Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Requirement 1. Journalize each transaction. Explanations are not required. (Record debits first, then credits. Excl explanations from journal entries) July 1: Yardley contributed $67,000 cash

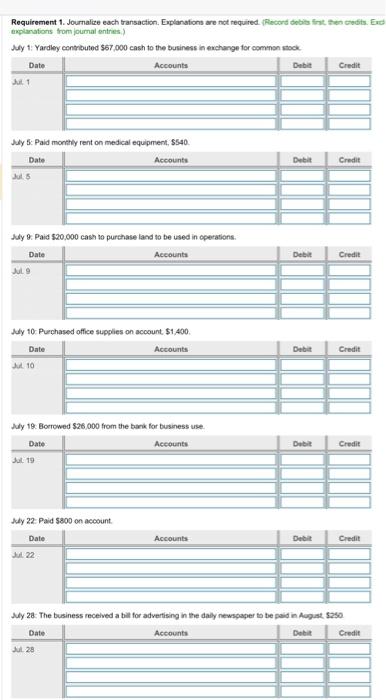

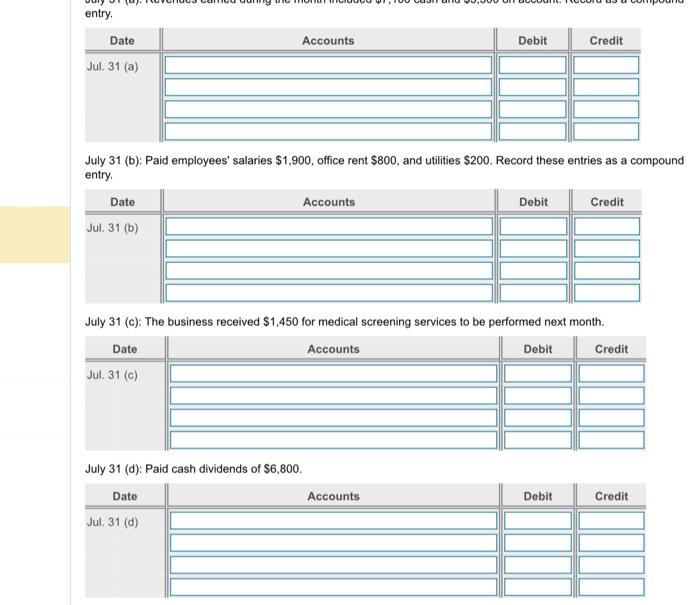

Requirement 1. Journalize each transaction. Explanations are not required. (Record debits first, then credits. Excl explanations from journal entries) July 1: Yardley contributed $67,000 cash to the business in exchange for common stock Date Jul 1 Accounts July 5: Paid monthly rent on medical equipment, $540. Date Jul 5 Accounts July 9: Paid $20,000 cash to purchase land to be used in operations. Date Jul 9 Accounts July 10: Purchased office supplies on account. $1,400. Date JUL 101 Accounts July 19: Borrowed $26,000 from the bank for business use Date Jul 19 July 22: Paid $800 on account. Date Jul 22 Accounts Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit Accounts Debit Credit July 28: The business received a bill for advertising in the daily newspaper to be paid in August $250 Date Jul 28 Accounts Debit Credit entry. Date Accounts Debit Credit Jul. 31 (a) July 31 (b): Paid employees' salaries $1,900, office rent $800, and utilities $200. Record these entries as a compound entry. Date Jul. 31 (b) Accounts Debit Credit July 31 (c): The business received $1,450 for medical screening services to be performed next month. Date Jul. 31 (c) July 31 (d): Paid cash dividends of $6,800. Date Jul. 31 (d) Accounts Debit Credit Accounts Debit Credit

Requirement 1. Journalize each transaction. Explanations are not required. (Record debits first, then credits. Excl explanations from journal entries) July 1: Yardley contributed $67,000 cash to the business in exchange for common stock Date Jul 1 Accounts July 5: Paid monthly rent on medical equipment, $540. Date Jul 5 Accounts July 9: Paid $20,000 cash to purchase land to be used in operations. Date Jul 9 Accounts July 10: Purchased office supplies on account. $1,400. Date JUL 101 Accounts July 19: Borrowed $26,000 from the bank for business use Date Jul 19 July 22: Paid $800 on account. Date Jul 22 Accounts Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit Accounts Debit Credit July 28: The business received a bill for advertising in the daily newspaper to be paid in August $250 Date Jul 28 Accounts Debit Credit entry. Date Accounts Debit Credit Jul. 31 (a) July 31 (b): Paid employees' salaries $1,900, office rent $800, and utilities $200. Record these entries as a compound entry. Date Jul. 31 (b) Accounts Debit Credit July 31 (c): The business received $1,450 for medical screening services to be performed next month. Date Jul. 31 (c) July 31 (d): Paid cash dividends of $6,800. Date Jul. 31 (d) Accounts Debit Credit Accounts Debit Credit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started