Required: Nancy, who is 59 years old, is the beneficiary of a $220,000 life insurance policy. What amount of the insurance proceeds is taxable

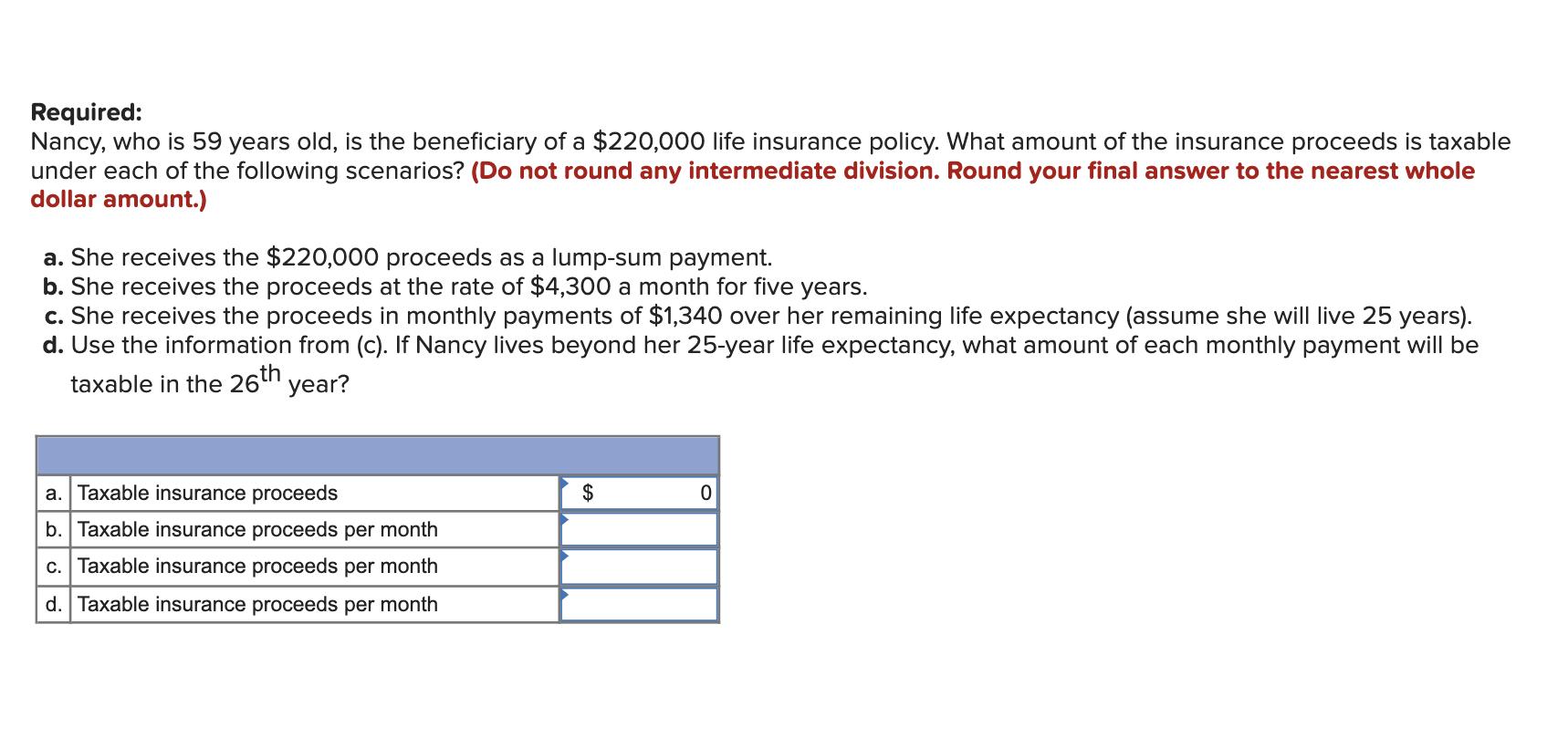

Required: Nancy, who is 59 years old, is the beneficiary of a $220,000 life insurance policy. What amount of the insurance proceeds is taxable under each of the following scenarios? (Do not round any intermediate division. Round your final answer to the nearest whole dollar amount.) a. She receives the $220,000 proceeds as a lump-sum payment. b. She receives the proceeds at the rate of $4,300 a month for five years. c. She receives the proceeds in monthly payments of $1,340 over her remaining life expectancy (assume she will live 25 years). d. Use the information from (c). If Nancy lives beyond her 25-year life expectancy, what amount of each monthly payment will be taxable in the 26th year? a. Taxable insurance proceeds b. Taxable insurance proceeds per month c. Taxable insurance proceeds per month d. Taxable insurance proceeds per month $ 0

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started