Question

Required: What are the consolidated balances for the year ended/at December 31, Year 5, for the following accounts? (Omit $ sign in your response.) (a)

Required:What are the consolidated balances for the year ended/at December 31, Year 5, for the following accounts? (Omit $ sign in your response.) (a) Net income OIL's net income considered in the Consolidated Financial Statement b) Retained earnings, 1/1/Year 5 OIL's retained earnings in the Financial statement for Consolidation c) Equipment Value of equipment after acquisition d) Patented technology Value of patent after acquisition e) Goodwill Goodwill f) Liabilities Total liabilities after acquisition g) Common shares Total value of common shares after acquisition (h) Non-controlling interests Total value of non-controlling interest after acquisition

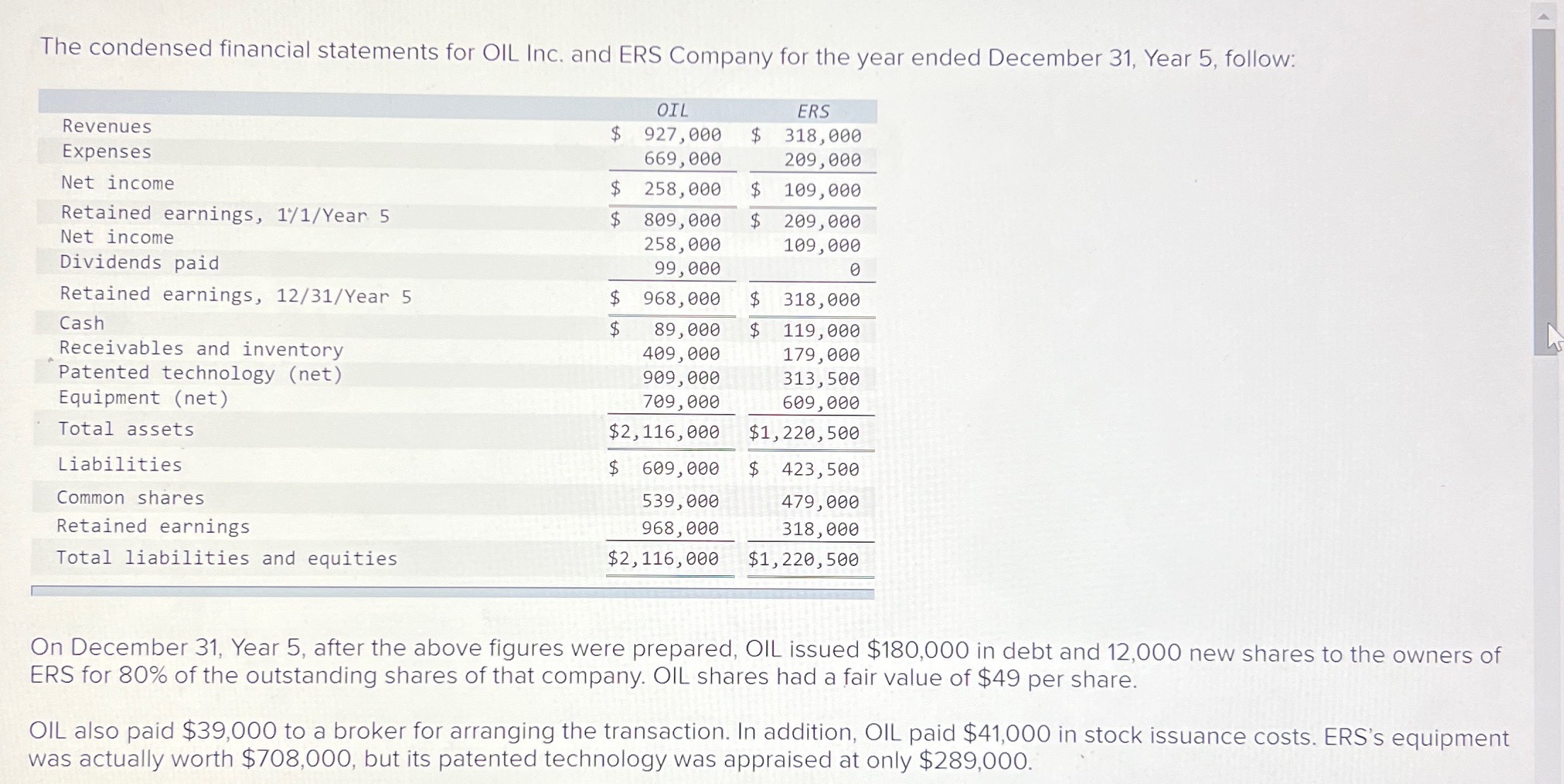

The condensed financial statements for OIL Inc. and ERS Company for the year ended December 31, Year 5, follow: OIL ERS Revenues Expenses Net income Retained earnings, 1/1/Year 5 Net income Dividends paid Retained earnings, 12/31/Year 5 Cash Receivables and inventory Patented technology (net) Equipment (net) Total assets Liabilities Common shares Retained earnings Total liabilities and equities $ 927,000 $ 318,000 669,000 209,000 $ 258,000 $ 109,000 $ 809,000 $ 209,000 258,000 109,000 99,000 0 $ 968,000 $ 318,000 89,000 $ 119,000 409,000 179,000 909,000 313,500 709,000 609,000 $2,116,000 $1,220,500 $ 609,000 423,500 539,000 479,000 968,000 $2,116,000 318,000 $1,220,500 On December 31, Year 5, after the above figures were prepared, OIL issued $180,000 in debt and 12,000 new shares to the owners of ERS for 80% of the outstanding shares of that company. OIL shares had a fair value of $49 per share. OIL also paid $39,000 to a broker for arranging the transaction. In addition, OIL paid $41,000 in stock issuance costs. ERS's equipment was actually worth $708,000, but its patented technology was appraised at only $289,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started