Answered step by step

Verified Expert Solution

Question

1 Approved Answer

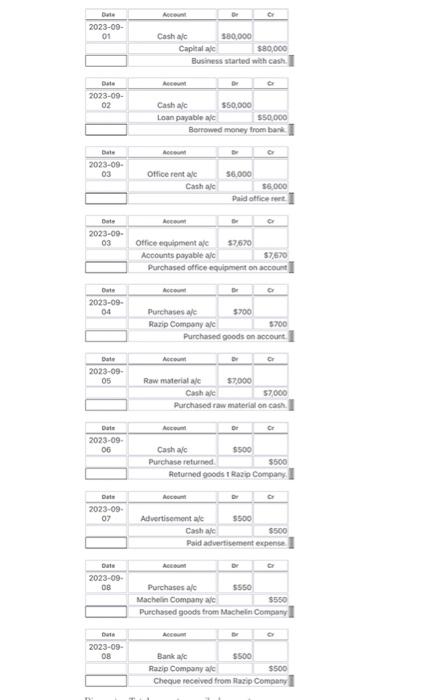

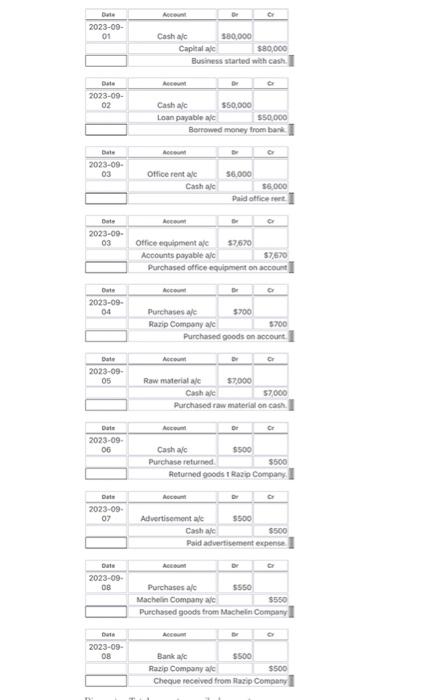

Required to open T account begin{tabular}{|c|c|c|c|} hline Beit & Acewent & er & or hline 20230001 & Coshale & se0,000 & hline multicolumn{2}{|c|}{

Required to open T account

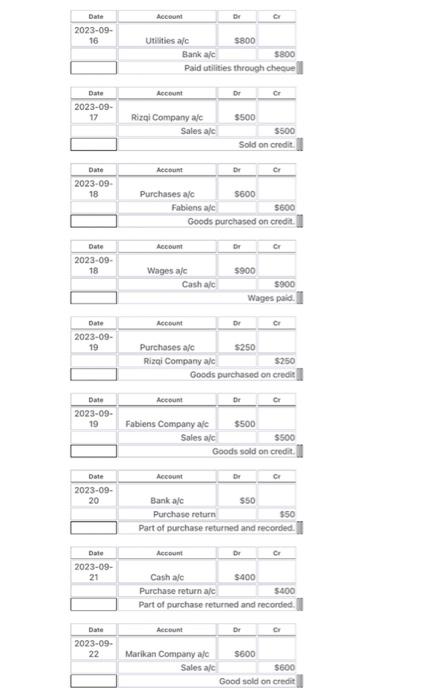

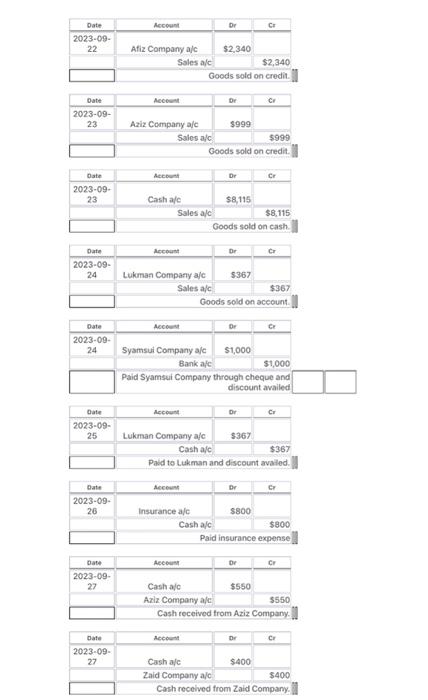

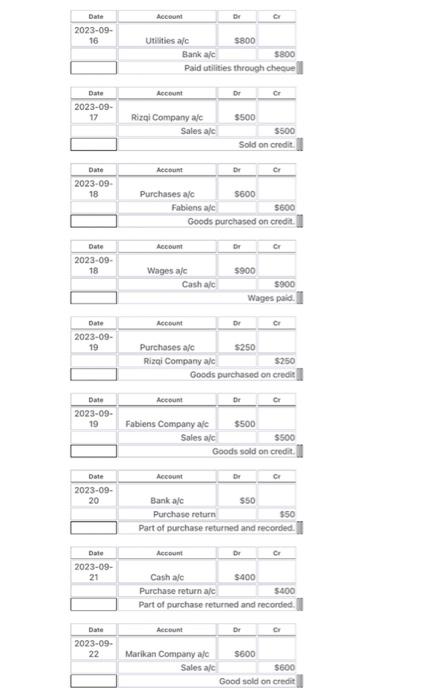

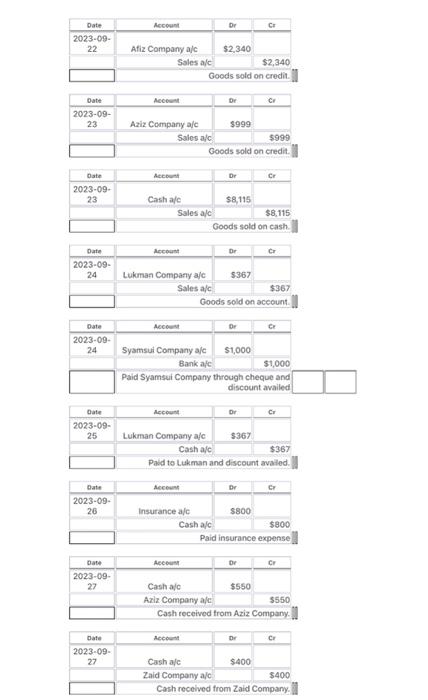

\begin{tabular}{|c|c|c|c|} \hline Beit & Acewent & er & or \\ \hline 20230001 & Coshale & se0,000 & \\ \hline \multicolumn{2}{|c|}{ Caplal alc } & $80,000 \\ \hline & \multicolumn{2}{|c|}{ Business started with cash. } \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|} \hline Date & Aewen & or & 0 \\ \hline 20230902 & Cash ale & 550,000 & \\ \hline & Loan payable ale & $50,000 \\ \hline & & Berowed money trom bark: \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Bute & kereun & b & 0 \\ \hline 20230903 & otfice equipment ale & $7,670 & \\ \hline & Accounts poyable alt & $7,670 \\ \hline & Purchased otfice equipment on account \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Oott & Acceon & 0 & 0 \\ \hline 20230904 & Purchases alc & 5700 & \\ \hline & Parip Company ale & & 5700 \\ \hline & & Purchased goods on account. \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Ditn & Acchent & & 0 \\ \hline 20230907 & Advertisement ate & s500 & \\ \hline & Cash afc & & $500 \\ \hline & Paid advertisement expense \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Dutt & Acrom & D & 0 \\ \hline 20230908 & Bank ale & 5500 & \\ \hline & Razp Company alc & & $500 \\ \hline & Cheque receved from llatip Comparfy \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account & Dr & or \\ \hline 2023-00-17 & Rirgi Company alc & $500 & \\ \hline & Sales a/c & & $500 \\ \hline & & Sold on credit. \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Dete & Aecount & or & or \\ \hline 20230918 & Wages a/c & 5900 & \\ \hline & Cash alc & 5900 \\ \hline & & Wages paid. \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline oate & Mccount & or & or \\ \hline 20230919 & Purchases a/c & $250 & \\ \hline & Rizai Company alc & $250 \\ \hline & \multicolumn{2}{|c|}{ Goods purchased on credit } \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Acceunt & or & Or \\ \hline 20230919 & Fabiens Company ale & $500 \\ \hline & Sales alc & $500 \\ \hline & \multicolumn{2}{|c|}{ Goods sold on credit. } \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Aceount & or & cr \\ \hline 20230920 & Qank a/c & & \\ \hline & Purchase return & 550 \\ \hline & Part of purchase returned and recorded. \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Accoumt & Dr & cr \\ \hline 202309 & & & \\ 21 & Cash ajc & 5400 & \\ \hline & Purchase return a/c & 5400 \\ \hline & Part of purchase returned and recorded. \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Acceant & Dr & cr \\ \hline 202309 & & & \\ \hline 22 & Afiz Company ale & $2,340 & \\ \hline & Sales afe & $2,340 \\ \hline & & Goods sold on credit. \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline Date & Mecont & or & cr \\ \hline 20230923 & Aziz Company a/c & $999 \\ \hline \multicolumn{2}{|r|}{ Sales a/c } & $999 \\ \hline & \multicolumn{2}{|c|}{ Goods sold on credit. A } \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Accoent & Or & Cr \\ \hline 20230923 & Cash a/c & & \\ \hline & Sales a/c & & $8,115 \\ \hline & \multicolumn{3}{|c|}{ Goods sold on cash. } \\ \hline \end{tabular} \begin{tabular}{|c||c|c|c|} \hline Date & Mcceust & Dr & cr \\ \hline 20230924 & Lukman Company ajc & $367 & \\ \hline \multicolumn{3}{|r|}{ Sales a/c } & $367 \\ \hline & Goods sold on account. \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & \multicolumn{1}{|c|}{ Acceat } & or & cr \\ \hline 20230924 & Syamsui Company ajc & S1,000 \\ \hline & Bank ajc & $1,000 \\ \hline & Paid Syamsui Company through cheque and \\ \hline & & discount availed \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Acceume & or & cr \\ \hline 20230925 & Lukman Company a/c & $367 & \\ \hline & Cash a/c & & $367 \\ \hline \end{tabular} Paid to Lukman and discount avaled. \begin{tabular}{|c|c|c|c|} \hline Date & Accewat & or & cr \\ \hline 20230926 & Insurance a/c & & \\ \hline & Cash a/c & $800 & \\ \hline & \multicolumn{2}{|c|}{ Paid insurance expense } \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Acceunn & or & cr \\ \hline 20230927 & Cash ajc & $550 & \\ \hline & Aziz Company alc & $550 \\ \hline & Cash received trom Aziz Company. . \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account & or & cr \\ \hline 20230927 & Cash ajc & & \\ \hline \multicolumn{1}{|c|}{ Zaid Company a/c } & & $400 \\ \hline & Cash recelved from Zaid Company. & \\ \hline \end{tabular} \begin{tabular}{|c||c|c|r|} \hline Date & Account & Dr & \multicolumn{1}{|c|}{ Cr } \\ \hline 20230928 & Bank a/c & $600 & \\ \hline \hline & Lukman Company a/c & & $600 \\ \hline & Cheque received from Lukman Company. \\ \hline \end{tabular} \begin{tabular}{|c||c||c|r|} \hline Date & Account & Dr & \multicolumn{1}{|c|}{ Cr } \\ \hline 20230929 & Cash a/c & $400 & \\ \hline \hline & Zamri Company a/c & & $400 \\ \hline & Cash received from Zamri Company. \\ \hline \end{tabular} \begin{tabular}{|c||c||c|c|} \hline Date & Account & \multicolumn{1}{|c|}{ Dr } & \multicolumn{1}{|c|}{Cr} \\ \hline 20230930 & Drawings a/c & $440 & \\ \hline & Cash a/c & & $440 \\ \hline & Cash withdrawn and recorded. \\ \hline \end{tabular} \begin{tabular}{|c||c|c|c|} \hline Date & Account & Dr & \multicolumn{1}{|c|}{ Cr } \\ \hline 20230930 & Drawings a/c & $470 & \\ \hline \hline & Purchases a/c & & $470 \\ \hline & Goods withdrawn and recorded. \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started