Question

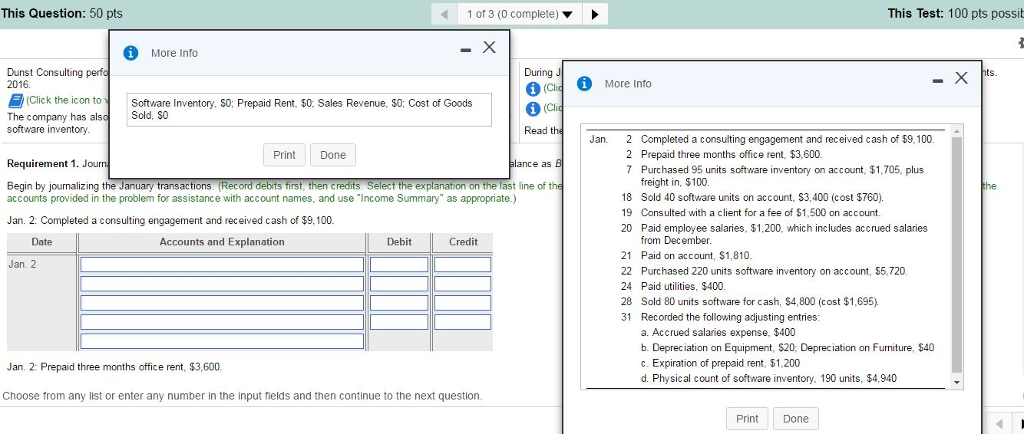

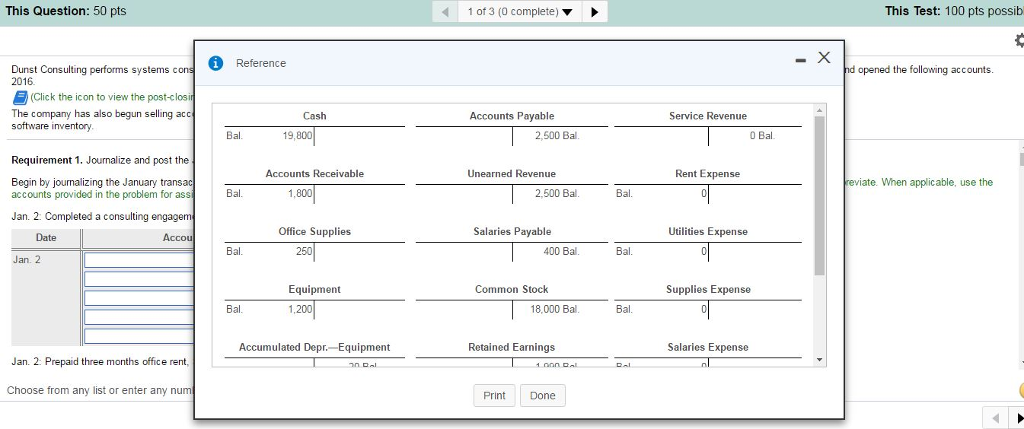

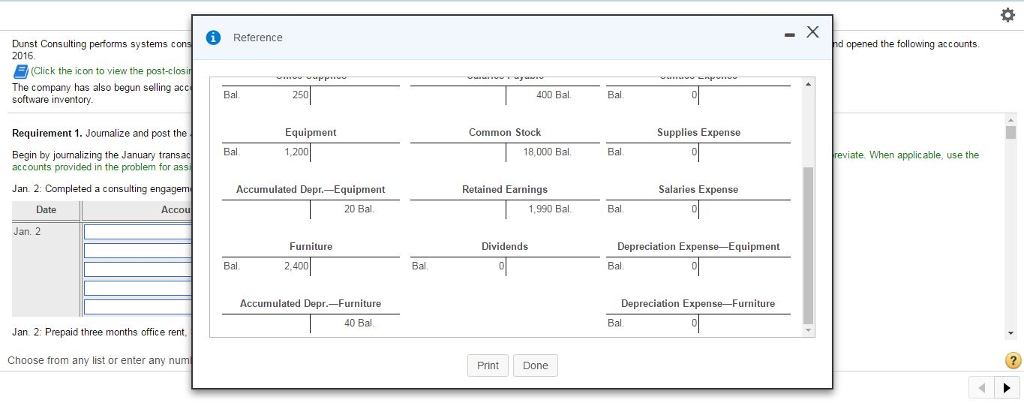

Requirement 1 . Journalize and post the transactions. Compute each account balance, and denote the balance as Bal. Begin by journalizing the January transactions. (Record

Requirement 1.Journalize and post the transactions. Compute each account balance, and denote the balance as Bal. Begin by journalizing the January transactions. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. Check your spelling carefully and do not abbreviate. When applicable, use the accounts provided in the problem for assistance with account names, and use "Income Summary" as appropriate.)

January 31:Recorded adjusting entries.

Post the January transactions using the dates and adjusting references as appropriate. Compute each account balance, and denote the balance as Bal.

Requirement 2. Prepare the month ended January 31, 2017 income statement of Dunst Consulting. Use the multi-step format. List Service Revenue under gross profit and ignore classifying the expenses as selling and administrative. (Check your spelling carefully and do not abbreviate. When applicable, use the accounts provided in the problem for assistance with account names, and use "Income Summary" as appropriate.)

Requirement 3. Journalize and post the closing entries. Denote each closing amount as Clo. After posting all closing entries, prove the equality of debits and credits in the ledger.

Begin by journalizing the closing entries. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. Check your spelling carefully and do not abbreviate. When applicable, use the accounts provided in the problem for assistance with account names, and use "Income Summary" as appropriate.)

Start by closing revenues.

Post the closing entries. Use "Clo." and the corresponding number as shown in the journal entry as posting

referencesl Enter the adjusted balance of each account and select a "Bal." reference to identify the unadjusted balances. Post any closing entries to the accounts and then calculate the post-closing balance ("Bal.") of each account (including those that were not closed). For any accounts with a zero balance after closing, select a "Bal." reference and enter a "0" on the normal side of the account. For Income Summary, calculate and enter the balance ("Bal.") before posting the entry to close out the account. Post the entry to close Income Summary account on the same line as you entered the balance prior to closing (the second line) and then show the post-closing balance ("Bal.") on the last (third) line of the account.

After posting all closing entries, prove the equality of debits and credits in the ledger by preparing a post-closing trial balance.

Requirement 4. Compute the gross profit percentage of Dunst Consulting. (Round the gross profit percentage to the nearest tenth of a percent, X.X%.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started