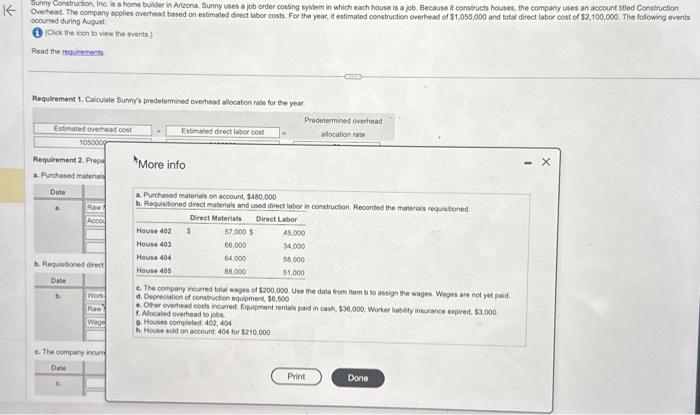

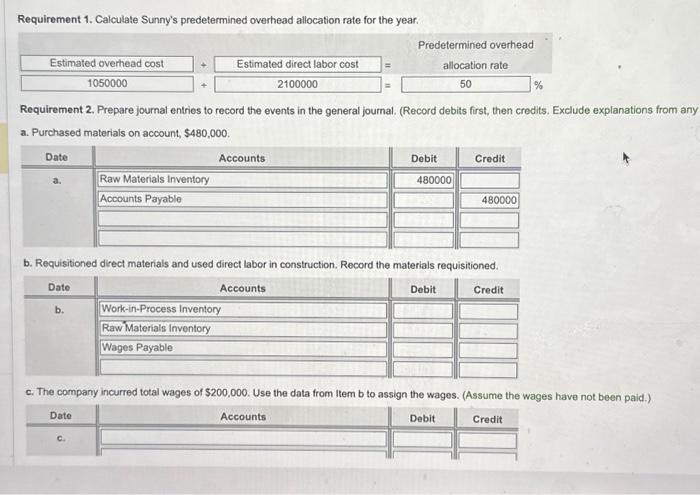

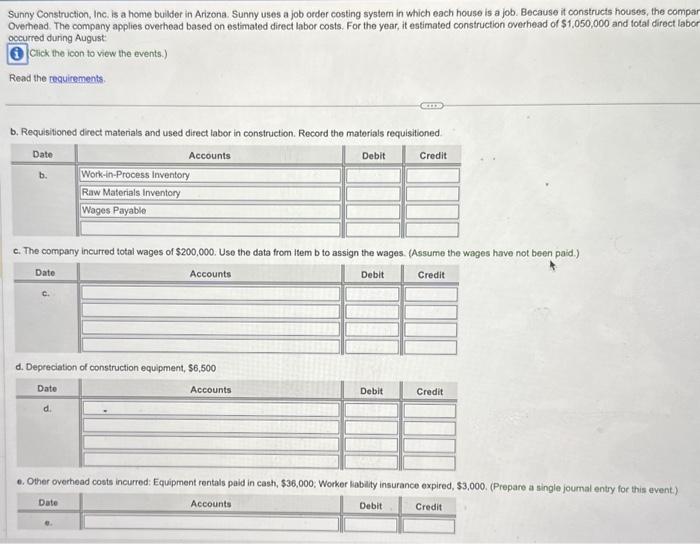

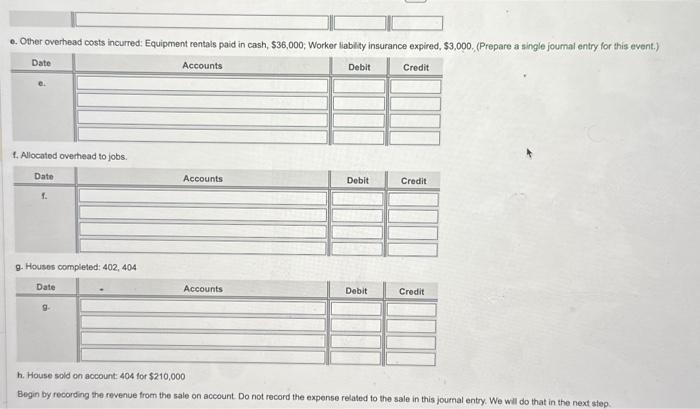

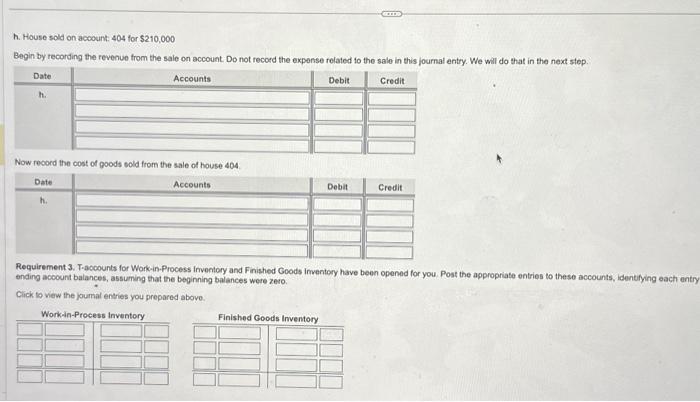

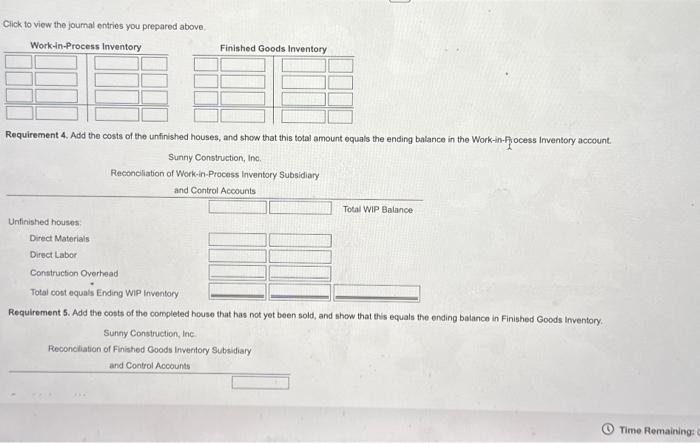

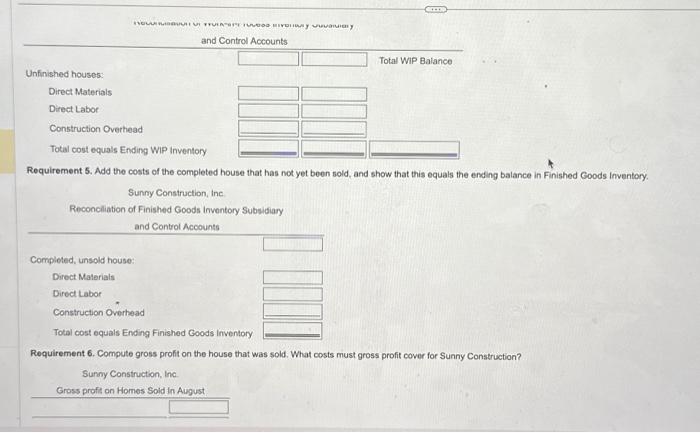

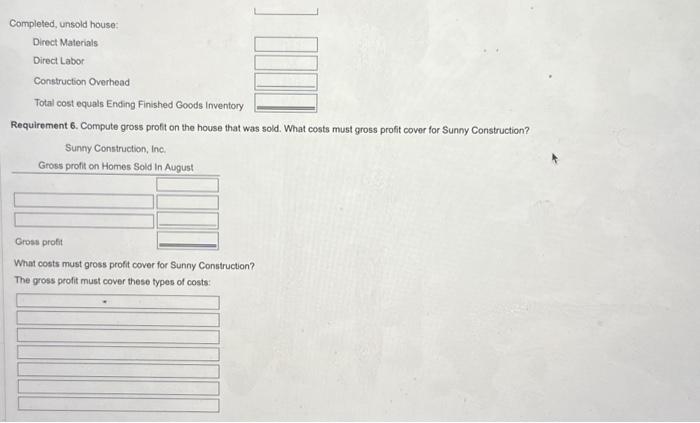

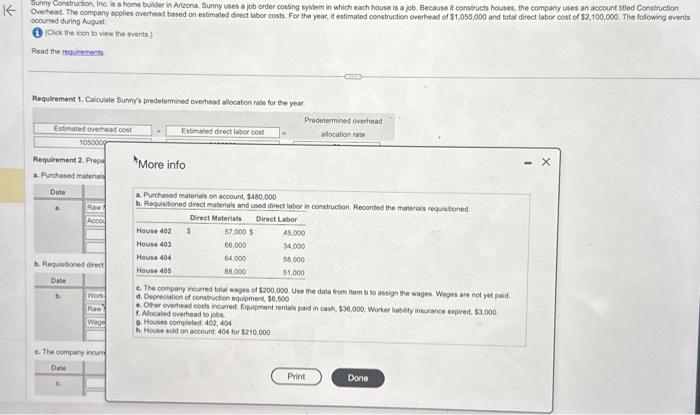

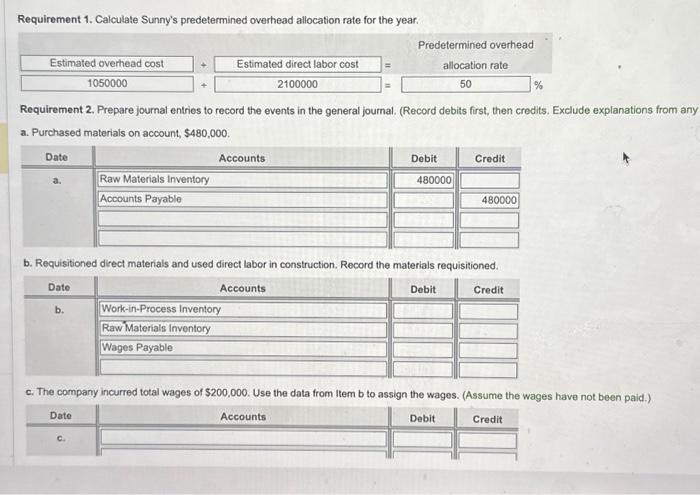

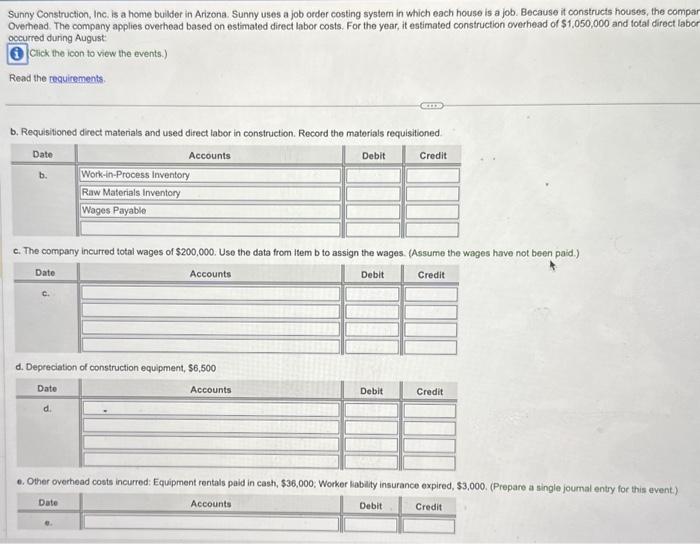

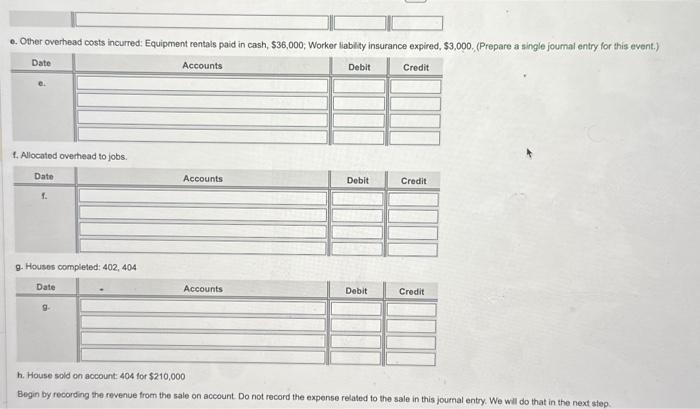

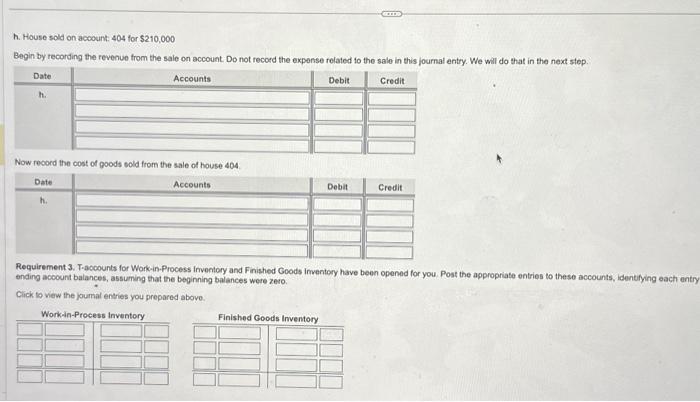

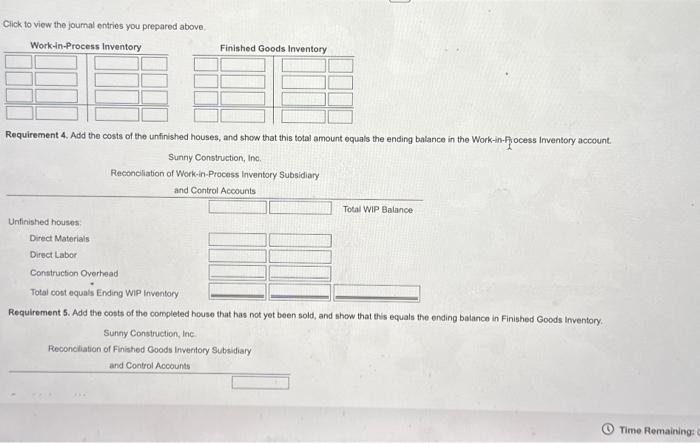

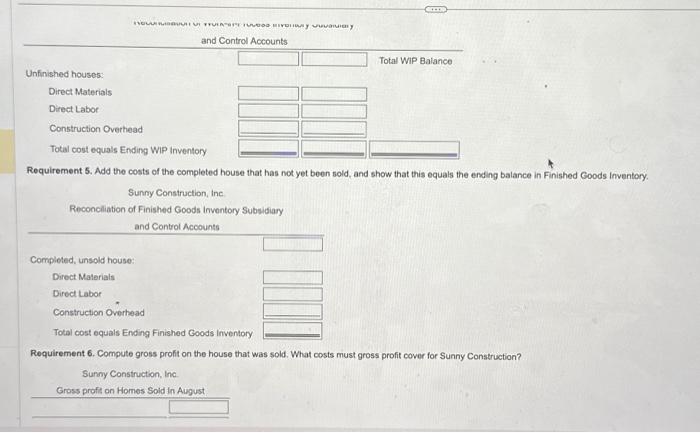

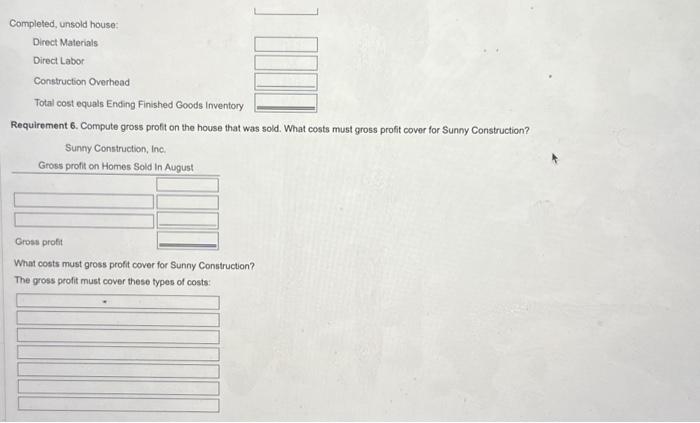

Requirement 1. Calculate Sunny's predetermined overhead allocation rate for the year. Requirement 2. Prepare journal entries to record the events in the general journal. (Record debits first, then credits. Exclude explanations from any a. Purchased materials on account, $480,000. Requirement 5. Add the costs of the completed house that has not yet been sold, and show that this equals the ending balance in Finished Goods inventory. Sunny Construction, ine Sunny Construction, Inc. is a home bulder in Arizona. Sunny uses a job order costing systern in which each house is a job. Because it constructs houses, the compar Overhead. The company applies overhead based on estimated direct labor costs. For the year, it estimated construction overhead of $1,050,000 and fotal direct labor occurred during August: Click the icon to view the events.) Read the requirements. b. Requisitioned direct materials and used direct labor in construction. Record the materials tequisitioned c. The company incurred total wages of $200,000. Use the data from item b to assign the wages. (Assume the wages have not been paid.) d. Depreciation of construction equipment, $6,500 Click to view the joumal entries you prepared above, Requirement 4. Add the costs of the unfinished houses, and show that this total amount equals the ending balance in the Work-in-frocess Inventory account Sunny Construction, Inc. Reconcliation of Work-in-Process Inventory Subsidiary Requirement 5. Add the costs of the completed house that has not yet been sold, and show that this equals the onding balance in Finished Goods inventory. Sunny Construction, Ine Reconcliation of Finishod Goods Invertory Subsidiary (1. Ruccanoc overneag to jots. h. House sold on account: 404 for $210,000 Begin by recording the revenue from the sale on account Do not record the expense related to the sale in this journal entry. We will do that in the next steo h. House sold on account: 404 for $210,000 Begin by recording the revenue from the sale on account. Do not record the expense related to the sale in this journal entry. We will do that in the next step. Now fecord the cost of goods sold from the sale of house 404 Requirement 3. T-accounts for Work-in-Process inventory and Finished Goods imventory have been opened for you. Post the appropriate entries to these accounts, identifying each entry ending account balances, assuming that the beginning balances were zero. Click to view the joumal entries you prepared abovo. Requirement 6. Compute gross profit on the house that was sold. What costs must gross profit cover for Sunny Construction? What costs must gross profit cover for Sunny Construction? occured during Aupust (1) Cick the ioon lo view the evente) Read the requicements Requlrement 1. Caiculate Sunny/s predetermined ovehesd albcation rate for the year