Answered step by step

Verified Expert Solution

Question

1 Approved Answer

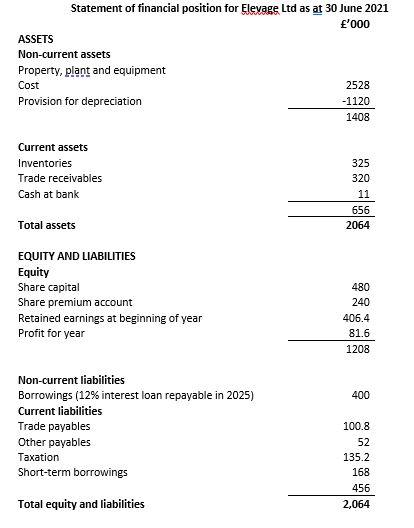

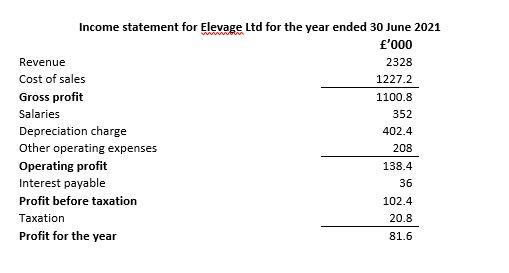

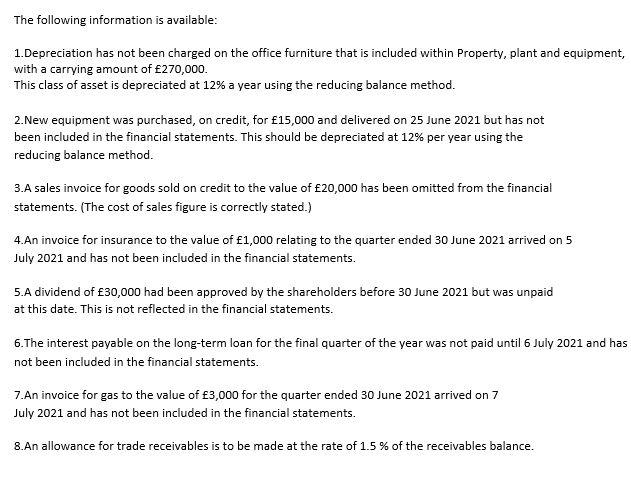

Required: Prepare a revised set of financial statements for the year ended 30 June 2021, incorporating the additional information provided. Statement of financial position for

Required: Prepare a revised set of financial statements for the year ended 30 June 2021, incorporating the additional information provided.

Statement of financial position for Elevage Ltd as at 30 June 2021 000 Income statement for Elevage Ltd for the year ended 30 June 2021 1.Depreciation has not been charged on the office furniture that is included within Property, plant and equipment, with a carrying amount of 270,000. This class of asset is depreciated at 12% a year using the reducing balance method. 2.New equipment was purchased, on credit, for 15,000 and delivered on 25 June 2021 but has not been included in the financial statements. This should be depreciated at 12% per year using the reducing balance method. 3.A sales invoice for goods sold on credit to the value of 20,000 has been omitted from the financial statements. (The cost of sales figure is correctly stated.) 4.An invoice for insurance to the value of 1,000 relating to the quarter ended 30 June 2021 arrived on 5 July 2021 and has not been included in the financial statements. 5.A dividend of 30,000 had been approved by the shareholders before 30 June 2021 but was unpaid at this date. This is not reflected in the financial statements. 6.The interest payable on the long-term loan for the final quarter of the year was not paid until 6 July 2021 and has not been included in the financial statements. 7.An invoice for gas to the value of 3,000 for the quarter ended 30 June 2021 arrived on 7 July 2021 and has not been included in the financial statements. 8.An allowance for trade receivables is to be made at the rate of 1.5% of the receivables balanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started