Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Requirement: 1 . Determine the amounts necessary to record income taxes for 2 0 2 5 and prepare the appropriate journal entry. 2 . How

Requirement:

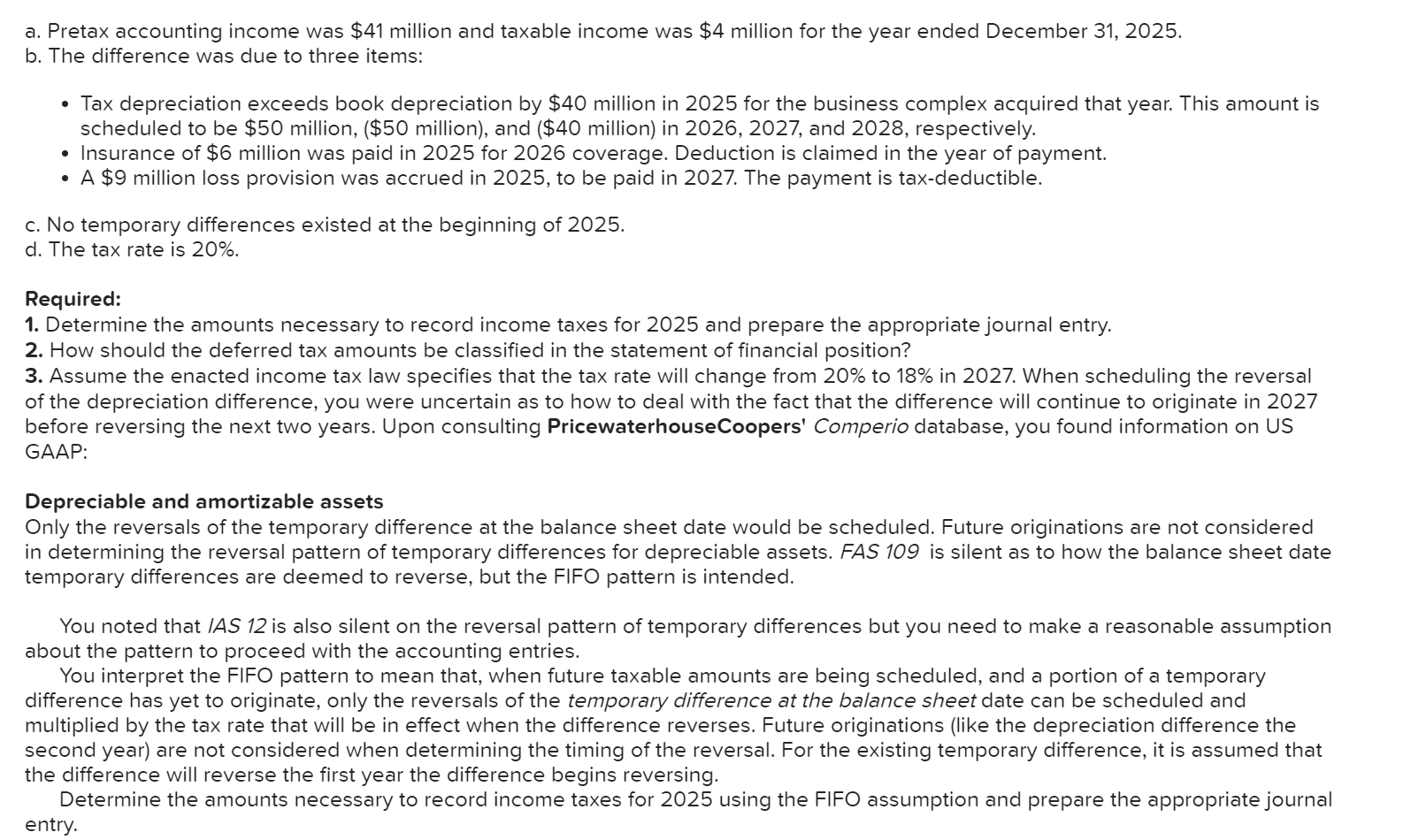

Determine the amounts necessary to record income taxes for and prepare the appropriate journal entry.

How should the deferred tax amounts be classified in the statement of financial position?

Assume the enacted income tax law specifies that the tax rate will change from to in When scheduling the reversal of the depreciation difference, you were uncertain as to how to deal with the fact that the difference will continue to originate in before reversing the next two years. Upon consulting PricewaterhouseCoopers' Comperio database, you found information on US GAAP:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started