Question

Record the tax effect of the above for 2019 Show the income tax section and loss section of the income statement for 2019 Record the

Record the tax effect of the above for 2019

Show the income tax section and loss section of the income statement for 2019

Record the tax effect of the above for 2021 , taking into consideration the effect of 2020.

Show the income tax section and loss section of the income statement for 2021

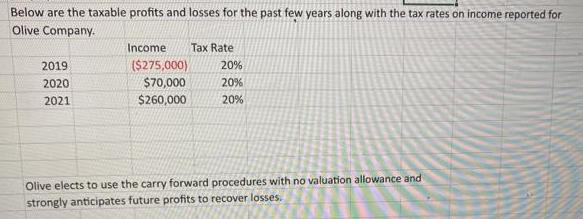

Below are the taxable profits and losses for the past few years along with the tax rates on income reported for Olive Company. 2019 2020 2021 Income ($275,000) $70,000 $260,000 Tax Rate 20% 20% 20% Olive elects to use the carry forward procedures with no valuation allowance and strongly anticipates future profits to recover losses.

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

2019 Income Statement Sales Revenue 0 Cost of Goods Sold 0 Gross Profit 0 Operating Expenses 0 Opera...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App