Answered step by step

Verified Expert Solution

Question

1 Approved Answer

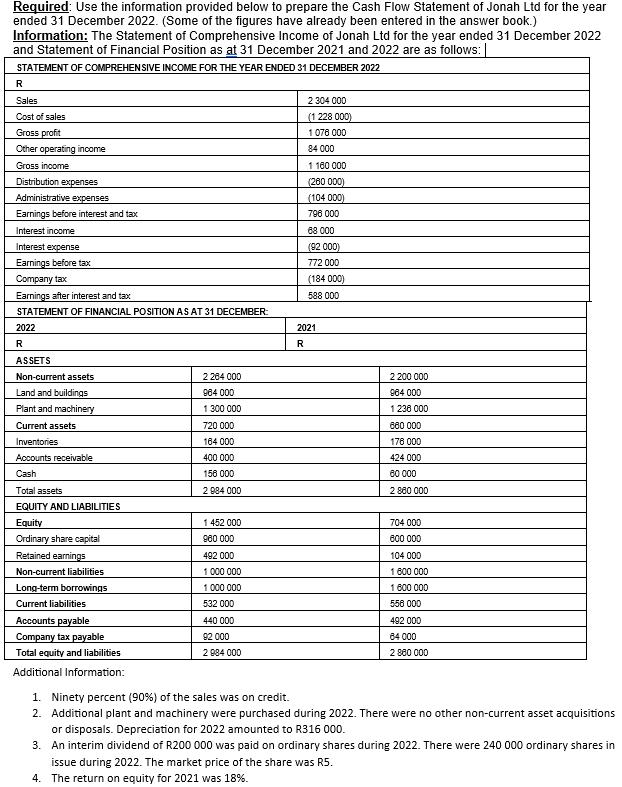

Required: Use the information provided below to prepare the Cash Flow Statement of Jonah Ltd for the year ended 31 December 2022. (Some of

Required: Use the information provided below to prepare the Cash Flow Statement of Jonah Ltd for the year ended 31 December 2022. (Some of the figures have already been entered in the answer book.) Information: The Statement of Comprehensive Income of Jonah Ltd for the year ended 31 December 2022 and Statement of Financial Position as at 31 December 2021 and 2022 are as follows: STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2022 R Sales Cost of sales Gross profit Other operating income Gross income Distribution expenses Administrative expenses Earnings before interest and tax Interest income Interest expense Earnings before tax Company tax Earnings after interest and tax 2 304 000 (1 228 000) 1 076 000 84 000 1 160 000 (260 000) (104 000) 796 000 68 000 (92 000) 772 000 (184 000) 588 000 STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER: 2022 R ASSETS Non-current assets Land and buildings Plant and machinery Current assets 2 264 000 964 000 1 300 000 720 000 164 000 Inventories Accounts receivable 400 000 Cash 150 000 Total assets 2 984 000 EQUITY AND LIABILITIES Equity 1 452 000 2021 R 2 200 000 964 000 1238 000 660 000 178 000 424 000 60 000 2 860 000 Ordinary share capital Retained earnings Non-current liabilities 960 000 492 000 704 000 600 000 104 000 1 000 000 1 600 000 Long-term borrowings 1 000 000 Current liabilities Accounts payable Company tax payable Total equity and liabilities Additional Information: 532 000 440 000 92 000 1 600 000 558 000 492 000 2 984 000 64 000 2 860 000 1. Ninety percent (90%) of the sales was on credit. 2. Additional plant and machinery were purchased during 2022. There were no other non-current asset acquisitions or disposals. Depreciation for 2022 amounted to R316 000. 3. An interim dividend of R200 000 was paid on ordinary shares during 2022. There were 240 000 ordinary shares in issue during 2022. The market price of the share was R5. 4. The return on equity for 2021 was 18%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started