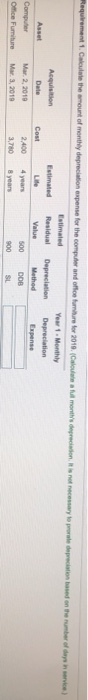

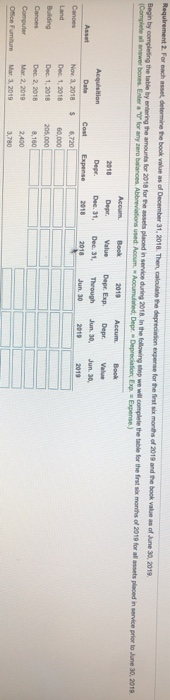

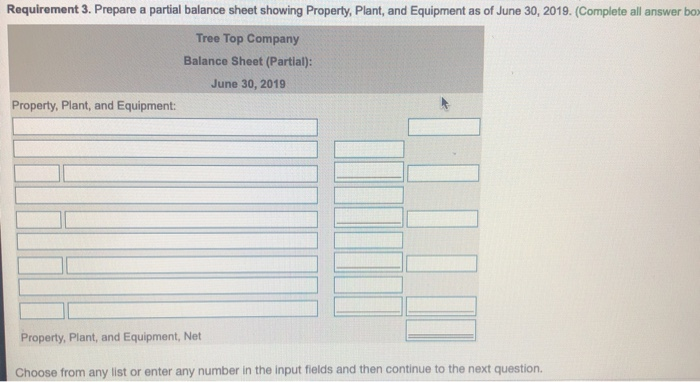

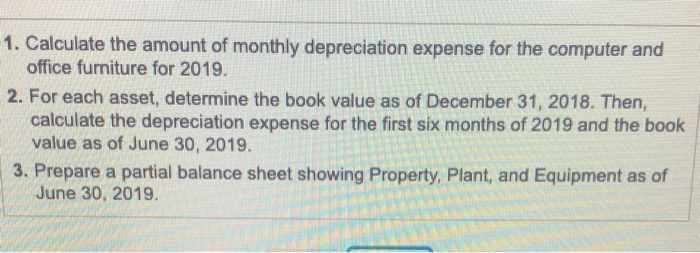

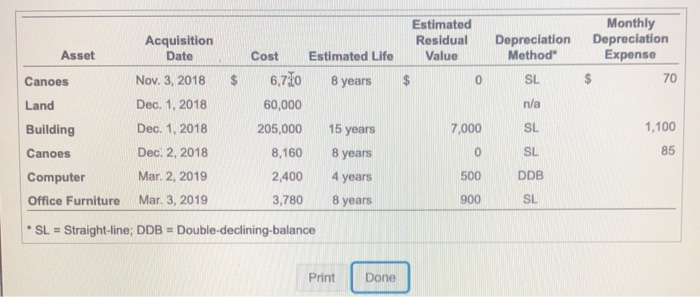

Requirement 1. Calculate the amount of monthly depreciation expense for the computer and office furniture for 2018. Calculate a month depreciation. It is not necessary to proste depreciation based on the number of days) Estimated Yew. Monthly Acquisition Estimated Residual Depreciation Depreciation Asset Date Cost Lille Value Method Computer Mar 2, 2019 2.400 4 years 500 Omice Furniture Mar 3, 2019 3.780 8 years 900 SL Requirement 2. For each as determine the book values of December 31, 2018. Then, calculate the depreciation expense for the first six months of 2019 and the book value as of June 30, 2019 Begin by completing the table by entering the amounts for 2018 for these placed in service during 2018. In the following up we will complete the table for the first six months of 2019 for alle placed in service prior to June 30, 2018 Complete al nuwer boxes. Enter for any zero balances Abbreviations used Accum. Accumulated Depr Depreciation Expense) Accum Book 2019 Accum Book 2018 Depr. Value Dept. Exp Depr. Value Acquisition Depe Dec 31 Dec 31, Though Jun 30 Jun 30. Asset Date Cost Expense 2018 2018 Jun 30 2010 2019 Cance Now. 3. 2018 $ 720 Land Dec. 1. 2018 80,000 Building Dec. 1. 2018 205.000 Cancer Dec. 2. 2018 8,160 Computer Mar 2, 2019 2.400 Office Fumare Mar. 2019 3,780 Requirement 3. Prepare a partial balance sheet showing Property, Plant, and Equipment as of June 30, 2019. (Complete all answer box Tree Top Company Balance Sheet (Partial): June 30, 2019 Property, Plant, and Equipment: Property, Plant, and Equipment, Net Choose from any list or enter any number in the input fields and then continue to the next question. 1. Calculate the amount of monthly depreciation expense for the computer and office furniture for 2019. 2. For each asset, determine the book value as of December 31, 2018. Then, calculate the depreciation expense for the first six months of 2019 and the book value as of June 30, 2019. 3. Prepare a partial balance sheet showing Property, Plant, and Equipment as of June 30, 2019 Acquisition Date Estimated Residual Value Depreciation Method Asset Cost Estimated Life Monthly Depreciation Expense $ 70 8 years $ 0 SL Canoes Land Building 6,730 60,000 205,000 n/a 7,000 SL 1,100 Nov. 3, 2018 Dec. 1, 2018 Dec. 1. 2018 Dec 2, 2018 Mar. 2, 2019 Mar. 3, 2019 15 years 8 years Canoes 0 SL 85 8,160 2,400 3,780 4 years 500 Computer Office Furniture DDB 8 years 900 SL * SL = Straight-line; DDB = Double-declining balance Print Done