Question

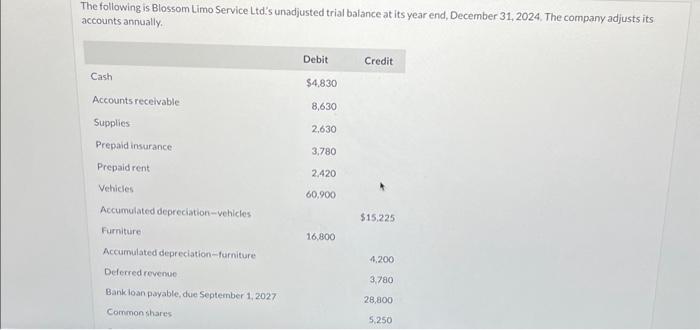

Required: Prepare the adjusting journal entries required at December 31. The following is Blossom Limo Service Ltd's unadjusted trial balance at its year end, December

Required:

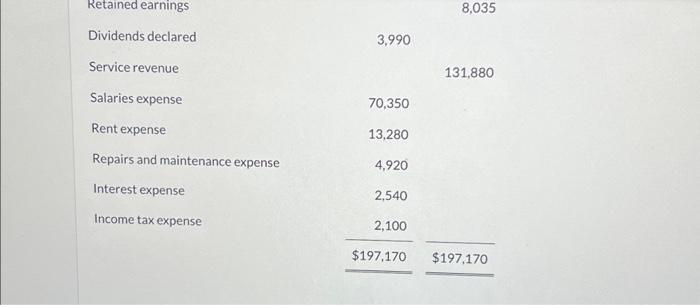

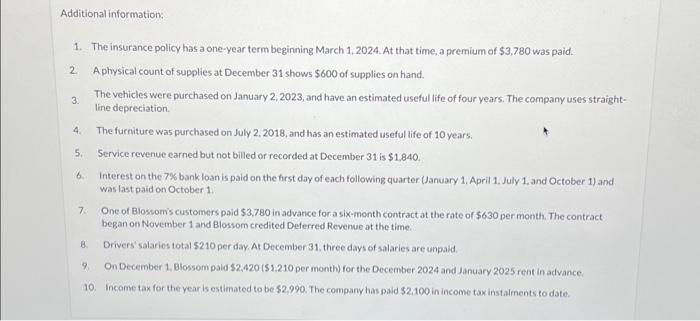

Prepare the adjusting journal entries required at December 31.The following is Blossom Limo Service Ltd's unadjusted trial balance at its year end, December 31, 2024. The company adjusts its accounts annually. Cash Accounts receivable Supplies Prepaid insurance Prepaid rent Vehicles Accumulated depreciation-vehicles Furniture: Accumulated depreciation-furniture Deferred revenue Bank loan payable, due September 1, 2027 Common shares Debit $4,830 8,630 2,630 3,780 2,420 60,900 16,800 Credit $15,225 4,200 3,780 28,800 5,250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

BLOSSOM LIMOSERVICE LTD CLOSING ADJUSTED JOURNAL ENTRIES Account Title Debit Credit 1 I nsurance Expense Dr 3150 To Prepaid Expense Cr 3150 Insurance ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Tools for Business Decision Making

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Barbara Trenholm, Wayne Irvine

5th Canadian edition

978-1118024492

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App