Answered step by step

Verified Expert Solution

Question

1 Approved Answer

REQUIRED: Prepare the journal entry or entries to admit Dar into the partnership and calculate the partners' capital balances immediately after his admission under

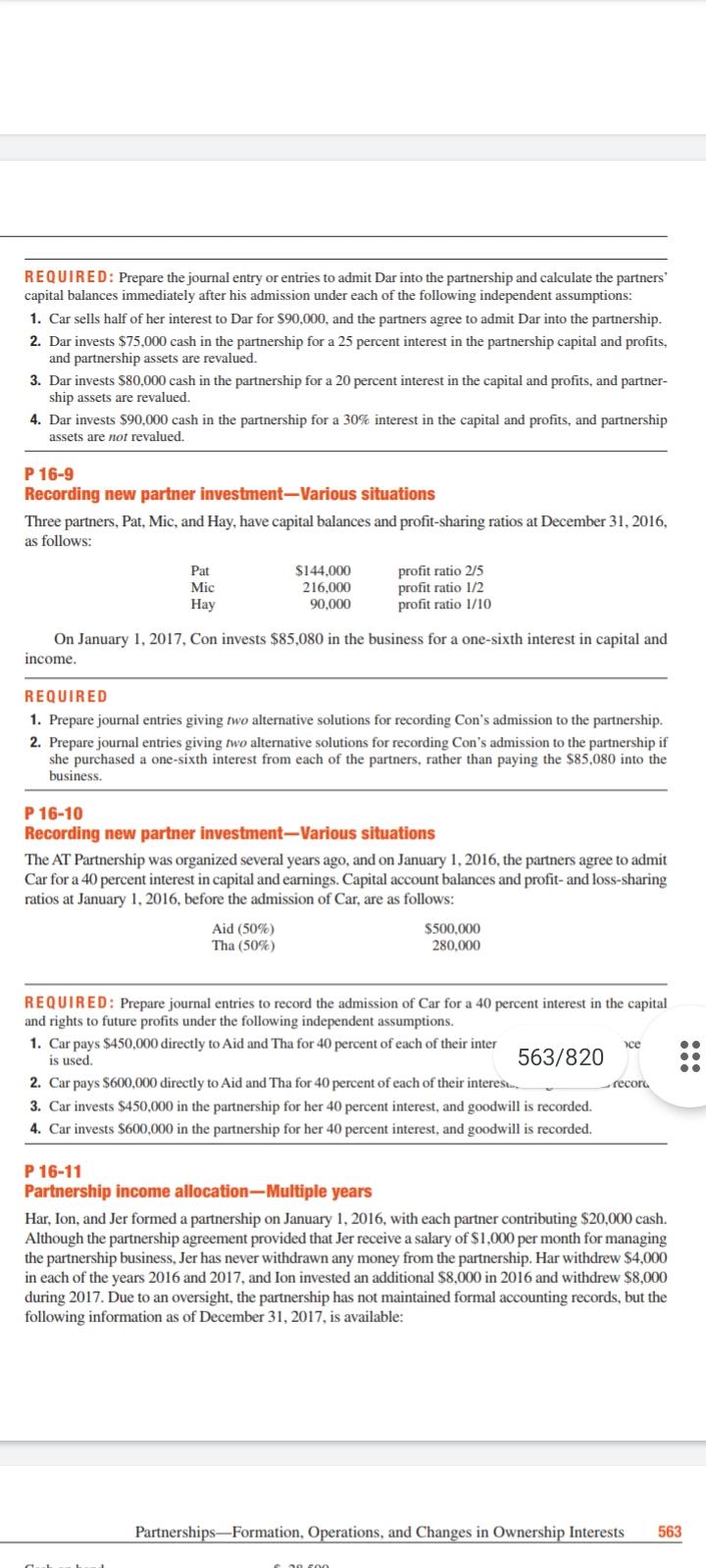

REQUIRED: Prepare the journal entry or entries to admit Dar into the partnership and calculate the partners' capital balances immediately after his admission under each of the following independent assumptions: 1. Car sells half of her interest to Dar for $90,000, and the partners agree to admit Dar into the partnership. 2. Dar invests $75,000 cash in the partnership for a 25 percent interest in the partnership capital and profits, and partnership assets are revalued. 3. Dar invests $80,000 cash in the partnership for a 20 percent interest in the capital and profits, and partner- ship assets are revalued. 4. Dar invests $90,000 cash in the partnership for a 30% interest in the capital and profits, and partnership assets are not revalued. P 16-9 Recording new partner investment-Various situations Three partners, Pat, Mic, and Hay, have capital balances and profit-sharing ratios at December 31, 2016, as follows: Pat Mic Hay $144,000 216,000 90,000 profit ratio 2/5 profit ratio 1/2 profit ratio 1/10 On January 1, 2017, Con invests $85,080 in the business for a one-sixth interest in capital and income. REQUIRED 1. Prepare journal entries giving two alternative solutions for recording Con's admission to the partnership. 2. Prepare journal entries giving two alternative solutions for recording Con's admission to the partnership if she purchased a one-sixth interest from each of the partners, rather than paying the $85,080 into the business. P 16-10 Recording new partner investment-Various situations The AT Partnership was organized several years ago, and on January 1, 2016, the partners agree to admit Car for a 40 percent interest in capital and earnings. Capital account balances and profit- and loss-sharing ratios at January 1, 2016, before the admission of Car, are as follows: Aid (50%) Tha (50%) $500,000 280,000 REQUIRED: Prepare journal entries to record the admission of Car for a 40 percent interest in the capital and rights to future profits under the following independent assumptions. 1. Car pays $450,000 directly to Aid and Tha for 40 percent of each of their inter is used. 563/820 record 2. Car pays $600,000 directly to Aid and Tha for 40 percent of each of their interest 3. Car invests $450,000 in the partnership for her 40 percent interest, and goodwill is recorded. 4. Car invests $600,000 in the partnership for her 40 percent interest, and goodwill is recorded. P 16-11 Partnership income allocation-Multiple years Har, Ion, and Jer formed a partnership on January 1, 2016, with each partner contributing $20,000 cash. Although the partnership agreement provided that Jer receive a salary of $1,000 per month for managing the partnership business, Jer has never withdrawn any money from the partnership. Har withdrew $4,000 in each of the years 2016 and 2017, and Ion invested an additional $8,000 in 2016 and withdrew $8,000 during 2017. Due to an oversight, the partnership has not maintained formal accounting records, but the following information as of December 31, 2017, is available: Partnerships-Formation, Operations, and Changes in Ownership Interests 563

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started