Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required USE IFRS a) Prepare a Statement of Comprehensive Income for the year ended December 31, 20x5. b) Prepare a Statement of Financial Position as

Required

USE IFRS

a) Prepare a Statement of Comprehensive Income for the year ended December 31, 20x5.

b) Prepare a Statement of Financial Position as at December 31, 20x5. Show the 20x4 comparative balances.

c) Prepare a Statement of Cash Flow for the year ended December 31, 20x5. Calculate the cash flow from operations using the indirect method.

d) Calculate the cash flow from operations using the direct method. The statements should be prepared in good form.

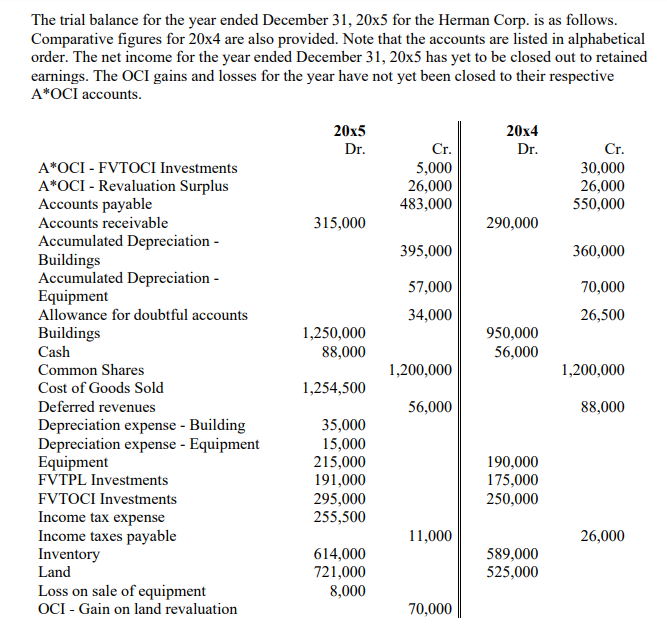

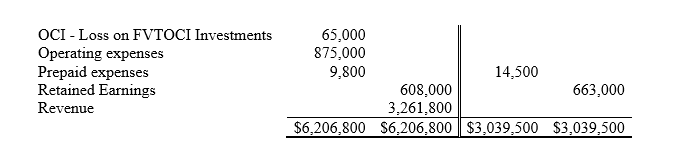

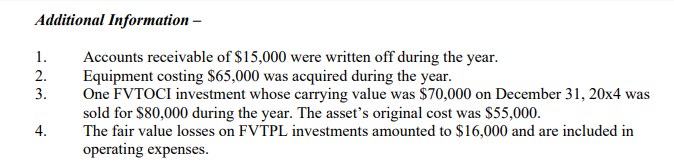

The trial balance for the year ended December 31, 20x5 for the Herman Corp. is as follows. Comparative figures for 20x4 are also provided. Note that the accounts are listed in alphabetical order. The net income for the year ended December 31, 20x5 has yet to be closed out to retained earnings. The OCI gains and losses for the year have not yet been closed to their respective A*OCI accounts. 20x5 Dr. 20x4 Dr. Cr. 5,000 26,000 483,000 Cr. 30,000 26,000 550,000 315,000 290,000 395,000 360,000 57,000 34,000 70,000 26,500 1,250,000 88,000 950,000 56,000 1,200,000 1,200,000 A*OCI - FVTOCI Investments A*OCI - Revaluation Surplus Accounts payable Accounts receivable Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Allowance for doubtful accounts Buildings Cash Common Shares Cost of Goods Sold Deferred revenues Depreciation expense - Building Depreciation expense - Equipment Equipment FVTPL Investments FVTOCI Investments Income tax expense Income taxes payable Inventory Land Loss on sale of equipment OCI - Gain on land revaluation 1,254,500 56,000 88,000 35,000 15,000 215,000 191,000 295,000 255,500 190,000 175,000 250,000 11,000 26,000 614,000 721,000 8,000 589,000 525,000 70,000 OCI - Loss on FVTOCI Investments Operating expenses Prepaid expenses Retained Earnings Revenue 65,000 875,000 9,800 14,500 608.000 663,000 3,261,800 $6,206,800 $6.206.800 $3,039,500 $3,039,500 Additional Information - 1. Accounts receivable of $15,000 were written off during the year. 2. Equipment costing $65,000 was acquired during the year. 3. One FVTOCI investment whose carrying value was $70,000 on December 31, 20x4 was sold for $80,000 during the year. The asset's original cost was $55,000. 4. The fair value losses on FVTPL investments amounted to $16,000 and are included in operating expenses. The statements should be prepared in good form. This is how I recommend you proceed: analyze the two A*OCI, the Retained Earnings and the FVTOCI Investment accounts make sure you understand how these go from their opening to the balance listed in the trial balance. prepare part (a) complete the analysis of the two A*OCI and R/E accounts to arrive at the ending balance prepare part (6) analyze the following accounts: AR, Allowance for Doubtful Accounts, Land. Equipment, Acc Dep, FVTPL Investments, and Building accounts. prepare parts (c) and (d) The trial balance for the year ended December 31, 20x5 for the Herman Corp. is as follows. Comparative figures for 20x4 are also provided. Note that the accounts are listed in alphabetical order. The net income for the year ended December 31, 20x5 has yet to be closed out to retained earnings. The OCI gains and losses for the year have not yet been closed to their respective A*OCI accounts. 20x5 Dr. 20x4 Dr. Cr. 5,000 26,000 483,000 Cr. 30,000 26,000 550,000 315,000 290,000 395,000 360,000 57,000 34,000 70,000 26,500 1,250,000 88,000 950,000 56,000 1,200,000 1,200,000 A*OCI - FVTOCI Investments A*OCI - Revaluation Surplus Accounts payable Accounts receivable Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Allowance for doubtful accounts Buildings Cash Common Shares Cost of Goods Sold Deferred revenues Depreciation expense - Building Depreciation expense - Equipment Equipment FVTPL Investments FVTOCI Investments Income tax expense Income taxes payable Inventory Land Loss on sale of equipment OCI - Gain on land revaluation 1,254,500 56,000 88,000 35,000 15,000 215,000 191,000 295,000 255,500 190,000 175,000 250,000 11,000 26,000 614,000 721,000 8,000 589,000 525,000 70,000 OCI - Loss on FVTOCI Investments Operating expenses Prepaid expenses Retained Earnings Revenue 65,000 875,000 9,800 14,500 608.000 663,000 3,261,800 $6,206,800 $6.206.800 $3,039,500 $3,039,500 Additional Information - 1. Accounts receivable of $15,000 were written off during the year. 2. Equipment costing $65,000 was acquired during the year. 3. One FVTOCI investment whose carrying value was $70,000 on December 31, 20x4 was sold for $80,000 during the year. The asset's original cost was $55,000. 4. The fair value losses on FVTPL investments amounted to $16,000 and are included in operating expenses. The statements should be prepared in good form. This is how I recommend you proceed: analyze the two A*OCI, the Retained Earnings and the FVTOCI Investment accounts make sure you understand how these go from their opening to the balance listed in the trial balance. prepare part (a) complete the analysis of the two A*OCI and R/E accounts to arrive at the ending balance prepare part (6) analyze the following accounts: AR, Allowance for Doubtful Accounts, Land. Equipment, Acc Dep, FVTPL Investments, and Building accounts. prepare parts (c) and (d)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started