Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: a) Calculate goodwill on consolidation and prepare the relevant consolidation journal entries at 31 Dec 2019 Globe Bhd had acquired 75% interest in the

Required:

Required:a) Calculate goodwill on consolidation and prepare the relevant consolidation journal entries at 31 Dec 2019

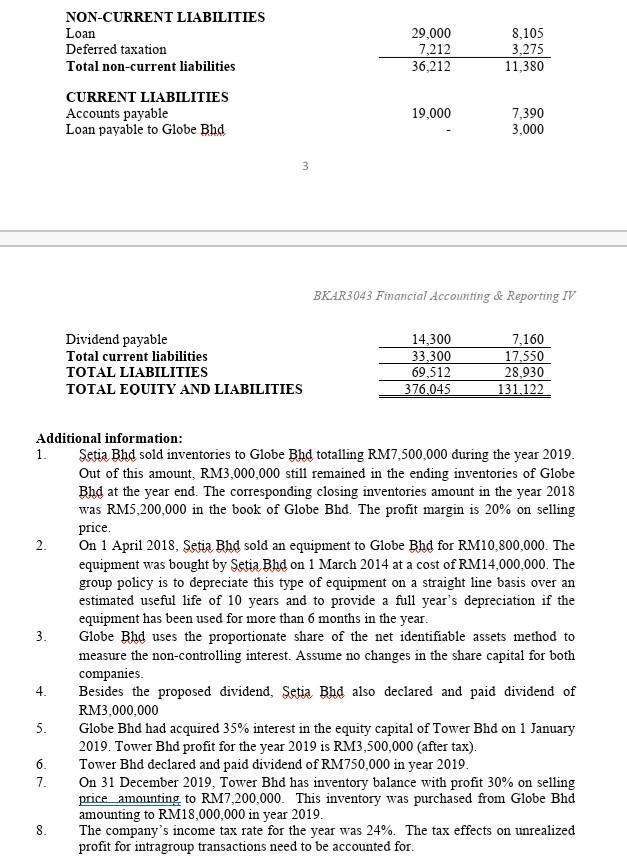

Globe Bhd had acquired 75% interest in the equity capital of Setia Bhd on 1 January 2017. On the acquisition date, the retained earnings of Setia Bhd were RM12,000,000. A freehold land and equipment of Setia Bhd recorded at cost of RM5,500,000 and 4,500,000 respectively. But the freehold land and the equipment was said to have a fair value of RM8,000,000 and 4,000,000 respectively. There are no adjustment had been made in the Setia Bhd s accounts to reflect the fair values. The share price of Setia Bhd was fair valued at RM1.60 per share. Setia Bhd s shares were issued at RM1.00 per share. The financial statements of both companies for the year ended 31 December 2019 are as follows: Statement of Profit or Loss and Other Comprehensive Income For the year ended 31 December 2019 Globe Bhd Setia Bhd RM 000 RM 000 Turnover Cost of sales Gross profit Gain from disposal of land Dividend income Operating expenses Profit before taxation Tax expenses Profit for the year Other comprehensive income Gains on revaluation of property Total comprehensive income Retained earnings brought forward + Profit for the period - Proposed dividend - Dividend Retained earnings carried forward NON-CURRENT ASSETS Property, plant and equipment Investments in Setia Bhd Investment in Tower Bhd Total non-current assets CURRENT ASSETS Inventories Accounts receivable Dividend receivable 2 Loan receivable from Setia Bhd Cash and bank balances Total current assets. TOTAL ASSETS EQUITY Share capital Retained earnings Revaluation reserves Total equity 65,250 (23,400) 41,850 Statements of Changes in Equity (Partial) For the year ended 31 December 2019 Globe Bhd RM 000 7,882.5 (26,782.5) 22,950 Statement of Financial Position As at 31 December 2019 BKAR3043 Financial Accounting & Reporting IV (5.967) 16,983 2,000 18,983 92,750 16,983 (14,300) (8,400) 87,033 Globe Bhd RM 000 217,300 78,000 15,000 310,300 35,250 5,625 5,370 3.000 16,500 65,745 376,045 39.000 (17,550) 21,450 1,120 200,000 87,033 19,500 306,533 (10,310) 12,260 (2,408) 9,852 9,852 Setia Bhd RM 000 22,500 9,852 (7,160) (3,000) 22,192 Setia Bhd RM 000 89,000 89,000 14,081 15,919 12,122 42,122 131,122 80.000 22,192 102,192 2. 3. 4. 5. 6. 7. NON-CURRENT LIABILITIES 8. Loan Deferred taxation Total non-current liabilities CURRENT LIABILITIES Accounts payable Loan payable to Globe Bhd 3 Dividend payable Total current liabilities TOTAL LIABILITIES TOTAL EQUITY AND LIABILITIES 29,000 7,212 36,212 19,000 Additional information: 1. Setia Bhd sold inventories to Globe Bhd totalling RM7,500,000 during the year 2019. Out of this amount, RM3,000,000 still remained in the ending inventories of Globe Bhd at the year end. The corresponding closing inventories amount in the year 2018 was RM5,200,000 in the book of Globe Bhd. The profit margin is 20% on selling price. On 1 April 2018, Setia Bhd sold an equipment to Globe Bhd for RM10,800,000. The equipment was bought by Setia Bhd on 1 March 2014 at a cost of RM14,000,000. The group policy is to depreciate this type of equipment on a straight line basis over an estimated useful life of 10 years and to provide a full year s depreciation if the equipment has been used for more than 6 months in the year. Globe Bhd uses the proportionate share of the net identifiable assets method to measure the non-controlling interest. Assume no changes in the share capital for both companies. Besides the proposed dividend, Setia Bhd also declared and paid dividend of RM3,000,000 Globe Bhd had acquired 35% interest in the equity capital of Tower Bhd on 1 January 2019. Tower Bhd profit for the year 2019 is RM3,500,000 (after tax). Tower Bhd declared and paid dividend of RM750,000 in year 2019. On 31 December 2019, Tower Bhd has inventory balance with profit 30% on selling price amounting to RM7,200,000. This inventory was purchased from Globe Bhd amounting to RM18,000,000 in year 2019. 8,105 3,275 11,380 14,300 33,300 69,512 376,045 7,390 3,000 BKAR3043 Financial Accounting & Reporting IV 7,160 17,550 28,930 131.122 The company s income tax rate for the year was 24%. The tax effects on unrealized profit for intragroup transactions need to be accounted for.

Step by Step Solution

★★★★★

3.25 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To solve this problem we need to make various calculations and adjustments based on the given financial information of Globe Bhd and Setia Bhd ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started