Question

Required: Prepare the entry on Perch's books to record its investment in Salmon on December 30, year 2. Calculate the acquisition differential, goodwill and non-controlling

Required:

Prepare the entry on Perch's books to record its investment in Salmon on December 30, year 2.

Calculate the acquisition differential, goodwill and non-controlling interest (NCI) at acquisition date using the FVE (entity) theory.

Prepare the acquisition eliminating worksheet entry at acquisition to facilitate the preparation of the consolidated financial statements.

Prepare the consolidated balance sheet at December 31, year 2 using the direct method. Show all calculations for each account balance.

Now assume Perch uses the Identifiable Net Asset (INA) theory (also known as parent company extension (PCE) theory) to prepare its consolidated financial statements. What would be the value of goodwill and NCI at acquisition under the Identifiable net asset theory.

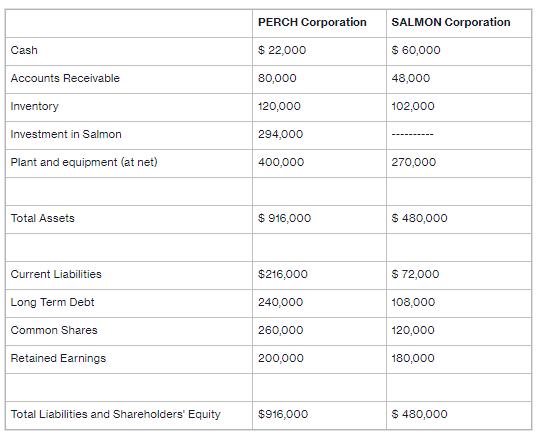

On December 30, year 2, Perch Corporation acquired a 70% interest in Salmon Corporation by purchasing 70% of the outstanding voting (common) shares of Salmon Corporation for cash. Perch's cost of the Investment in Salmon was $294,000. To complete the transaction, Perch incurred legal fees of $12,000. On December 30, year 2, Perch assessed the book values of Salmon were equal to fair values with the exception of the following accounts: Account Plant and equipment (at net) Inventory Long Term Debt Book Value $270,000 $102,000 $108,000 Fair Value $310,000 $112,000 $103,000 Condensed statements of financial position for Perch Corporation and Salmon Corporation on December 31, Year 2 (the day after the purchase) are shown below:

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Im sorry but it seems like the condensed statements of financial position for Perch Corporation and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started