Answered step by step

Verified Expert Solution

Question

1 Approved Answer

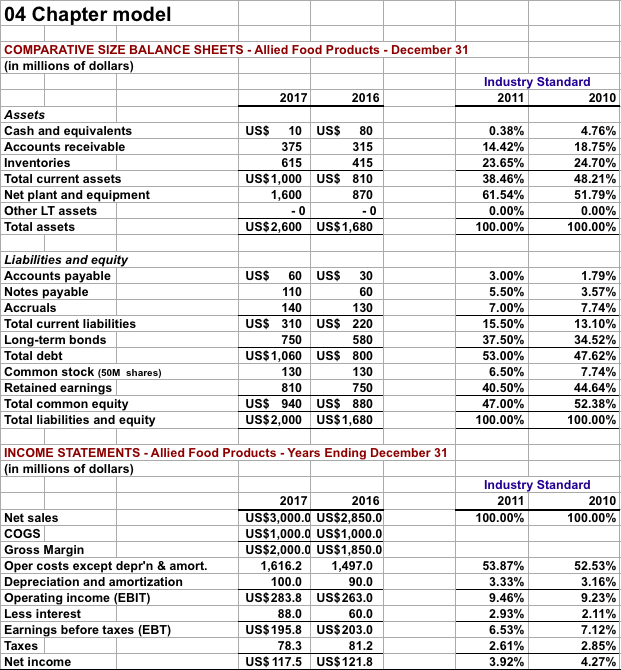

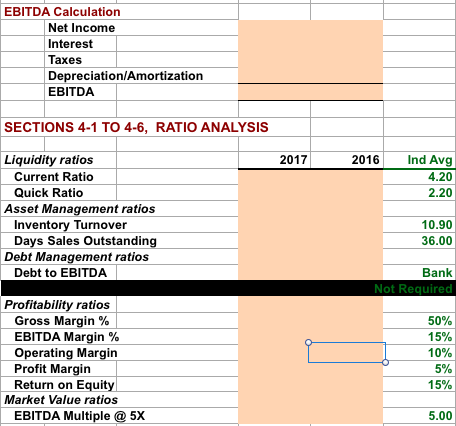

required to calculate various financial ratios in Excel What are answer that orange blanks? 04 Chapter model COMPARATIVE SIZE BALANCE SHEETS - Allied Food Products

required to calculate various financial ratios in Excel

What are answer that orange blanks?

04 Chapter model COMPARATIVE SIZE BALANCE SHEETS - Allied Food Products - December 31 (in millions of dollars) Industry Standard 2011 2010 2017 2016 Assets Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Other LT assets Total assets US$ 10 US$ 80 375 315 615 415 US$1,000 US$ 810 1,600 870 - 0 -0 US$2,600 US$ 1,680 0.38% 14.42% 23.65% 38.46% 61.54% 0.00% 100.00% 4.76% 18.75% 24.70% 48.21% 51.79% 0.00% 100.00% Liabilities and equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Total debt Common stock (50M shares) Retained earnings Total common equity Total liabilities and equity US$ 60 US$ 30 110 60 140 130 US$ 310 US$ 220 750 580 US$ 1,060 US$ 800 130 130 810 750 US$ 940 US$ 880 US$ 2,000 US$ 1,680 3.00% 5.50% 7.00% 15.50% 37.50% 53.00% 6.50% 40.50% 47.00% 100.00% 1.79% 3.57% 7.74% 13.10% 34.52% 47.62% 7.74% 44.64% 52.38% 100.00% INCOME STATEMENTS - Allied Food Products - Years Ending December 31 (in millions of dollars) Industry Standard 2010 100.00% 100.00% Net sales COGS Gross Margin Oper costs except depr'n & amort. Depreciation and amortization Operating income (EBIT) Less interest Earnings before taxes (EBT) Taxes Net income 2017 2016 US$3,000.0 US$2,850.0 US$1,000.0 US$1,000.0 US$2,000.0 US$1,850.0 1,616.2 1,497.0 100.0 90.0 US$ 283.8 US$ 263.0 88.0 60.0 US$195.8 US$203.0 78.3 81.2 US$ 117.5 US$121.8 53.87% 3.33% 9.46% 2.93% 6.53% 2.61% 3.92% 52.53% 3.16% 9.23% 2.11% 7.12% 2.85% 4.27% EBITDA Calculation Net Income Interest Taxes Depreciation/Amortization EBITDA SECTIONS 4-1 TO 4-6, RATIO ANALYSIS 2017 2016 Ind Avg 4.20 2.20 Liquidity ratios Current Ratio Quick Ratio Asset Management ratios Inventory Turnover Days Sales Outstanding Debt Management ratios Debt to EBITDA 10.90 36.00 Bank Not Required Profitability ratios Gross Margin % EBITDA Margin % Operating Margin Profit Margin Return on Equity Market Value ratios EBITDA Multiple @ 5X 50% 15% 10% 5% 15% 5.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started