Required

Your assignment will involve a case study which is to be completed individually. As an associate financial adviser, you will be required to analyse personal and financial information collected from clients with regard to personal risk protection, then develop and recommend appropriate strategies. A written report supporting your analysis and recommending a course of action to the senior Financial Planner will be required. (1500 words)

-

Complete a risk analysis, identifying for Genevieve the risks for herself, the family and the business. (6 marks)

-

Suggest strategies to mitigate against the identified risks. (6 marks)

-

To support strategies suggested discuss the impact of the business risk factors that Genevieve may face in her practice. (3 marks)

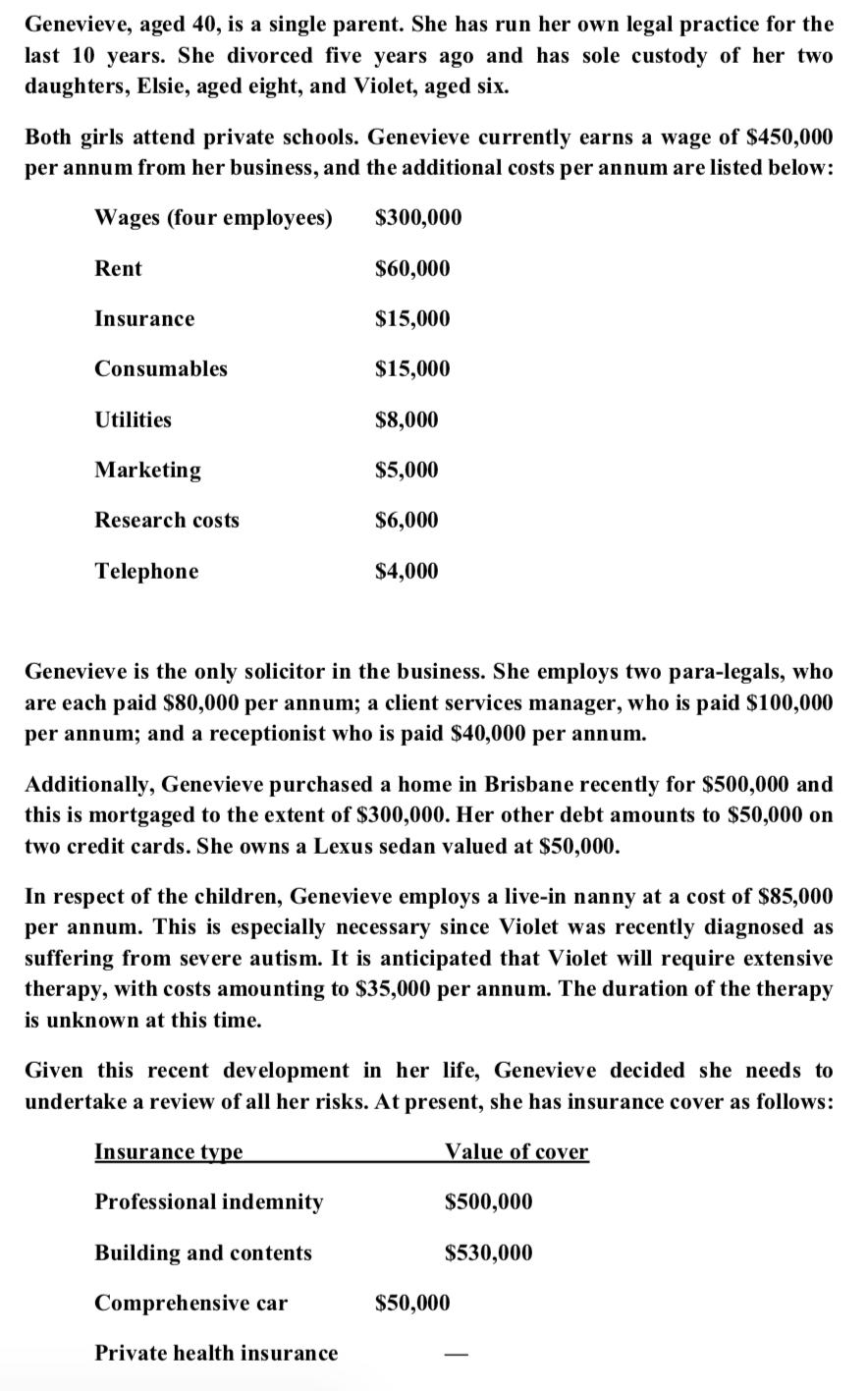

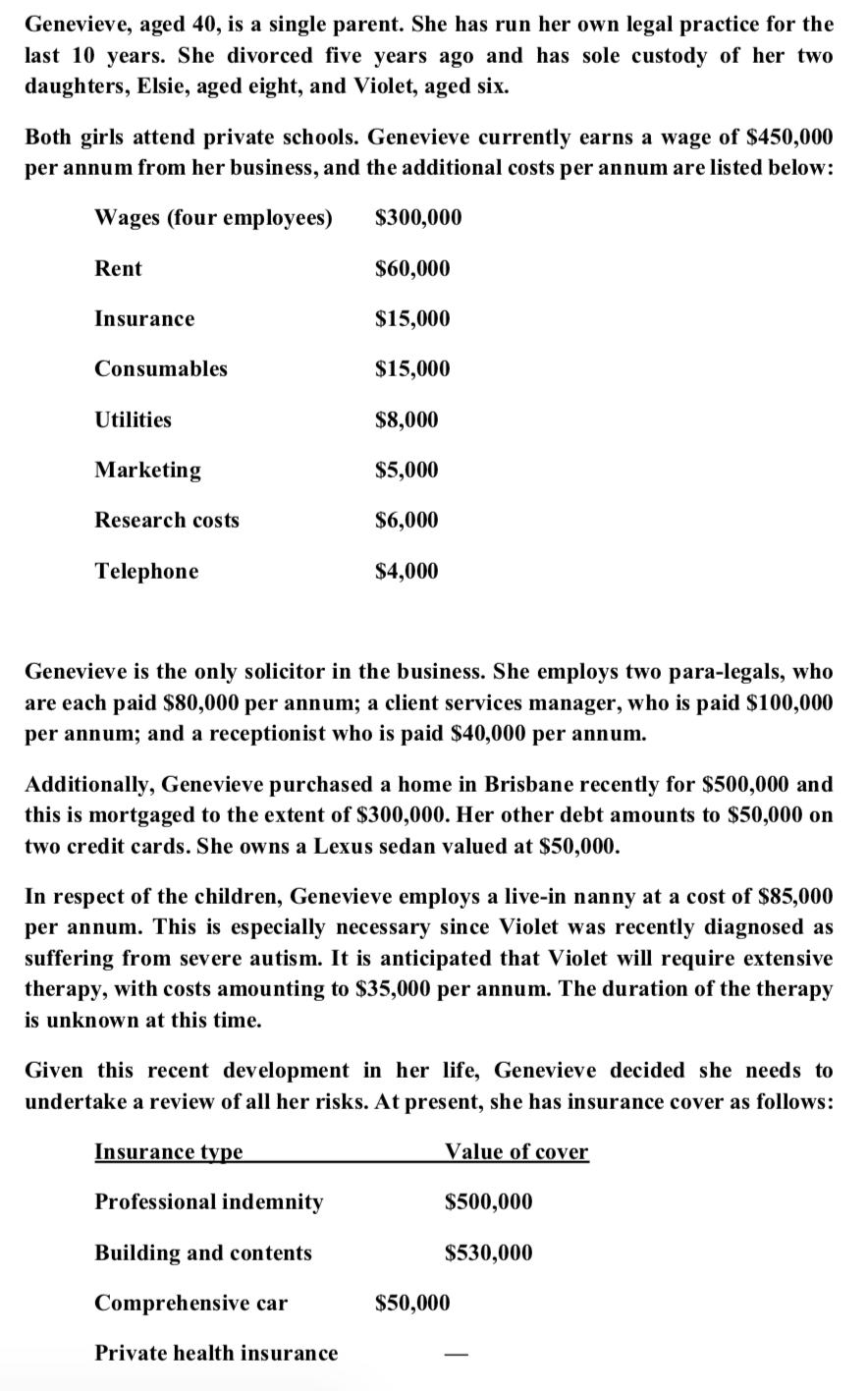

Genevieve, aged 40, is a single parent. She has run her own legal practice for the last 10 years. She divorced five years ago and has sole custody of her two daughters, Elsie, aged eight, and Violet, aged six. Both girls attend private schools. Genevieve currently earns a wage of $450,000 per annum from her business, and the additional costs per annum are listed below: Wages (four employees) $300,000 Rent $60,000 Insurance $15,000 Consumables $15,000 Utilities $8,000 Marketing $5,000 Research costs $6,000 Telephone $4,000 Genevieve is the only solicitor in the business. She employs two para-legals, who are each paid $80,000 per annum; a client services manager, who is paid $100,000 per annum; and a receptionist who is paid $40,000 per annum. Additionally, Genevieve purchased a home in Brisbane recently for $500,000 and this is mortgaged to the extent of $300,000. Her other debt amounts to $50,000 on two credit cards. She owns a Lexus sedan valued at $50,000. In respect of the children, Genevieve employs a live-in nanny at a cost of $85,000 per annum. This is especially necessary since Violet was recently diagnosed as suffering from severe autism. It is anticipated that Violet will require extensive therapy, with costs amounting to $35,000 per annum. The duration of the therapy is unknown at this time. Given this recent development in her life, Genevieve decided she needs to undertake a review of all her risks. At present, she has insurance cover as follows: Insurance type Value of cover Professional indemnity $500,000 Building and contents $530,000 Comprehensive car $50,000 Private health insurance Genevieve, aged 40, is a single parent. She has run her own legal practice for the last 10 years. She divorced five years ago and has sole custody of her two daughters, Elsie, aged eight, and Violet, aged six. Both girls attend private schools. Genevieve currently earns a wage of $450,000 per annum from her business, and the additional costs per annum are listed below: Wages (four employees) $300,000 Rent $60,000 Insurance $15,000 Consumables $15,000 Utilities $8,000 Marketing $5,000 Research costs $6,000 Telephone $4,000 Genevieve is the only solicitor in the business. She employs two para-legals, who are each paid $80,000 per annum; a client services manager, who is paid $100,000 per annum; and a receptionist who is paid $40,000 per annum. Additionally, Genevieve purchased a home in Brisbane recently for $500,000 and this is mortgaged to the extent of $300,000. Her other debt amounts to $50,000 on two credit cards. She owns a Lexus sedan valued at $50,000. In respect of the children, Genevieve employs a live-in nanny at a cost of $85,000 per annum. This is especially necessary since Violet was recently diagnosed as suffering from severe autism. It is anticipated that Violet will require extensive therapy, with costs amounting to $35,000 per annum. The duration of the therapy is unknown at this time. Given this recent development in her life, Genevieve decided she needs to undertake a review of all her risks. At present, she has insurance cover as follows: Insurance type Value of cover Professional indemnity $500,000 Building and contents $530,000 Comprehensive car $50,000 Private health insurance