Answered step by step

Verified Expert Solution

Question

1 Approved Answer

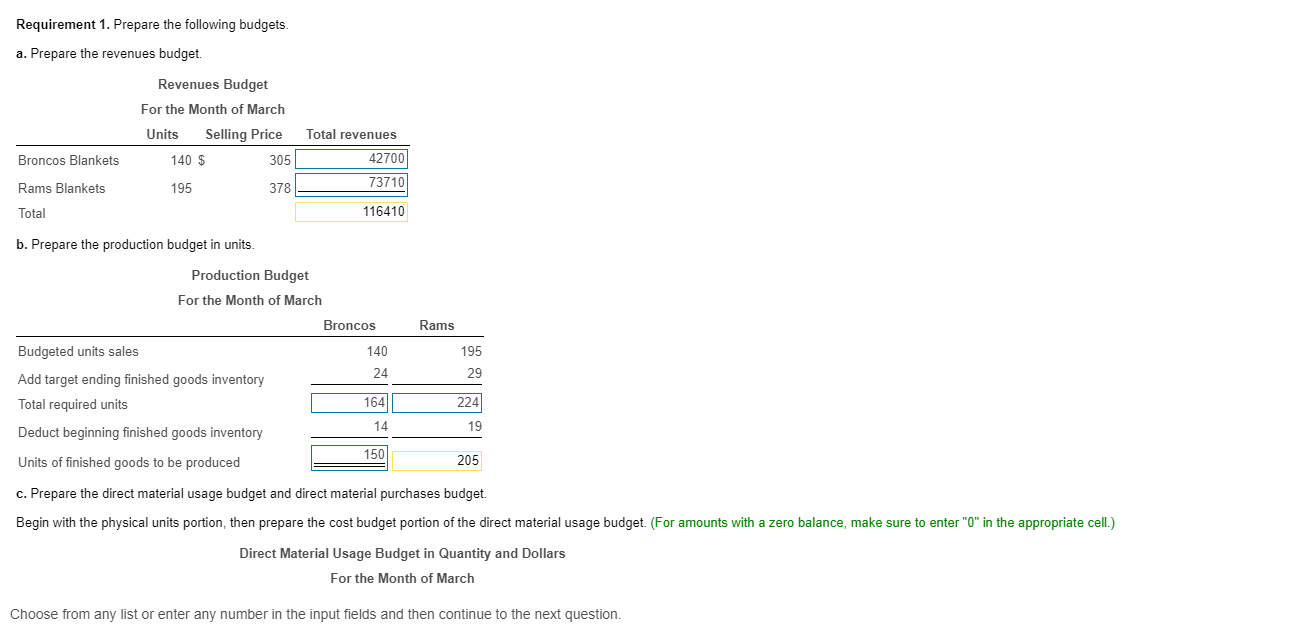

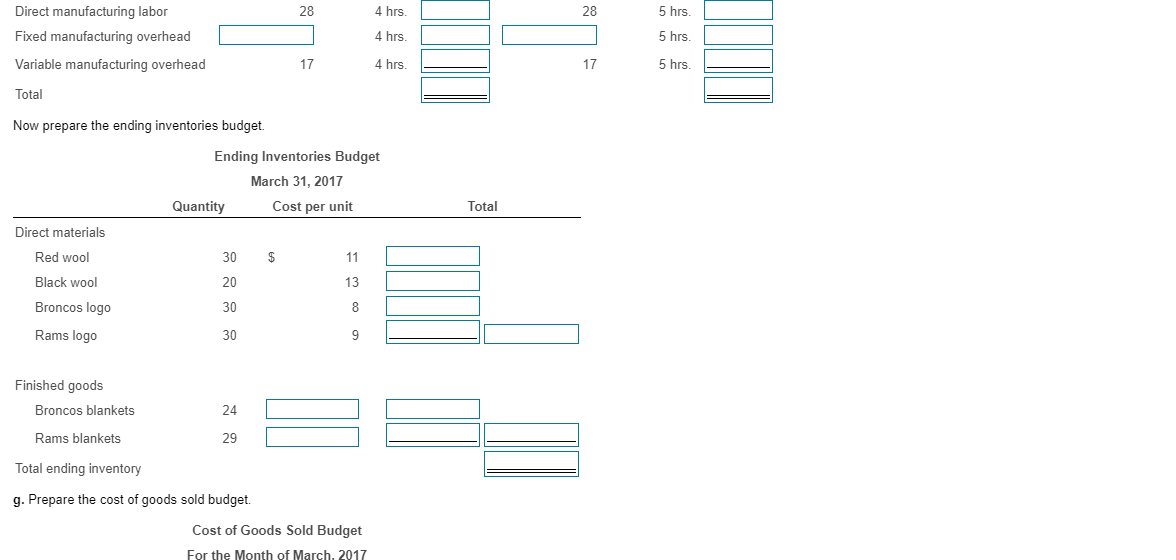

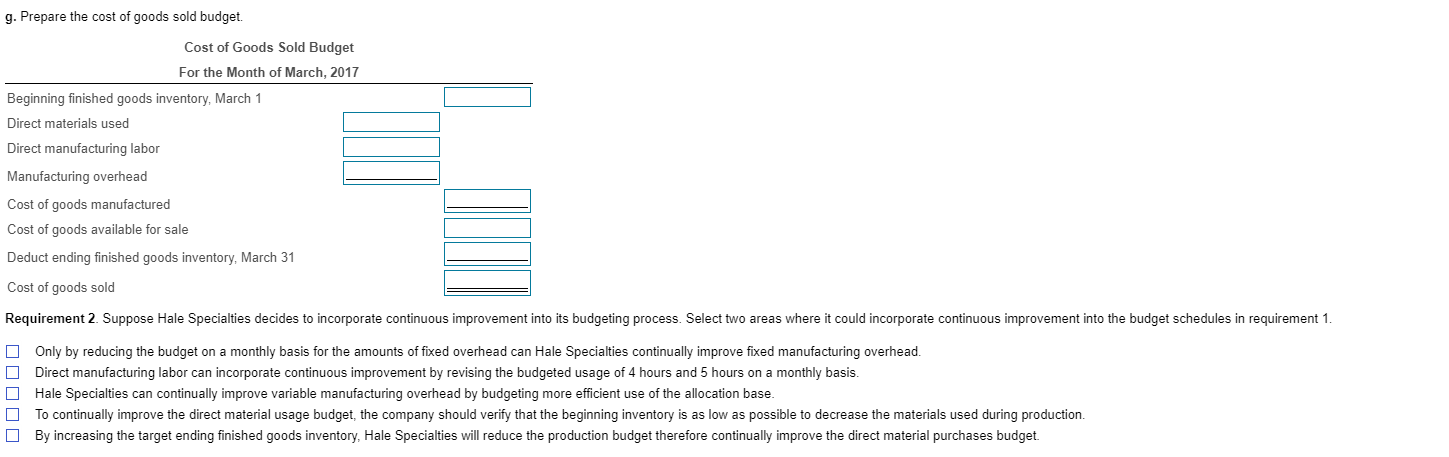

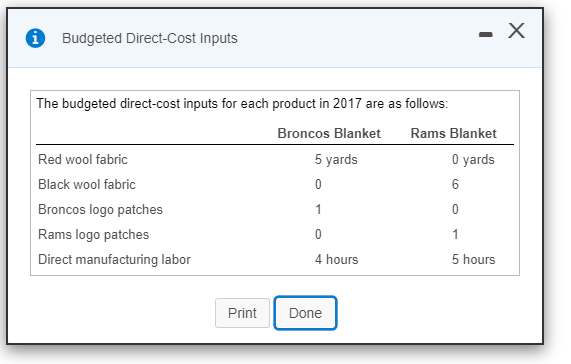

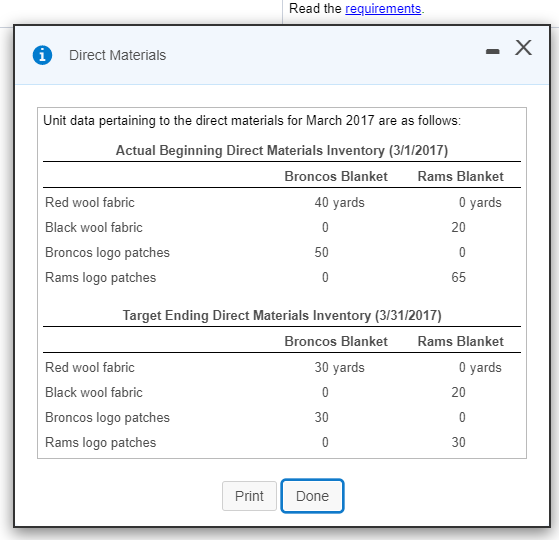

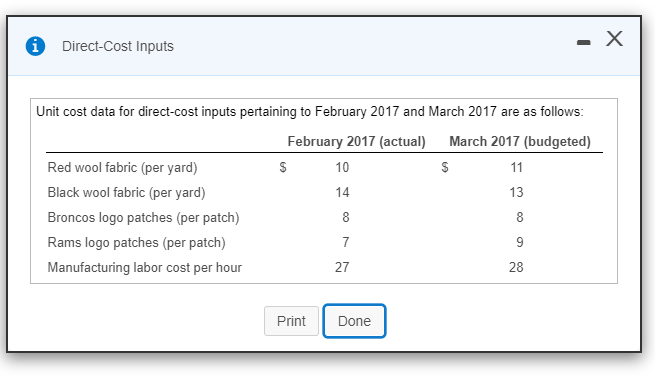

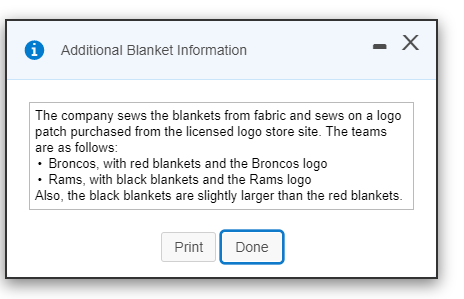

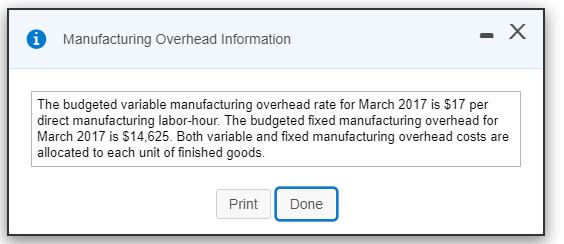

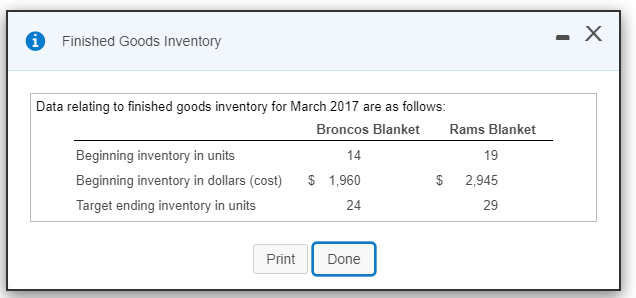

Requirement 1. Prepare the following budgets. a. Prepare the revenues budget. Revenues Budget For the Month of March Units Selling Price Total revenues Broncos

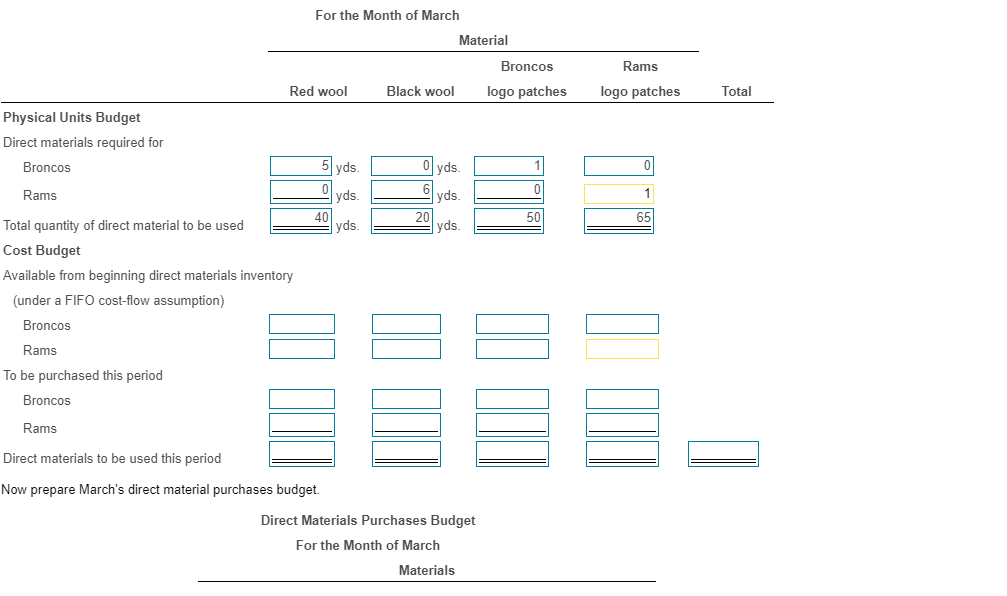

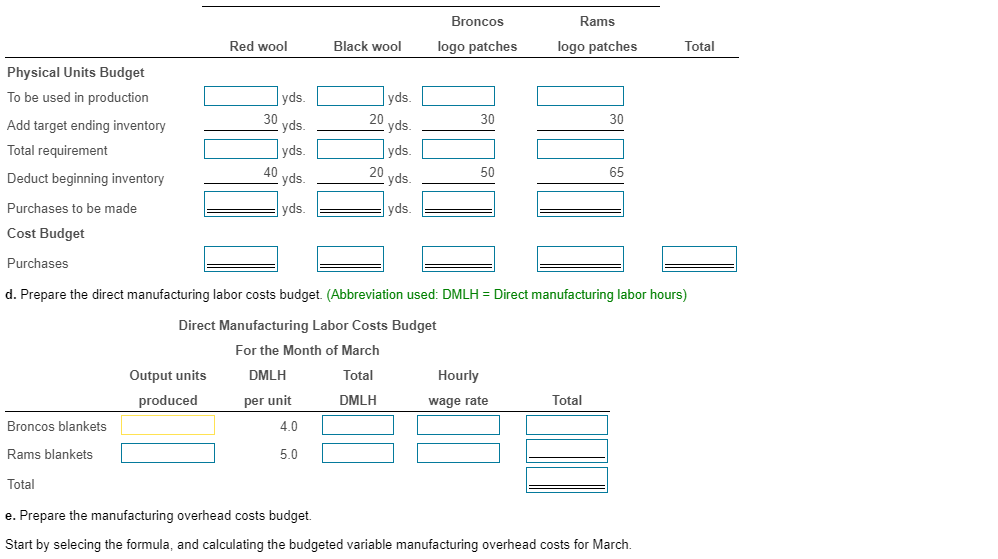

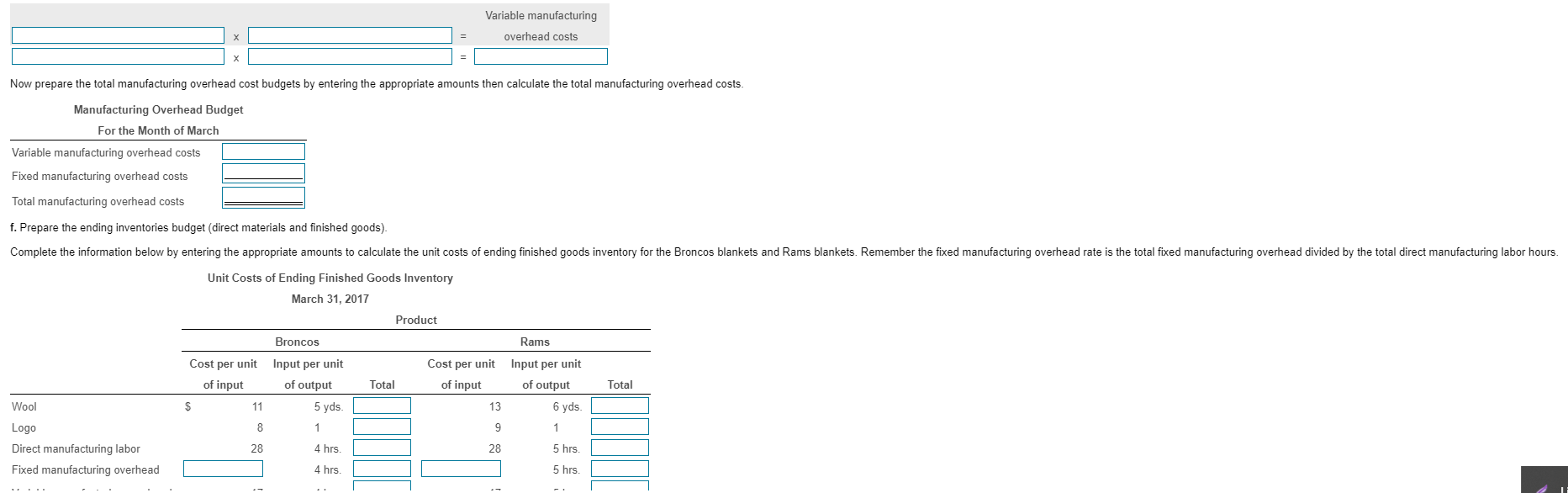

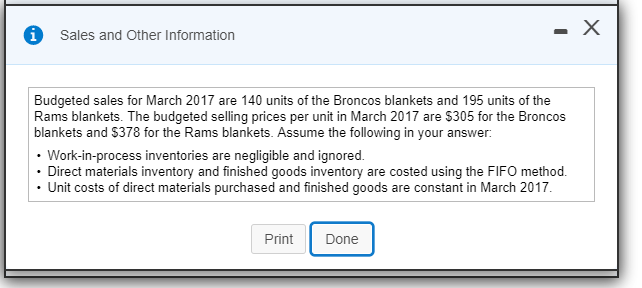

Requirement 1. Prepare the following budgets. a. Prepare the revenues budget. Revenues Budget For the Month of March Units Selling Price Total revenues Broncos Blankets 140 $ 305 42700 73710 Rams Blankets 195 378 Total 116410 b. Prepare the production budget in units. Production Budget For the Month of March Broncos Rams Budgeted units sales 140 195 24 29 Add target ending finished goods inventory Total required units 164 224 14 19 Deduct beginning finished goods inventory 150 Units of finished goods to be produced 205 c. Prepare the direct material usage budget and direct material purchases budget. Begin with the physical units portion, then prepare the cost budget portion of the direct material usage budget. (For amounts with a zero balance, make sure to enter "0" in the appropriate cell.) Direct Material Usage Budget in Quantity and Dollars For the Month of March Choose from any list or enter any number in the input fields and then continue to the next question. Physical Units Budget Direct materials required for For the Month of March Material Broncos Red wool Black wool logo patches Rams logo patches Total Broncos Rams 5 yds. 0 yds. 1 yds. yds. 40 20 50 65 Total quantity of direct material to be used yds. yds. Cost Budget Available from beginning direct materials inventory (under a FIFO cost-flow assumption) Broncos Rams To be purchased this period Broncos Rams Direct materials to be used this period Now prepare March's direct material purchases budget. Direct Materials Purchases Budget For the Month of March Materials Physical Units Budget Broncos Red wool Black wool logo patches Rams logo patches Total To be used in production yds. yds. 30 20 30 30 Add target ending inventory yds. yds. Total requirement yds. yds. 40 Deduct beginning inventory Purchases to be made yds. yds. 20 yds. 50 65 yds. Cost Budget Purchases d. Prepare the direct manufacturing labor costs budget. (Abbreviation used: DMLH = Direct manufacturing labor hours) Direct Manufacturing Labor Costs Budget For the Month of March Output units produced DMLH Total Hourly per unit DMLH wage rate Total Broncos blankets 4.0 Rams blankets 5.0 Total e. Prepare the manufacturing overhead costs budget. Start by selecing the formula, and calculating the budgeted variable manufacturing overhead costs for March. x Variable manufacturing overhead costs Now prepare the total manufacturing overhead cost budgets by entering the appropriate amounts then calculate the total manufacturing overhead costs. Manufacturing Overhead Budget For the Month of March Variable manufacturing overhead costs Fixed manufacturing overhead costs Total manufacturing overhead costs f. Prepare the ending inventories budget (direct materials and finished goods). Complete the information below by entering the appropriate amounts to calculate the unit costs of ending finished goods inventory for the Broncos blankets and Rams blankets. Remember the fixed manufacturing overhead rate is the total fixed manufacturing overhead divided by the total direct manufacturing labor hours. Unit Costs of Ending Finished Goods Inventory March 31, 2017 Product Broncos Cost per unit Input per unit Cost per unit Rams Input per unit of input of output Total of input of output Total Wool Logo 11 5 yds. 13 6 yds. 8 1 9 1 Direct manufacturing labor 28 4 hrs. 28 5 hrs. Fixed manufacturing overhead 4 hrs. 5 hrs. Direct manufacturing labor Fixed manufacturing overhead Variable manufacturing overhead Total 28 4 hrs. 28 5 hrs. 4 hrs. 5 hrs. 17 4 hrs. 17 5 hrs. Now prepare the ending inventories budget. Ending Inventories Budget March 31, 2017 Cost per unit Total Quantity Direct materials Red wool 30 $ 11 Black wool 20 13 Broncos logo 30 8 Rams logo 30 9 Finished goods Broncos blankets 24 Rams blankets 29 Total ending inventory g. Prepare the cost of goods sold budget. Cost of Goods Sold Budget For the Month of March, 2017 g. Prepare the cost of goods sold budget. Cost of Goods Sold Budget For the Month of March, 2017 Beginning finished goods inventory, March 1 Direct materials used Direct manufacturing labor Manufacturing overhead Cost of goods manufactured Cost of goods available for sale Deduct ending finished goods inventory, March 31 Cost of goods sold Requirement 2. Suppose Hale Specialties decides to incorporate continuous improvement into its budgeting process. Select two areas where it could incorporate continuous improvement into the budget schedules in requirement 1. Only by reducing the budget on a monthly basis for the amounts of fixed overhead can Hale Specialties continually improve fixed manufacturing overhead. Direct manufacturing labor can incorporate continuous improvement by revising the budgeted usage of 4 hours and 5 hours on a monthly basis. Hale Specialties can continually improve variable manufacturing overhead by budgeting more efficient use of the allocation base. To continually improve the direct material usage budget, the company should verify that the beginning inventory is as low as possible to decrease the materials used during production. By increasing the target ending finished goods inventory, Hale Specialties will reduce the production budget therefore continually improve the direct material purchases budget. i Budgeted Direct-Cost Inputs - The budgeted direct-cost inputs for each product in 2017 are as follows: Broncos Blanket 5 yards Rams Blanket Red wool fabric Black wool fabric Broncos logo patches Rams logo patches Direct manufacturing labor 0 yards 0 1 0 6 0 1 4 hours 5 hours Print Done Direct Materials Read the requirements. Unit data pertaining to the direct materials for March 2017 are as follows: Actual Beginning Direct Materials Inventory (3/1/2017) Broncos Blanket Red wool fabric Black wool fabric Broncos logo patches 40 yards 0 50 0 - X Rams Blanket 0 yards 20 0 65 Rams logo patches Target Ending Direct Materials Inventory (3/31/2017) Broncos Blanket Red wool fabric Black wool fabric Broncos logo patches Rams logo patches Rams Blanket 30 yards 0 yards 0 20 30 0 0 30 Print Done Direct-Cost Inputs - Unit cost data for direct-cost inputs pertaining to February 2017 and March 2017 are as follows: Red wool fabric (per yard) $ February 2017 (actual) 10 March 2017 (budgeted) Black wool fabric (per yard) Broncos logo patches (per patch) Rams logo patches (per patch) Manufacturing labor cost per hour $ 11 14 13 8 8 7 9 27 28 Print Done Additional Blanket Information - X The company sews the blankets from fabric and sews on a logo patch purchased from the licensed logo store site. The teams are as follows: Broncos, with red blankets and the Broncos logo Rams, with black blankets and the Rams logo Also, the black blankets are slightly larger than the red blankets. Print Done Manufacturing Overhead Information - The budgeted variable manufacturing overhead rate for March 2017 is $17 per direct manufacturing labor-hour. The budgeted fixed manufacturing overhead for March 2017 is $14,625. Both variable and fixed manufacturing overhead costs are allocated to each unit of finished goods. Print Done iFinished Goods Inventory Data relating to finished goods inventory for March 2017 are as follows: Rams Blanket Broncos Blanket Beginning inventory in units 14 19 Beginning inventory in dollars (cost) $ 1,960 $ 2,945 Target ending inventory in units 24 29 Print Done - X Sales and Other Information - Budgeted sales for March 2017 are 140 units of the Broncos blankets and 195 units of the Rams blankets. The budgeted selling prices per unit in March 2017 are $305 for the Broncos blankets and $378 for the Rams blankets. Assume the following in your answer: Work-in-process inventories are negligible and ignored. Direct materials inventory and finished goods inventory are costed using the FIFO method. Unit costs of direct materials purchased and finished goods are constant in March 2017. Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started