Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required to calculate: 1. Ordinary business income (loss) 2. Net rental real estate income (loss) 3. Other net rental income (loss) 4. Interest income 5a.

Required to calculate:

1. Ordinary business income (loss)

2. Net rental real estate income (loss)

3. Other net rental income (loss)

4. Interest income

5a. Ordinary dividends

5b. Qualified dividends

6. Royalties

7. Net short-term capital gain (loss)

8a. Net long-term capital gain (loss)

8b. Collectibles (28%) gain (loss)

8c . Unrecaptured section 1250 gain

9. Net section 1231 gain (loss)

10. Other income (loss)

11. Section 179 deduction

12. Other deductions

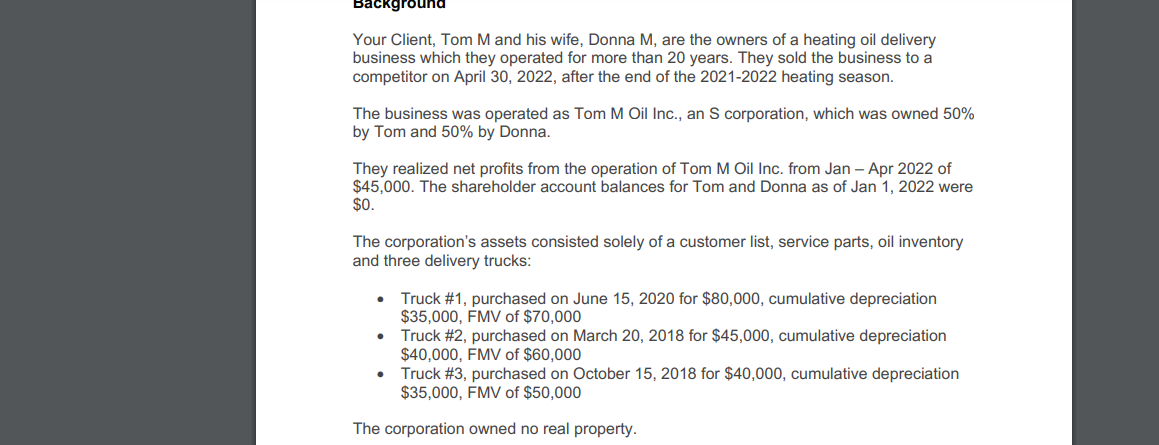

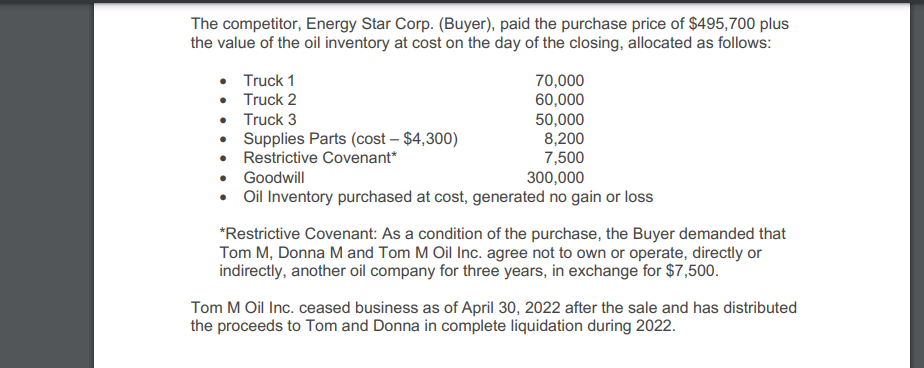

Your Client, Tom M and his wife, Donna M, are the owners of a heating oil delivery business which they operated for more than 20 years. They sold the business to a competitor on April 30, 2022, after the end of the 2021-2022 heating season. The business was operated as Tom M Oil Inc., an S corporation, which was owned 50% by Tom and 50% by Donna. They realized net profits from the operation of Tom M Oil Inc. from Jan - Apr 2022 of $45,000. The shareholder account balances for Tom and Donna as of Jan 1, 2022 were $0. The corporation's assets consisted solely of a customer list, service parts, oil inventory and three delivery trucks: - Truck \#1, purchased on June 15, 2020 for $80,000, cumulative depreciation $35,000, FMV of $70,000 - Truck \#2, purchased on March 20, 2018 for $45,000, cumulative depreciation $40,000, FMV of $60,000 - Truck \#3, purchased on October 15,2018 for $40,000, cumulative depreciation $35,000,FMV of $50,000 The corporation owned no real property. The competitor, Energy Star Corp. (Buyer), paid the purchase price of $495,700 plus the value of the oil inventory at cost on the day of the closing, allocated as follows: "Restrictive Covenant: As a condition of the purchase, the Buyer demanded that Tom M, Donna M and Tom M Oil Inc. agree not to own or operate, directly or indirectly, another oil company for three years, in exchange for $7,500. Tom M Oil Inc. ceased business as of April 30, 2022 after the sale and has distributed the proceeds to Tom and Donna in complete liquidation during 2022Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started