Required:

- Update the partial Statement of Financial Position of Omron Berhad showing the shareholders equity and liability account balances at 31 December, 2020.

(4 Marks)

- Compare and contrast (similarity and difference) between a right issue and a normal issue of ordinary shares in a company? State one (1) similarity and one (1) difference.

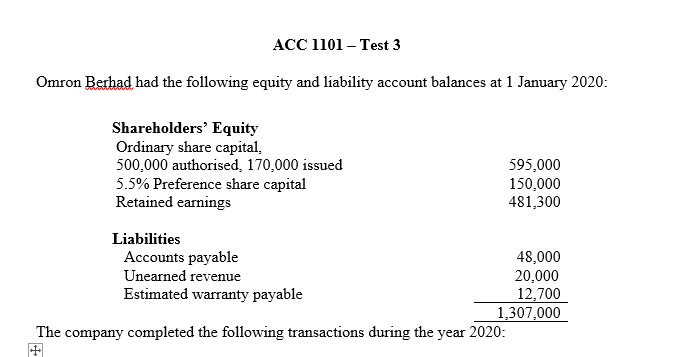

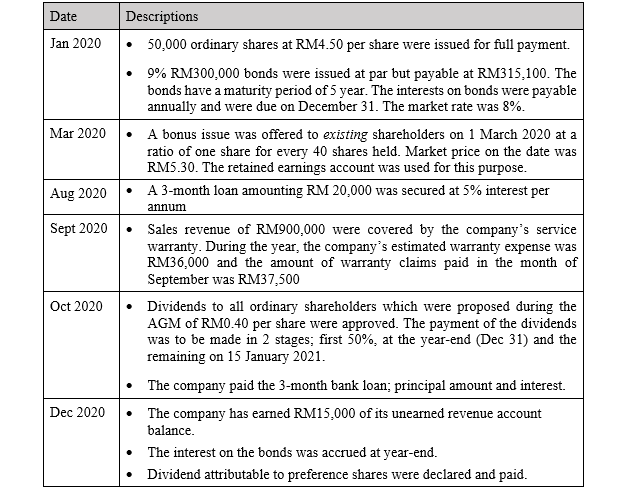

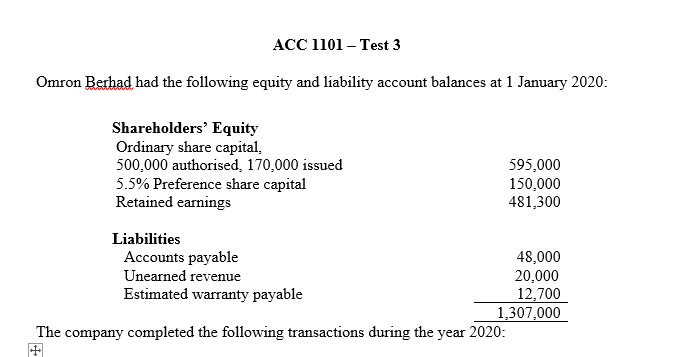

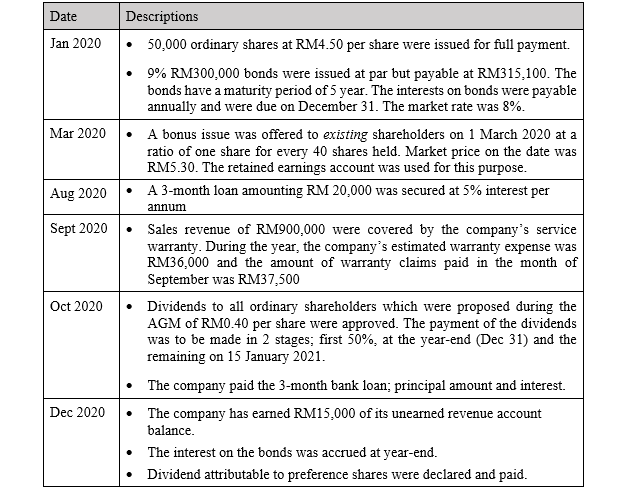

ACC 1101 Test 3 Omron Berhad had the following equity and liability account balances at 1 January 2020: Shareholders' Equity Ordinary share capital. 500,000 authorised, 170,000 issued 5.5% Preference share capital Retained earnings 595,000 150,000 481,300 Liabilities Accounts payable 48,000 Unearned revenue 20,000 Estimated warranty payable 12,700 1,307,000 The company completed the following transactions during the year 2020: Date Descriptions Jan 2020 50,000 ordinary shares at RM4.50 per share were issued for full payment. 9% RM300,000 bonds were issued at par but payable at RM315,100. The bonds have a maturity period of 5 year. The interests on bonds were payable annually and were due on December 31. The market rate was 8%. Mar 2020. A bonus issue was offered to existing shareholders on 1 March 2020 at a ratio of one share for every 40 shares held. Market price on the date was RM5.30. The retained earnings account was used for this purpose. Aug 2020 A 3-month loan amounting RM 20,000 was secured at 5% interest per annum Sept 2020 Sales revenue of RM900,000 were covered by the company's service warranty. During the year, the company's estimated warranty expense was RM36,000 and the amount of warranty claims paid in the month of September was RM37,500 Oct 2020 Dividends to all ordinary shareholders which were proposed during the AGM of RM0.40 per share were approved. The payment of the dividends was to be made in 2 stages; first 50%, at the year-end (Dec 31) and the remaining on 15 January 2021. The company paid the 3-month bank loan; principal amount and interest. Dec 2020. The company has earned RM15,000 of its unearned revenue account balance. The interest on the bonds was accrued at year-end. Dividend attributable to preference shares were declared and paid. ACC 1101 Test 3 Omron Berhad had the following equity and liability account balances at 1 January 2020: Shareholders' Equity Ordinary share capital. 500,000 authorised, 170,000 issued 5.5% Preference share capital Retained earnings 595,000 150,000 481,300 Liabilities Accounts payable 48,000 Unearned revenue 20,000 Estimated warranty payable 12,700 1,307,000 The company completed the following transactions during the year 2020: Date Descriptions Jan 2020 50,000 ordinary shares at RM4.50 per share were issued for full payment. 9% RM300,000 bonds were issued at par but payable at RM315,100. The bonds have a maturity period of 5 year. The interests on bonds were payable annually and were due on December 31. The market rate was 8%. Mar 2020. A bonus issue was offered to existing shareholders on 1 March 2020 at a ratio of one share for every 40 shares held. Market price on the date was RM5.30. The retained earnings account was used for this purpose. Aug 2020 A 3-month loan amounting RM 20,000 was secured at 5% interest per annum Sept 2020 Sales revenue of RM900,000 were covered by the company's service warranty. During the year, the company's estimated warranty expense was RM36,000 and the amount of warranty claims paid in the month of September was RM37,500 Oct 2020 Dividends to all ordinary shareholders which were proposed during the AGM of RM0.40 per share were approved. The payment of the dividends was to be made in 2 stages; first 50%, at the year-end (Dec 31) and the remaining on 15 January 2021. The company paid the 3-month bank loan; principal amount and interest. Dec 2020. The company has earned RM15,000 of its unearned revenue account balance. The interest on the bonds was accrued at year-end. Dividend attributable to preference shares were declared and paid.