Answered step by step

Verified Expert Solution

Question

1 Approved Answer

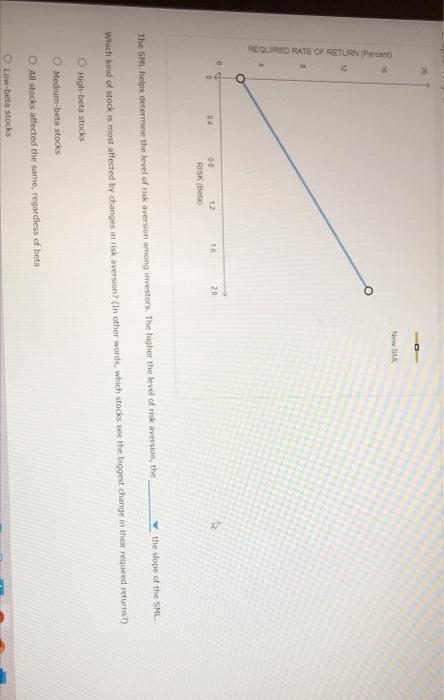

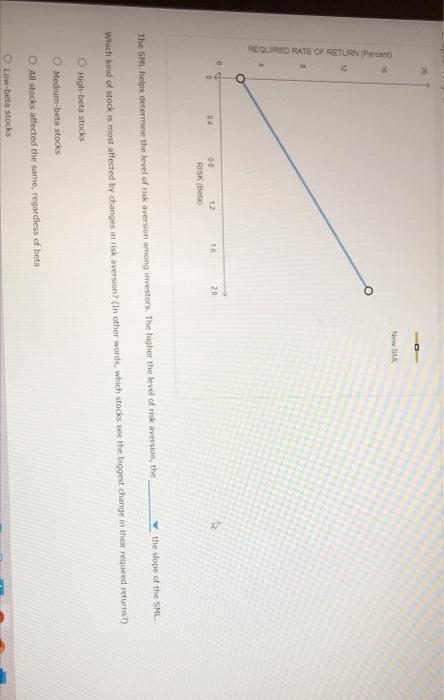

REQUIRED RATE OF RETURN (Percent) W 00 12 New SM D 04 16 20 RISK (Beta) the slope of the SML The SML helps determine

REQUIRED RATE OF RETURN (Percent) W 00 12 New SM D 04 16 20 RISK (Beta) the slope of the SML The SML helps determine the level of risk aversion among investors. The higher the level of risk aversion, the Which kind of stock is most affected by changes in risk aversion? (In other words, which stocks see the biggest change in their required returns?) O High-beta stocks O Medium-beta stocks O All stocks affected the same, regardless of beta Low-beta stocks

REQUIRED RATE OF RETURN (Percent) W 00 12 New SM D 04 16 20 RISK (Beta) the slope of the SML The SML helps determine the level of risk aversion among investors. The higher the level of risk aversion, the Which kind of stock is most affected by changes in risk aversion? (In other words, which stocks see the biggest change in their required returns?) O High-beta stocks O Medium-beta stocks O All stocks affected the same, regardless of beta Low-beta stocks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started