Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: Note: Note that for all questions below you may select more than one answer. Single click the box with the question mark to produce

Required: Note: Note that for all questions below you may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.

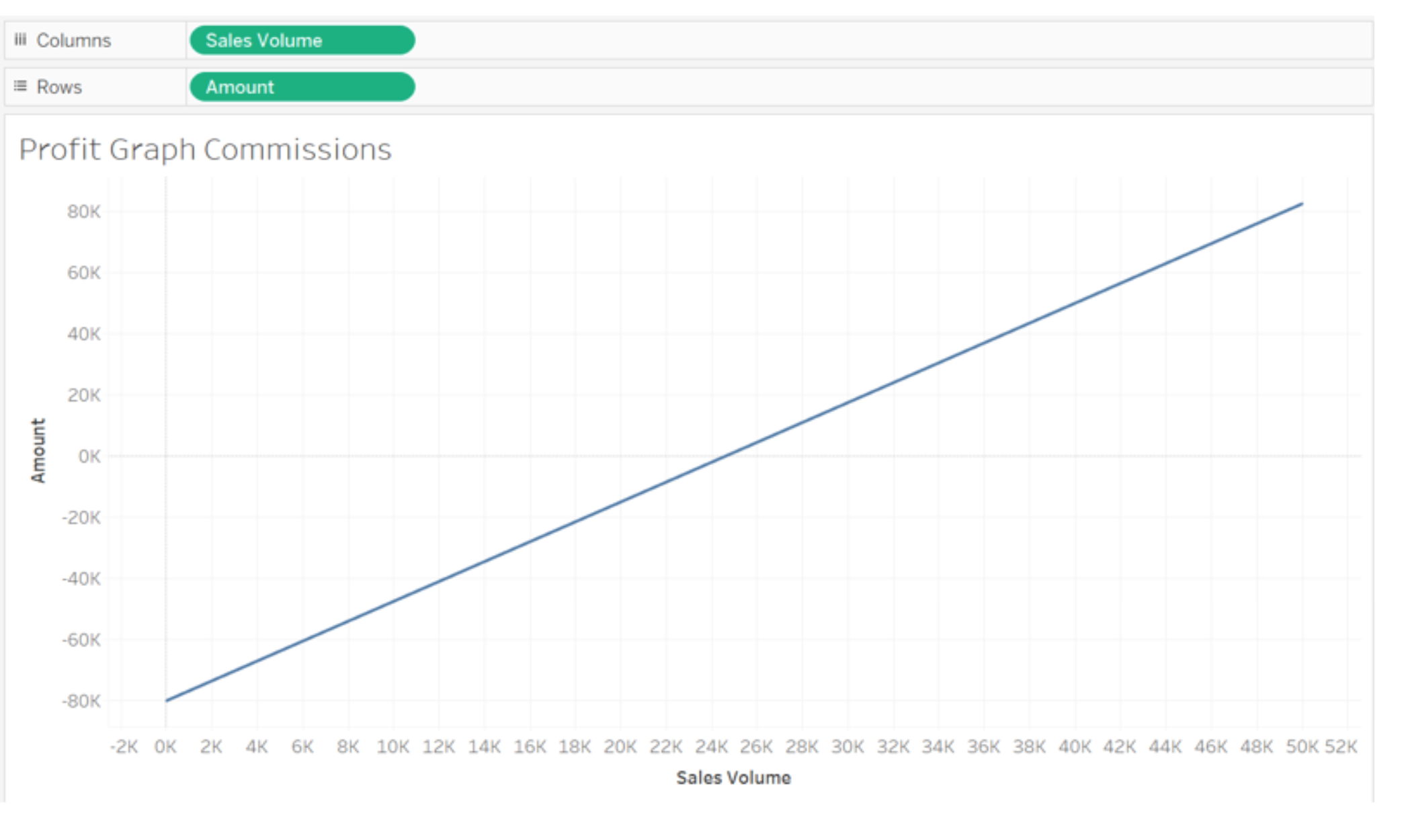

a The point where the blue line intersects the Yaxis the vertical axis indicates which of the following statements is true?

A The companys total expense at all sales volumes between zero and units is $

B The companys total fixed expense at all sales volumes between zero and units is $

C he companys total variable expense at all sales volumes between zero and units is $

D The companys total contribution margin at all sales volumes between zero and units is $

b For each increase of one unit on the Xaxis the horizontal axis the amount on the Yaxis the vertical axis increases by:

A The contribution margin per unit.

B The selling price per unit.

C The profit margin per unit.

D The variable expense per unit.

c If the selling price per unit decreased and the variable expense per unit and total fixed expense remained unchanged, then which of the following statements is true?

A The line shown in the profit graph would shift to a Vshape.

B The line shown in the profit graph would not change.

C The line shown in the profit graph would steepen.

D The line shown in the profit graph would flatten out.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started