Answered step by step

Verified Expert Solution

Question

1 Approved Answer

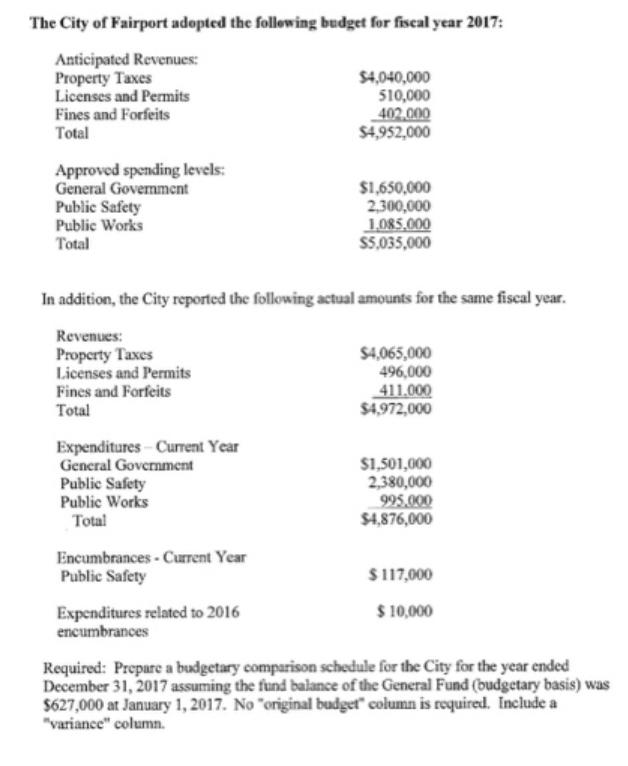

The City of Fairport adopted the follewing budget for fiscal year 2017: Anticipated Revenues: Property Taxes Licenses and Permits Fines and Forfeits Total $4,040,000

The City of Fairport adopted the follewing budget for fiscal year 2017: Anticipated Revenues: Property Taxes Licenses and Permits Fines and Forfeits Total $4,040,000 510,000 402.000 $4,952,000 Approved spending levels: General Govemment Public Safety Public Works Total $1,650,000 2,300,000 1,085.000 $5,035,000 In addition, the City reported the following actual amounts for the same fiscal year. Revenues: Property Taxes Licenses and Permits Fines and Forfeits Total $4,065,000 496,000 411.000 $4,972,000 Expenditures- Current Year General Government Public Safety Public Works Total $1,501,000 2,380,000 995.000 $4,876,000 Encumbrances- Current Year Public Safety $117,000 Expenditures related to 2016 encumbrances $ 10,000 Required: Prepare a budgetary comparison schedule for the City for the year ended December 31, 2017 assuming the fund balance of the General Fund (budgetary basis) was $627,000 at January 1, 2017. No "original budget" column is required. Include a "variance" column.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Final budget Actual Variance Revenue Property taxes 4040000 4065000 25000 licenses and permits 51...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started