Answered step by step

Verified Expert Solution

Question

1 Approved Answer

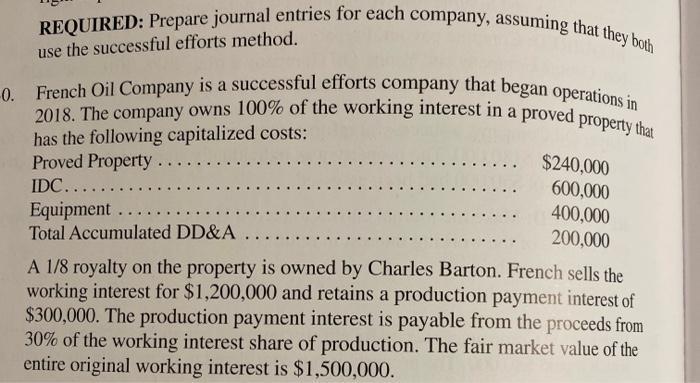

REQUIRED: Prepare journal entries for each company, assuming that they both use the successful efforts method. 2018. The company owns 100% of the working

REQUIRED: Prepare journal entries for each company, assuming that they both use the successful efforts method. 2018. The company owns 100% of the working interest in a proved property that French Oil Company is a successful efforts company that began operations in has the following capitalized costs: Proved Property. ... IDC...... Equipment Total Accumulated DD&A... $240,000 600,000 400,000 200,000 A 1/8 royalty on the property is owned by Charles Barton. French sells the working interest for $1,200,000 and retains a production payment interest of $300,000. The production payment interest is payable from the proceeds from 30% of the working interest share of production. The fair market value of the entire original working interest is $1,500,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solecting Al Suv 1 2 3 Accounts Titl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started