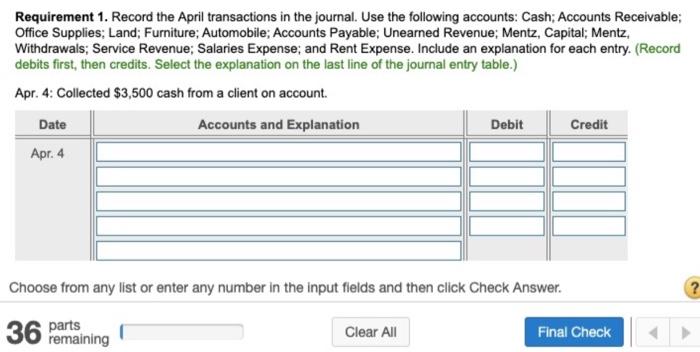

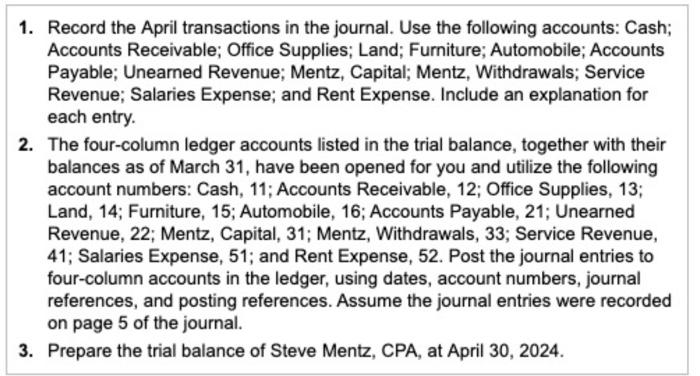

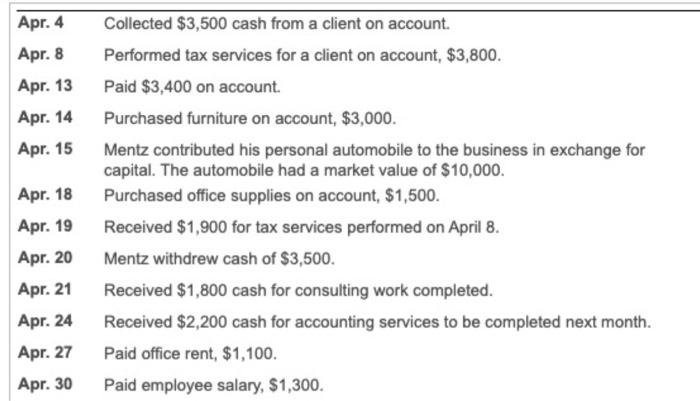

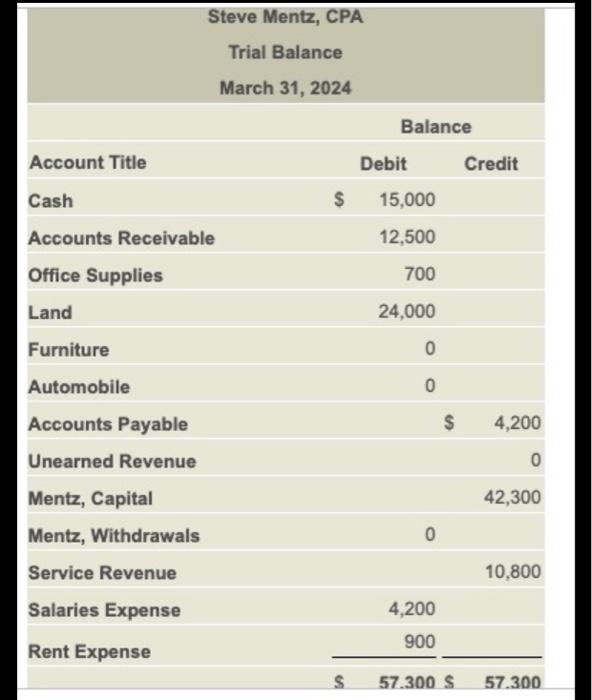

Requirement 1. Record the April transactions in the journal. Use the following accounts: Cash; Accounts Receivable; Office Supplies; Land; Furniture; Automobile; Accounts Payable; Unearned Revenue; Mentz, Capital; Mentz, Withdrawals; Service Revenue; Salaries Expense; and Rent Expense. Include an explanation for each entry. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Apr. 4: Collected $3,500 cash from a client on account. Date Accounts and Explanation Debit Credit Apr. 4 Choose from any list or enter any number in the input fields and then click Check Answer. ? 36 Pemaining Clear All Final Check 1. Record the April transactions in the journal. Use the following accounts: Cash; Accounts Receivable; Office Supplies; Land; Furniture; Automobile; Accounts Payable; Unearned Revenue; Mentz, Capital; Mentz, Withdrawals; Service Revenue; Salaries Expense; and Rent Expense. Include an explanation for each entry. 2. The four-column ledger accounts listed in the trial balance, together with their balances as of March 31, have been opened for you and utilize the following account numbers: Cash, 11; Accounts Receivable, 12; Office Supplies, 13; Land, 14; Furniture, 15; Automobile, 16; Accounts Payable, 21; Unearned Revenue, 22; Mentz, Capital, 31; Mentz, Withdrawals, 33; Service Revenue, 41; Salaries Expense, 51; and Rent Expense, 52. Post the journal entries to four-column accounts in the ledger, using dates, account numbers, journal references, and posting references. Assume the journal entries were recorded on page 5 of the journal. 3. Prepare the trial balance of Steve Mentz, CPA, at April 30, 2024. Apr. 4 Apr. 8 Apr. 13 Apr. 14 Apr. 15 Apr. 18 Apr. 19 Apr. 20 Apr. 21 Apr. 24 Apr. 27 Apr. 30 Collected $3,500 cash from a client on account. Performed tax services for a client on account, $3,800. Paid $3,400 on account. Purchased furniture on account, $3,000. Mentz contributed his personal automobile to the business in exchange for capital. The automobile had a market value of $10,000. Purchased office supplies on account, $1,500. Received $1,900 for tax services performed on April 8. Mentz withdrew cash of $3,500. Received $1,800 cash for consulting work completed. Received $2,200 cash for accounting services to be completed next month. Paid office rent, $1,100. Paid employee salary, $1,300. Steve Mentz, CPA Trial Balance March 31, 2024 Balance Account Title Credit Cash $ Debit 15,000 12,500 700 Accounts Receivable Office Supplies Land 24.000 0 0 $ 4,200 0 Furniture Automobile Accounts Payable Unearned Revenue Mentz, Capital Mentz, Withdrawals Service Revenue Salaries Expense 42,300 0 10.800 4,200 900 Rent Expense s 57.300 S 57.300