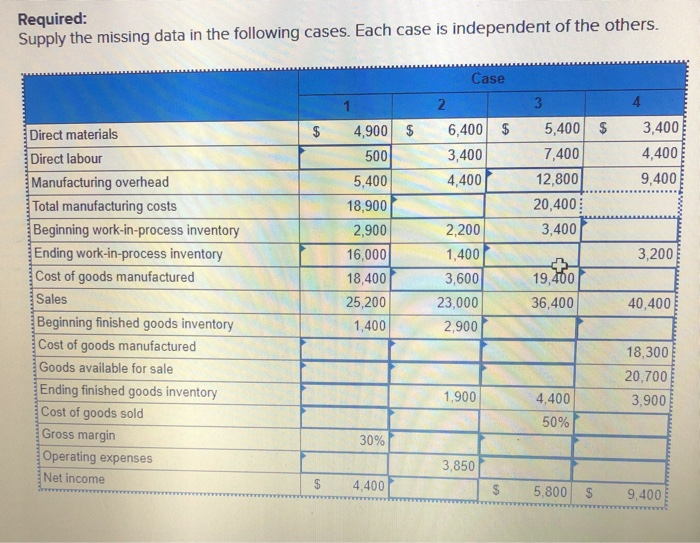

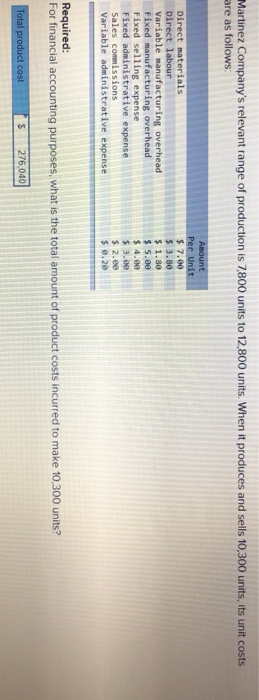

Required: Supply the missing data in the following cases. Each case is independent of the others. Case 1 3 4 $ $ 2 6,400 $ 3,400 4,400 5,400 7,400 12,800 20,400 3,400 3,400 4,400 9,400 4,900 $ 500 5,400 18,900 2,900 16,000 18,400 25,200 1,400 Direct materials Direct labour Manufacturing overhead Total manufacturing costs Beginning work-in-process inventory Ending work-in-process inventory Cost of goods manufactured Sales Beginning finished goods inventory Cost of goods manufactured Goods available for sale Ending finished goods inventory Cost of goods sold Gross margin Operating expenses Net income 3,200 2,200 1,400 3,600 23,000 2,900 19,400 36,400 40,400 18,300 20,700 3,900 1.900 www 4,400 50% 30% 3,850 CA $ 4,400 $ 5,800 $ 9,400 Chapter 2 - Augment-205 AM Connect eztomheducation.com/ext/map/index.html?con..contexternal browser touchdhttps2Fm.mheducation.com 25 mg ter 2 - Assignment Help Martinez Company's relevant range of production is 8.700 units to 13.700 units. When it produces and sells 1.200 units, its unit costs are as follows Per $7.00 5 2.70 Direct materials Direct labour Variable manufacturing overhead Fixed facturing overhead Fixed selling expense Sales comissions Variable distrative pense 5.2.0 Required: For financial accounting purposes, what is the total amount of period costs incurred to sell 1200 units? Total period cost s 262.080 Prev 7 of 8 Next > to search O BE 11:53 PM 9/21/2020 2 Martinez Company's relevant range of production is 7800 units to 12,800 units. When it produces and sells 10,300 units, its unit costs are as follows: Direct materials Direct labour Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Amount Per Unit $ 7.00 $ 3.80 $ 1.80 $ 5.00 $4.00 $ 3.00 $ 2.00 $ 0.20 Required: For financial accounting purposes, what is the total amount of product costs incurred to make 10,300 units? Total product cost $ 276,040 Required: Supply the missing data in the following cases. Each case is independent of the others. Case 1 3 4 $ $ 2 6,400 $ 3,400 4,400 5,400 7,400 12,800 20,400 3,400 3,400 4,400 9,400 4,900 $ 500 5,400 18,900 2,900 16,000 18,400 25,200 1,400 Direct materials Direct labour Manufacturing overhead Total manufacturing costs Beginning work-in-process inventory Ending work-in-process inventory Cost of goods manufactured Sales Beginning finished goods inventory Cost of goods manufactured Goods available for sale Ending finished goods inventory Cost of goods sold Gross margin Operating expenses Net income 3,200 2,200 1,400 3,600 23,000 2,900 19,400 36,400 40,400 18,300 20,700 3,900 1.900 www 4,400 50% 30% 3,850 CA $ 4,400 $ 5,800 $ 9,400 Chapter 2 - Augment-205 AM Connect eztomheducation.com/ext/map/index.html?con..contexternal browser touchdhttps2Fm.mheducation.com 25 mg ter 2 - Assignment Help Martinez Company's relevant range of production is 8.700 units to 13.700 units. When it produces and sells 1.200 units, its unit costs are as follows Per $7.00 5 2.70 Direct materials Direct labour Variable manufacturing overhead Fixed facturing overhead Fixed selling expense Sales comissions Variable distrative pense 5.2.0 Required: For financial accounting purposes, what is the total amount of period costs incurred to sell 1200 units? Total period cost s 262.080 Prev 7 of 8 Next > to search O BE 11:53 PM 9/21/2020 2 Martinez Company's relevant range of production is 7800 units to 12,800 units. When it produces and sells 10,300 units, its unit costs are as follows: Direct materials Direct labour Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Amount Per Unit $ 7.00 $ 3.80 $ 1.80 $ 5.00 $4.00 $ 3.00 $ 2.00 $ 0.20 Required: For financial accounting purposes, what is the total amount of product costs incurred to make 10,300 units? Total product cost $ 276,040