have a 31 December financial year end. - Assume an income tax rate of 28% for all periods and 80% of capital gains are included in taxable income. - Ignore the effects of Dividend Tax and Value Added Tax (VAT). 1.1 Prepare all the pro forma journal entries for the Flix Group Ltd for the financial year ended 31 December 2021. Show all your workings as marks are allocated for calculations. (85 Marks) 1.2 Prepare the Consolidated Statement of Profit and Loss and Other Comprehensive Income for the Flix Group for the financial year ended 31 December 2021. The following trial balances were obtained from the financial records of Flix Ltd ('Flix') and Tonns I td ('Tonns') for the financial vear ended 31 Deremher 2021 . On 1 January 2019 , Flix acquired 30% of the ordinary share capital of Toons for R70 000 and thereby obtained significant influence over Toons on that date. The share capital of Toons on 1 January 2019 was R100 000 and retained earnings was R120 000. All of Toons' assets and liabilities were considered to be fairly valued on this date. were considered to be fairly valued on the acquisition date except for an item of property, plant and equipment ("PPE") which was considered to be R200 000 more than the carrying value on 30 June 2021. The item of PPE had a remaining useful life of 4 years from 30 June 2021 and a zero residual value. On 30 June 2021, the fair value of Flix's previously held equity interest in Toons was R250 395. Flix elected to measure the non-controlling interest at its proportionate share of Toons' identifiable net assets at the acquisition date. Toons Ltd declared a dividend to all shareholders at 15 December 2021. This was the only dividend declaration made during the year. The dividends were still outstanding at year end. The amount receivable by Flix is included in trade and other receivables. Intragroup transactions: - On 1 July 2021, Flix issued 10000 debentures of R10 each. The debentures pay a 5% coupon annually in arrears and are redeemable at a premium of 15% in 5 years' time. The current market rate for a similar debt instrument is 10%. Toons took up 5000 of these debentures. Debentures in Flix is included in trade and other receivables in the books of Toons. The interest earned by Toons on these debentures is included in Toons' other income. Other information: - Toons' profit was earned evenly throughout the financial year except for the effects of the intercompany transactions regarding debentures that took place during the financial year (see intragroup transactions above). - Flix measures the investment in Toons at cost in accordance with IAS27.10 in its separate financial statements. - All companies in the Flix Ltd Group have a 31 December financial year end. - Assume an income tax rate of 28% for all periods and 80% of capital gains are included in taxable income. - Ignore the effects of Dividend Tax and Value Added Tax (VAT). 1.1 Prepare all the pro forma journal entries for the Flix Group Ltd for the financial year ended 31 December 2021. Show all your workings as marks are allocated for calculations. (85 Marks) 1.2 Prepare the Consolidated Statement of Profit and Loss and Other Comprehensive Income for the Flix Group for the financial year ended 31 December 2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started