Question

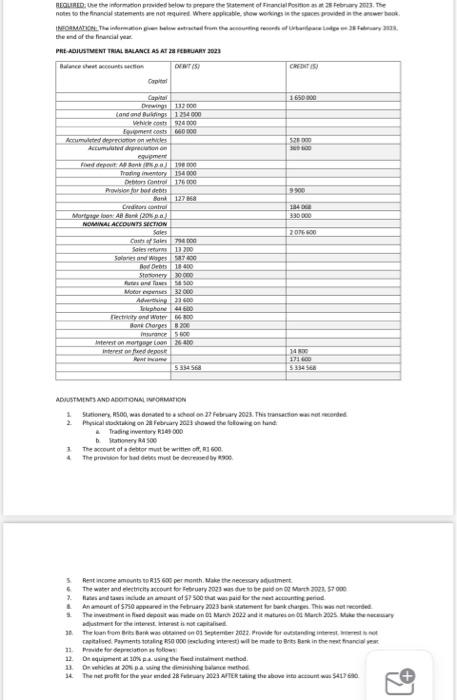

REQUIRED: Use the information provided below to prepare the Statement of Financial Position as at 28 February 2023. INFORMATION: The information given below extracted from

REQUIRED: Use the information provided below to prepare the Statement of Financial Position as at 28 February 2023.

INFORMATION: The information given below extracted from the accounting records of UrbanSpace Lodge on 28 February 2023, the end of the financial year.

PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2023

| Balance sheet accounts section Capital

| DEBIT ($) | CREDIT ($) |

Capital |

| 1 650 000 |

Drawings | 132 000 |

|

Land and Buildings | 1 254 000 |

|

Vehicle costs | 924 000 |

|

Equipment costs | 660 000 |

|

Accumulated depreciation on vehicles |

| 528 000 |

Accumulated depreciation on equipment |

| 369 600 |

Fixed deposit: AB Bank (8% p.a.) | 198 000 |

|

Trading inventory | 154 000 |

|

Debtors Control | 176 000 |

|

Provision for bad debts |

| 9 900 |

Bank | 127 868 |

|

Creditors control |

| 184 068 |

Mortgage loan: AB Bank (20% p.a.) |

| 330 000 |

NOMINAL ACCOUNTS SECTION |

|

|

Sales |

| 2 076 600 |

Costs of Sales | 794 000 |

|

Sales returns | 13 200 |

|

Salaries and Wages | 587 400 |

|

Bad Debts | 18 400 |

|

Stationery | 30 000 |

|

Rates and Taxes | 58 500 |

|

Motor expenses | 32 000 |

|

Advertising | 23 600 |

|

Telephone | 44 600 |

|

Electricity and Water | 66 800 |

|

Bank Charges | 8 200 |

|

Insurance | 5 600 |

|

Interest on mortgage Loan | 26 400 |

|

Interest on fixed deposit |

| 14 800 |

Rent Income |

| 171 600 |

| 5 334 568 | 5 334 568 |

|

|

|

ADJUSTMENTS AND ADDITIONAL INFORMATION

1. Stationery, R500, was donated to a school on 27 February 2023. This transaction was not recorded.

2. Physical stocktaking on 28 February 2023 showed the following on hand:

a. Trading inventory R149 000

b. Stationery R4 500

3. The account of a debtor must be written off, R1 600.

4. The provision for bad debts must be decreased by R900.

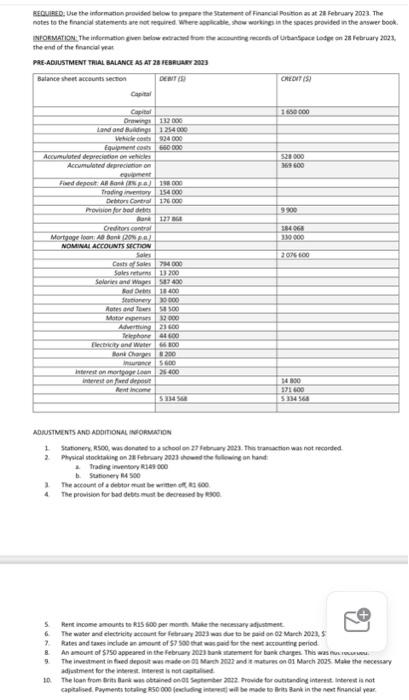

5. Rent income amounts to R15 600 per month. Make the necessary adjustment.

6. The water and electricity account for February 2023 was due to be paid on 02 March 2023, $7 000.

7. Rates and taxes include an amount of $7 500 that was paid for the next accounting period.

8. An amount of $750 appeared in the February 2023 bank statement for bank charges. This was not recorded.

9. The investment in fixed deposit was made on 01 March 2022 and it matures on 01 March 2025. Make the necessary adjustment for the interest. Interest is not capitalised.

10. The loan from Brits Bank was obtained on 01 September 2022. Provide for outstanding interest. Interest is not capitalised. Payments totaling R50 000 (excluding interest) will be made to Brits Bank in the next financial year.

11. Provide for depreciation as follows:

12. On equipment at 10% p.a. using the fixed instalment method.

13. On vehicles at 20% p.a. using the diminishing balance method.

14. The net profit for the year ended 28 February 2023 AFTER taking the above into account was $417 690.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started