Answered step by step

Verified Expert Solution

Question

1 Approved Answer

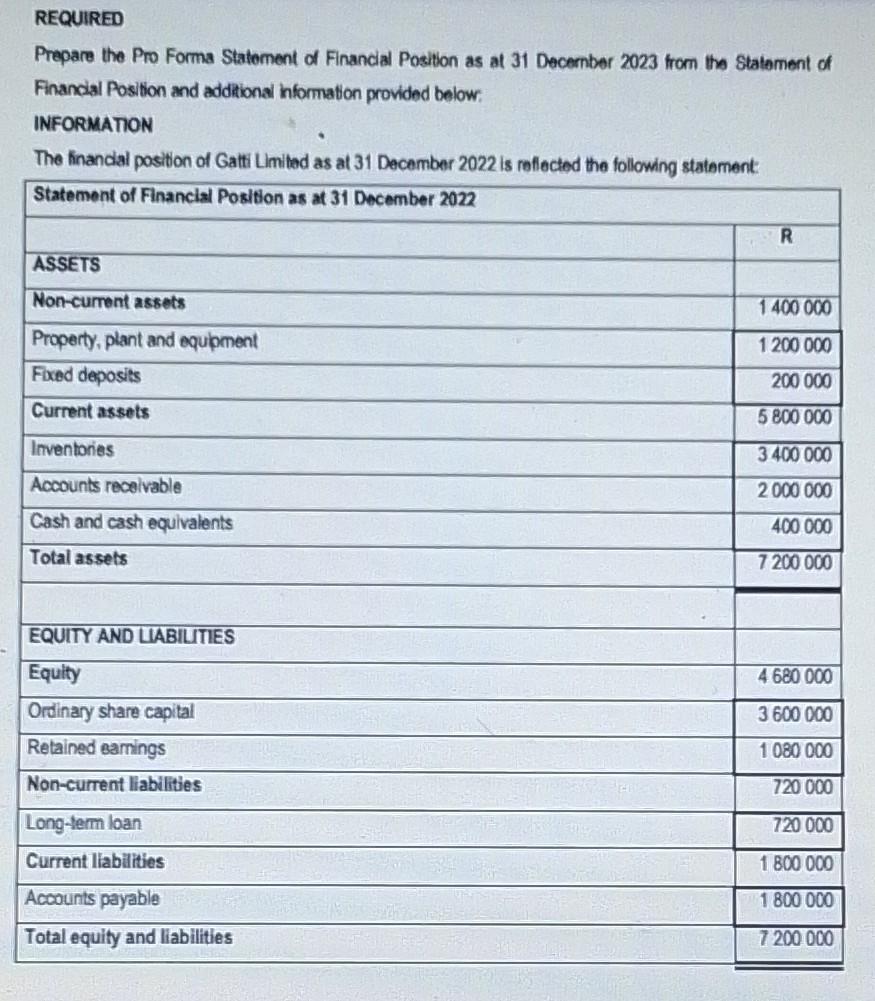

REQUIRED Prepare the Pro Forma Statement of Financial Position as at 31 Decernber 2023 from the Statement of Financial Position and additional information provided below:

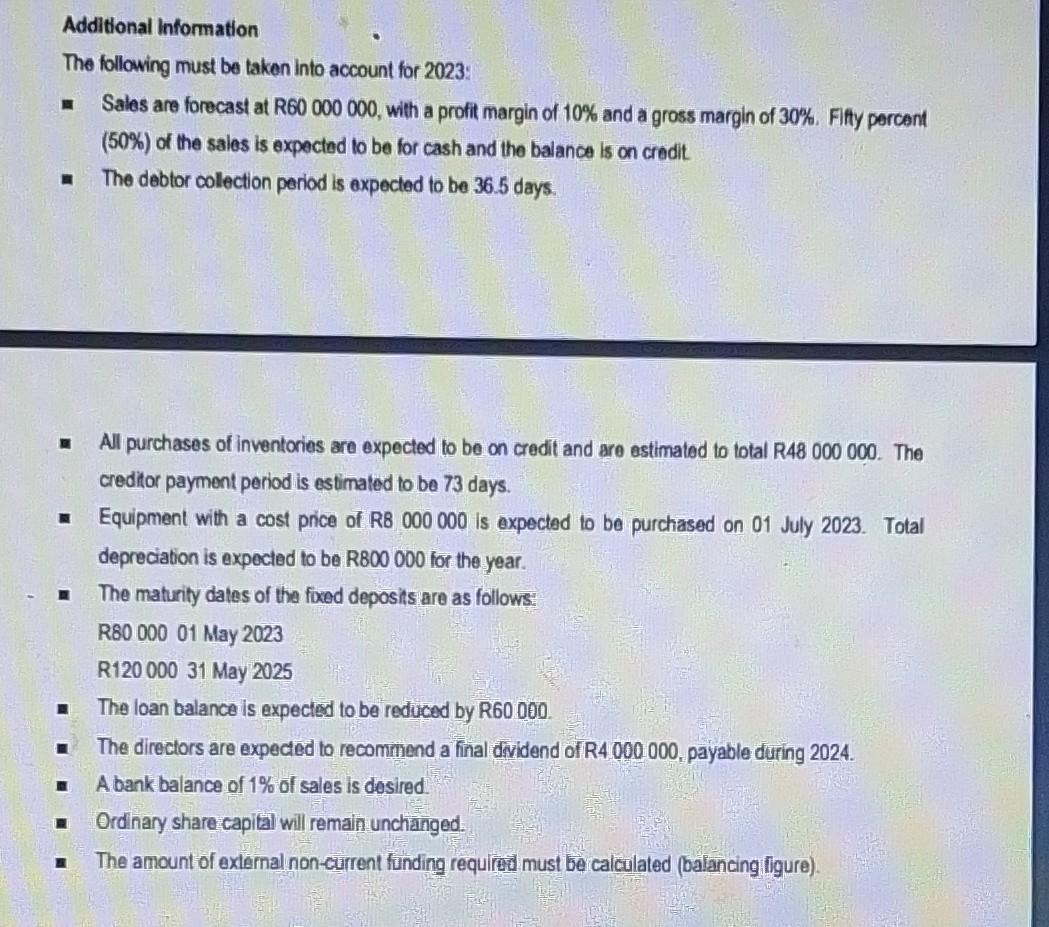

REQUIRED Prepare the Pro Forma Statement of Financial Position as at 31 Decernber 2023 from the Statement of Financial Position and additional information provided below: INFORMATION Additional information The following must be taken into account for 2023 : - Sales are forecast at R60 000000 , with a profit margin of 10% and a gross margin of 30%. Fifty percent (50%) of the sales is expected to be for cash and the balance is on credit - The debtor collection period is expected to be 36.5 days. - All purchases of inventories are expected to be on credit and are estimated to total R48000000. The creditor payment period is estimated to be 73 days. - Equipment with a cost price of R8 000000 is expected to be purchased on 01 July 2023. Total depreciation is expected to be R 800000 for the year. - The maturity dates of the foxed deposits are as follows: R80 00001 May 2023 R120000 31 May 2025 - The loan balance is expected to be reduced by R60 000 . - The directors are expected to recommend a final dividend of R4 000000 , payable during 2024. - A bank balance of 1% of sales is desired. Ordinary share capital will remain unchanged. - The amount of external non-current funding required must be calculated (balancing figure)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started