REQUIRED QUESTIONS ARE BELOW. THANKS!

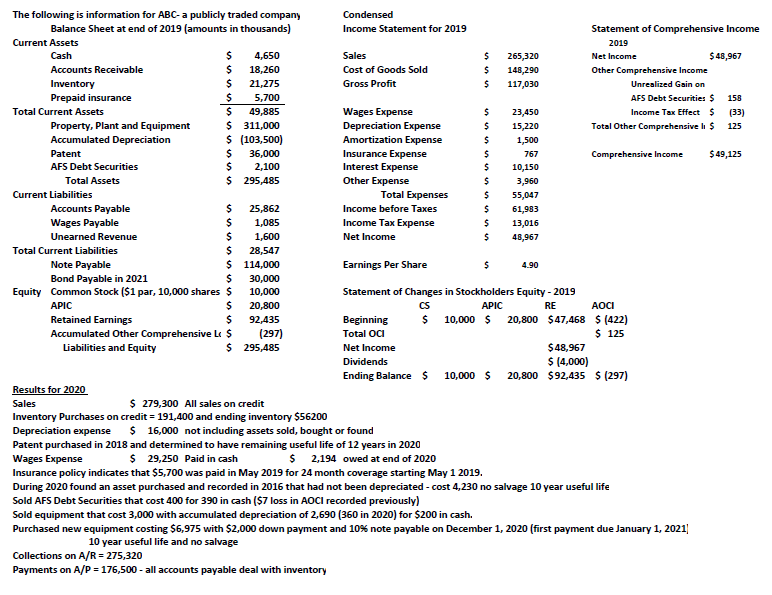

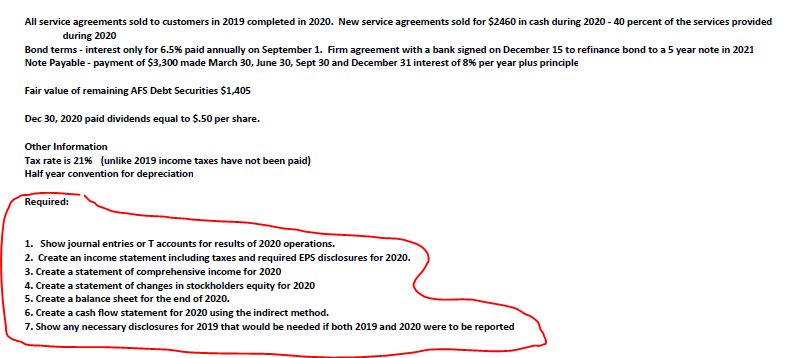

$ 4.90 The following is information for ABC-a publicly traded company Condensed Balance Sheet at end of 2019 (amounts in thousands) Income Statement for 2019 Statement of Comprehensive Income Current Assets 2019 Cash $ 4,650 Sales $ 265,320 Net Income $ 48,967 Accounts Receivable $ 18,260 Cost of Goods Sold $ 148,290 Other Comprehensive Income Inventory $ 21,275 Gross Profit $ 117,030 Unrealized Gain on Prepaid insurance $ 5,700 AFS Debt Securities $ 158 Total Current Assets $ 49,885 Wages Expense $ 23,450 Income Tax Effect $ (33) Property, Plant and Equipment $ 311,000 Depreciation Expense $ 15,220 Total Other Comprehensive li $ 125 Accumulated Depreciation $ (103,500) Amortization Expense $ 1,500 Patent $ 36,000 Insurance Expense $ 767 Comprehensive Income $ 49,125 AFS Debt Securities $ 2,100 Interest Expense $ 10,150 Total Assets $ 295,485 Other Expense $ 3,960 Current Liabilities Total Expenses $ 55,047 Accounts Payable $ 25,862 Income before Taxes $ 61,983 Wages Payable $ 1,085 Income Tax Expense $ 13,016 Unearned Revenue $ 1,600 Net Income 48,967 Total Current Liabilities $ 28,547 Note Payable $ 114,000 Earnings Per Share $ Bond Payable in 2021 $ 30,000 Equity Common Stock ($1 par, 10,000 shares $ 10,000 Statement of Changes in Stockholders Equity-2019 APIC $ 20,800 CS APIC RE AOCI Retained Earnings $ 92,435 Beginning $ 10,000 $ 20,800 $47,468 $ (422) Accumulated Other Comprehensive Le $ (297) Total oa $ 125 Liabilities and Equity $ 295,485 Net Income $ 48,967 Dividends $ (4,000) Ending Balance $10,000 $ 20,800 $92,435 $ (297) Results for 2020 Sales $ 279,300 All sales on credit Inventory Purchases on credit = 191,400 and ending inventory $56200 Depreciation expense $ 16,000 not including assets sold, bought or found Patent purchased in 2018 and determined to have remaining useful life of 12 years in 2020 Wages Expense $ 29,250 Paid in cash $ 2,194 owed at end of 2020 Insurance policy indicates that $5,700 was paid in May 2019 for 24 month coverage starting May 1 2019. During 2020 found an asset purchased and recorded in 2016 that had not been depreciated - cost 4,230 no salvage 10 year useful life Sold AFS Debt Securities that cost 400 for 390 in cash ($7 loss in AOCI recorded previously) Sold equipment that cost 3,000 with accumulated depreciation of 2,690 (360 in 2020) for $200 in cash. Purchased new equipment costing $6,975 with $2,000 down payment and 10% note payable on December 1, 2020 (first payment due January 1, 20211 10 year useful life and no salvage Collections on A/R = 275,320 Payments on A/P = 176,500 - all accounts payable deal with inventory All service agreements sold to customers in 2019 completed in 2020. New service agreements sold for $2460 in cash during 2020 - 40 percent of the services provided during 2020 Bond terms- interest only for 6.5% paid annually on September 1. Firm agreement with a bank signed on December 15 to refinance bond to a 5 year note in 2021 Note Payable - payment of $3,300 made March 30, June 30, Sept 30 and December 31 interest of 8% per year plus principle Fair value of remaining AFS Debt Securities $1,405 Dec 30, 2020 paid dividends equal to $.50 per share. Other Information Tax rate is 21% (unlike 2019 income taxes have not been paid) Half year convention for depreciation Required: 1. Show journal entries or T accounts for results of 2020 operations. 2. Create an income statement including taxes and required EPS disclosures for 2020. 3. Create a statement of comprehensive income for 2020 4. Create a statement of changes in stockholders equity for 2020 5. Create a balance sheet for the end of 2020. 6. Create a cash flow statement for 2020 using the indirect method. 7. Show any necessary disclosures for 2019 that would be needed if both 2019 and 2020 were to be reported $ 4.90 The following is information for ABC-a publicly traded company Condensed Balance Sheet at end of 2019 (amounts in thousands) Income Statement for 2019 Statement of Comprehensive Income Current Assets 2019 Cash $ 4,650 Sales $ 265,320 Net Income $ 48,967 Accounts Receivable $ 18,260 Cost of Goods Sold $ 148,290 Other Comprehensive Income Inventory $ 21,275 Gross Profit $ 117,030 Unrealized Gain on Prepaid insurance $ 5,700 AFS Debt Securities $ 158 Total Current Assets $ 49,885 Wages Expense $ 23,450 Income Tax Effect $ (33) Property, Plant and Equipment $ 311,000 Depreciation Expense $ 15,220 Total Other Comprehensive li $ 125 Accumulated Depreciation $ (103,500) Amortization Expense $ 1,500 Patent $ 36,000 Insurance Expense $ 767 Comprehensive Income $ 49,125 AFS Debt Securities $ 2,100 Interest Expense $ 10,150 Total Assets $ 295,485 Other Expense $ 3,960 Current Liabilities Total Expenses $ 55,047 Accounts Payable $ 25,862 Income before Taxes $ 61,983 Wages Payable $ 1,085 Income Tax Expense $ 13,016 Unearned Revenue $ 1,600 Net Income 48,967 Total Current Liabilities $ 28,547 Note Payable $ 114,000 Earnings Per Share $ Bond Payable in 2021 $ 30,000 Equity Common Stock ($1 par, 10,000 shares $ 10,000 Statement of Changes in Stockholders Equity-2019 APIC $ 20,800 CS APIC RE AOCI Retained Earnings $ 92,435 Beginning $ 10,000 $ 20,800 $47,468 $ (422) Accumulated Other Comprehensive Le $ (297) Total oa $ 125 Liabilities and Equity $ 295,485 Net Income $ 48,967 Dividends $ (4,000) Ending Balance $10,000 $ 20,800 $92,435 $ (297) Results for 2020 Sales $ 279,300 All sales on credit Inventory Purchases on credit = 191,400 and ending inventory $56200 Depreciation expense $ 16,000 not including assets sold, bought or found Patent purchased in 2018 and determined to have remaining useful life of 12 years in 2020 Wages Expense $ 29,250 Paid in cash $ 2,194 owed at end of 2020 Insurance policy indicates that $5,700 was paid in May 2019 for 24 month coverage starting May 1 2019. During 2020 found an asset purchased and recorded in 2016 that had not been depreciated - cost 4,230 no salvage 10 year useful life Sold AFS Debt Securities that cost 400 for 390 in cash ($7 loss in AOCI recorded previously) Sold equipment that cost 3,000 with accumulated depreciation of 2,690 (360 in 2020) for $200 in cash. Purchased new equipment costing $6,975 with $2,000 down payment and 10% note payable on December 1, 2020 (first payment due January 1, 20211 10 year useful life and no salvage Collections on A/R = 275,320 Payments on A/P = 176,500 - all accounts payable deal with inventory All service agreements sold to customers in 2019 completed in 2020. New service agreements sold for $2460 in cash during 2020 - 40 percent of the services provided during 2020 Bond terms- interest only for 6.5% paid annually on September 1. Firm agreement with a bank signed on December 15 to refinance bond to a 5 year note in 2021 Note Payable - payment of $3,300 made March 30, June 30, Sept 30 and December 31 interest of 8% per year plus principle Fair value of remaining AFS Debt Securities $1,405 Dec 30, 2020 paid dividends equal to $.50 per share. Other Information Tax rate is 21% (unlike 2019 income taxes have not been paid) Half year convention for depreciation Required: 1. Show journal entries or T accounts for results of 2020 operations. 2. Create an income statement including taxes and required EPS disclosures for 2020. 3. Create a statement of comprehensive income for 2020 4. Create a statement of changes in stockholders equity for 2020 5. Create a balance sheet for the end of 2020. 6. Create a cash flow statement for 2020 using the indirect method. 7. Show any necessary disclosures for 2019 that would be needed if both 2019 and 2020 were to be reported