Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: (Please use Excel and show all calculations). Assume a 35% Tax Rate. 2. Calculate a revised estimate of Walmart's depreciation expense for the year

Required: (Please use Excel and show all calculations).

Assume a 35% Tax Rate.

2. Calculate a revised estimate of Walmart's depreciation expense for the year ended January 31, 2015, using the estimated average useful life of Target's assets. Use this amount to recalculate Walmart's income before taxes and income from continuing operations for the year ended January 31, 2015.

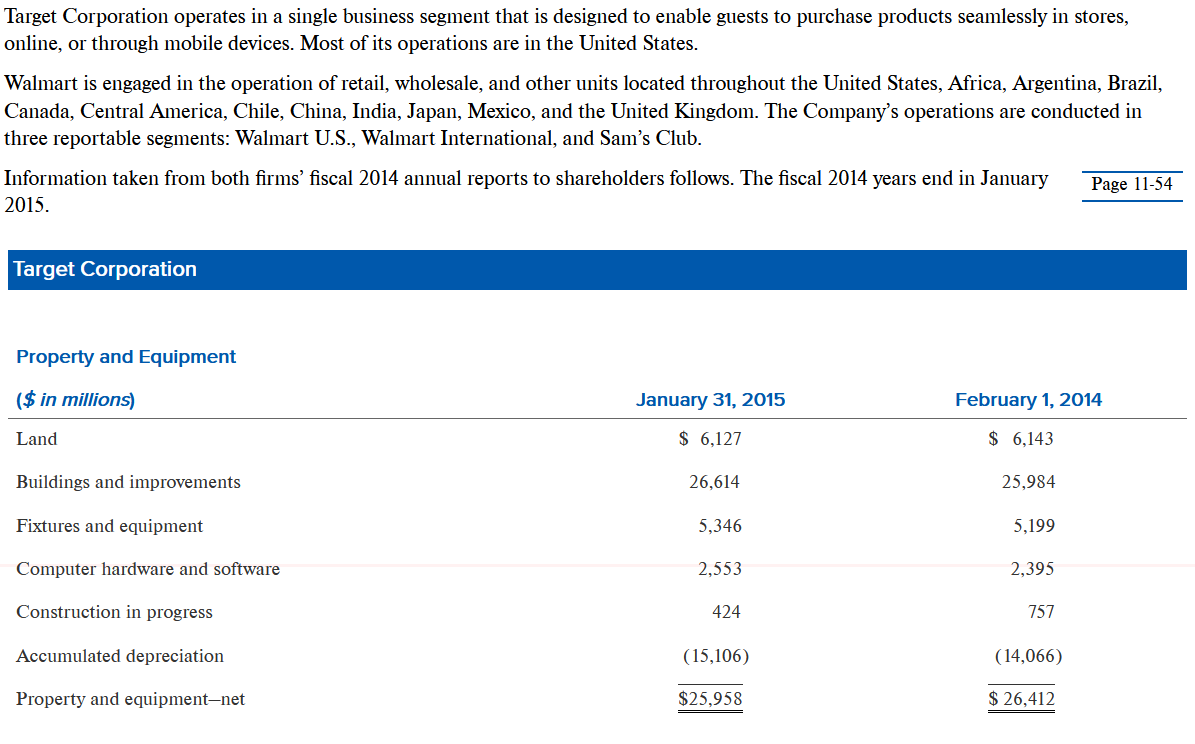

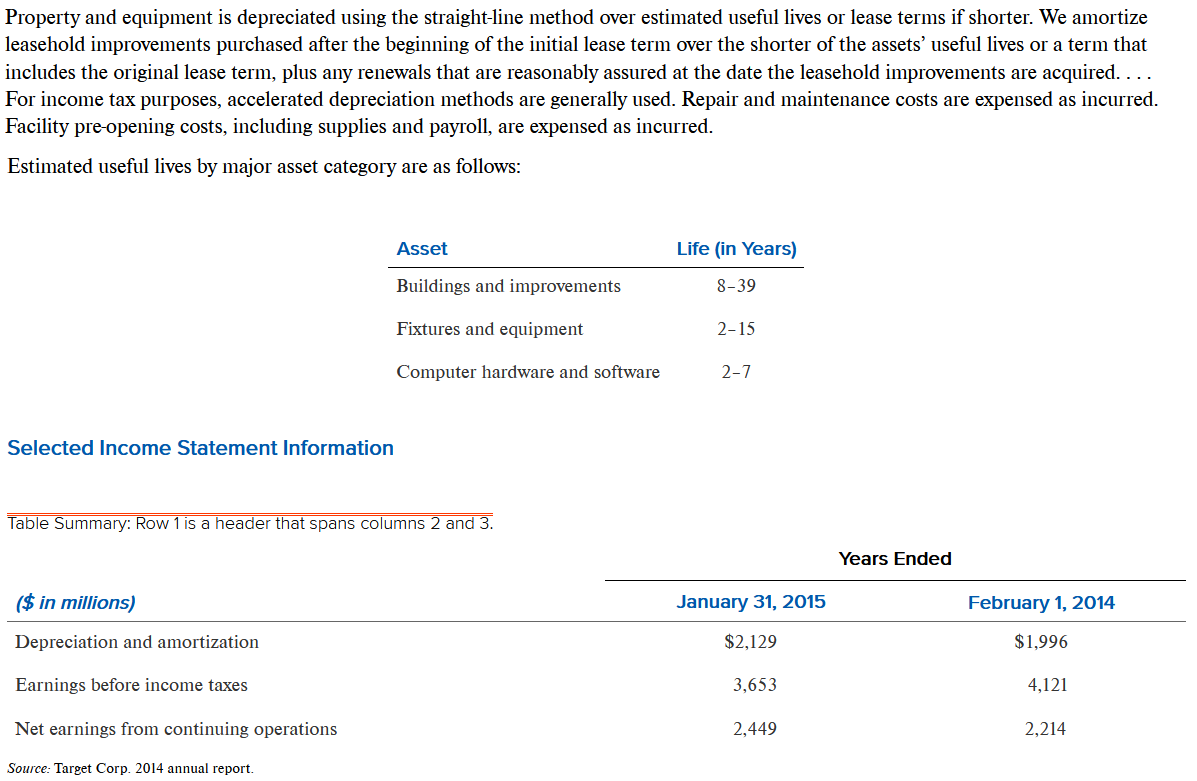

Target Corporation operates in a single business segment that is designed to enable guests to purchase products seamlessly in stores, online, or through mobile devices. Most of its operations are in the United States. Walmart is engaged in the operation of retail, wholesale, and other units located throughout the United States, Africa, Argentina, Brazil, Canada, Central America, Chile, China, India, Japan, Mexico, and the United Kingdom. The Company's operations are conducted in three reportable segments: Walmart U.S., Walmart International, and Sam's Club. Information taken from both firms' fiscal 2014 annual reports to shareholders follows. The fiscal 2014 years end in January Page 11-54 2015. Target Corporation Property and Equipment ($ in millions) January 31, 2015 February 1, 2014 Land $ 6,127 $ 6,143 Buildings and improvements 26,614 25,984 Fixtures and equipment 5,346 5,199 Computer hardware and software 2,553 2,395 Construction in progress 424 757 Accumulated depreciation (15,106) (14,066) Property and equipment-net $25,958 $ 26,412 Property and equipment is depreciated using the straight-line method over estimated useful lives or lease terms if shorter. We amortize leasehold improvements purchased after the beginning of the initial lease term over the shorter of the assets' useful lives or a term that includes the original lease term, plus any renewals that are reasonably assured at the date the leasehold improvements are acquired. ... For income tax purposes, accelerated depreciation methods are generally used. Repair and maintenance costs are expensed as incurred. Facility pre-opening costs, including supplies and payroll, are expensed as incurred. Estimated useful lives by major asset category are as follows: Asset Life (in Years) Buildings and improvements 8-39 Fixtures and equipment 2-15 Computer hardware and software 2-7 Selected Income Statement Information Table Summary: Row 1 is a header that spans columns 2 and 3. Years Ended ($ in millions) January 31, 2015 February 1, 2014 Depreciation and amortization $2,129 $1,996 Earnings before income taxes 3,653 4,121 Net earnings from continuing operations 2,449 2,214 Source: Target Corp. 2014 annual report. Walmart Stores, Inc. Property and Equipment ($ in millions) January 31, 2015 January 31, 2014 Land $ 26,261 $ 26,184 Buildings and improvements 97,496 95,488 Fixtures and equipment 45,044 42,971 Transportation equipment 2,807 2,785 Property under capital lease 5,787 5,661 Property and equipment 177,395 173,089 Accumulated depreciation (63,115) (57,725) Property and equipment, net $114,280 $115,364 Estimated useful lives for financial statement purposes are as follows: Page 11-55 Asset Life (in Years) Buildings and improvements 3-40 Fixtures and equipment 2-30 Transportation equipment 3-15 Selected Income Statement Information Table Summary: Row 1 is a header that spans columns 2 and 3. Years Ended January 31, 2015 January 31, 2015 ($ in millions) Depreciation and amortization $ 9,100 $ 8,800 Income from continuing operations before income taxes 24,799 24,656 Income from continuing operations 16,814 16,551 Source: Walmart Stores, Inc., 2014 annual reportStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started