Answered step by step

Verified Expert Solution

Question

1 Approved Answer

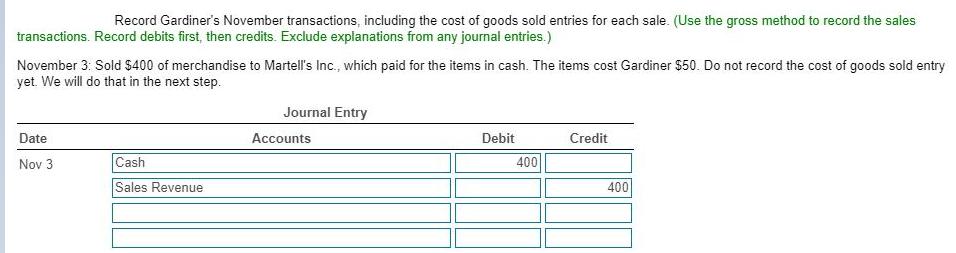

Record Gardiner's November transactions, including the cost of goods sold entries for each sale. (Use the gross method to record the sales transactions. Record

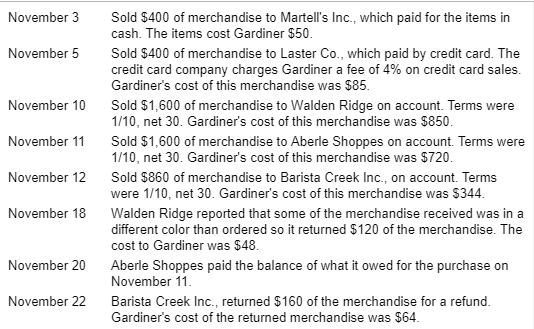

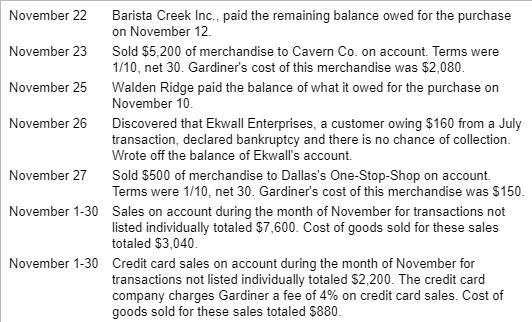

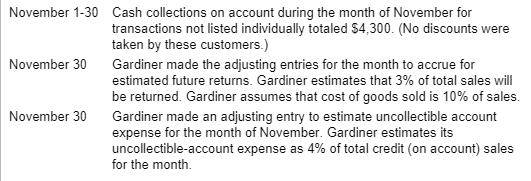

Record Gardiner's November transactions, including the cost of goods sold entries for each sale. (Use the gross method to record the sales transactions. Record debits first, then credits. Exclude explanations from any journal entries.) November 3: Sold $400 of merchandise to Martell's Inc., which paid for the items in cash. The items cost Gardiner $50. Do not record the cost of goods sold entry yet. We will do that in the next step. Journal Entry Date Accounts Debit Credit Nov 3 Cash 400 Sales Revenue 400 November 3 Sold $400 of merchandise to Martell's Ic., which paid for the items in cash. The items cost Gardiner $50. November 5 Sold $400 of merchandise to Laster Co., which paid by credit card. The credit card company charges Gardiner a fee of 4% on credit card sales. Gardiner's cost of this merchandise was $85. November 10 Sold $1,600 of merchandise to Walden Ridge on account. Terms were 1/10, net 30. Gardiner's cost of this merchandise was $850. November 11 Sold $1,600 of merchandise to Aberle Shoppes on account. Terms were 1/10, net 30. Gardiner's cost of this merchandise was $720. November 12 Sold $860 of merchandise to Barista Creek Inc., on account. Terms were 1/10, net 30. Gardiner's cost of this merchandise was $344. November 18 Walden Ridge reported that some of the merchandise received was in a different color than ordered so it returned $120 of the merchandise. The cost to Gardiner was $48. November 20 Aberle Shoppes paid the balance of what it owed for the purchase on November 11. November 22 Barista Creek Inc., returned $160 of the merchandise for a refund. Gardiner's cost of the returned merchandise was $64. November 22 Barista Creek Inc., paid the remaining balance owed for the purchase on November 12. November 23 Sold $5,200 of merchandise to Cavern Co. on account. Terms were 1/10, net 30. Gardiner's cost of this merchandise was $2,080. November 25 Walden Ridge paid the balance of what it owed for the purchase on November 10. November 26 Discovered that Ekwall Enterprises, a customer owing $160 from a July transaction, declared bankruptcy and there is no chance of collection. Wrote off the balance of Ekwall's account. November 27 Sold $500 of merchandise to Dallas's One-Stop-Shop on account. Terms were 1/10, net 30. Gardiner's cost of this merchandise was $150. November 1-30 Sales on account during the month of November for transactions not listed individually totaled $7,600. Cost of goods sold for these sales totaled $3,040. November 1-30 Credit card sales on account during the month of November for transactions not listed individually totaled $2,200. The credit card company charges Gardiner a fee of 4% on credit card sales. Cost of goods sold for these sales totaled S880. November 1-30 Cash collections on account during the month of November for transactions not listed individually totaled $4,300. (No discounts were taken by these customers.) November 30 Gardiner made the adjusting entries for the month to accrue for estimated future returns. Gardiner estimates that 3% of total sales will be returned. Gardiner assumes that cost of goods sold is 10% of sales. November 30 Gardiner made an adjusting entry to estimate uncollectible account expense for the month of November. Gardiner estimates its uncollectible-account expense as 4% of total credit (on account) sales for the month.

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Note Gross method of recording sales usually assumes that customers will not take advantage of cash discount Date Details Debit Credit Nov 3 Cash 400 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635f7845e19f3_230229.pdf

180 KBs PDF File

635f7845e19f3_230229.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started