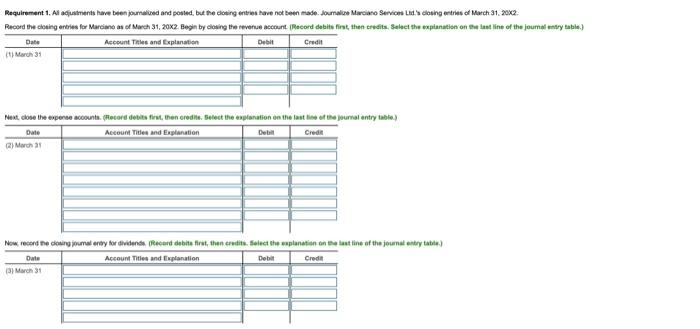

requirement 1 :

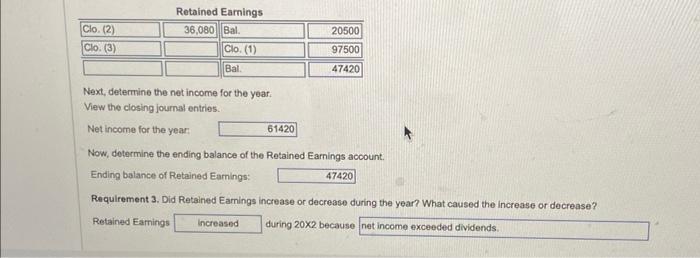

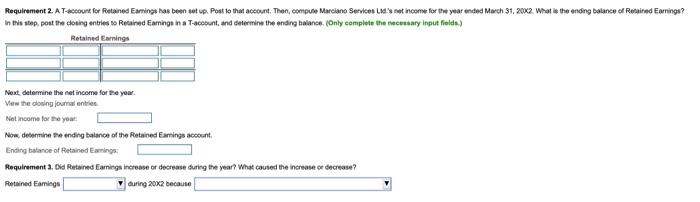

requirement 2- a t-account fir retained earnjng has been set up. post to that account then compute the companies bet income for the year ended. what is the ending balance of retained earning. post rhe closing entrues to retained earnings in t-account determine ending balance

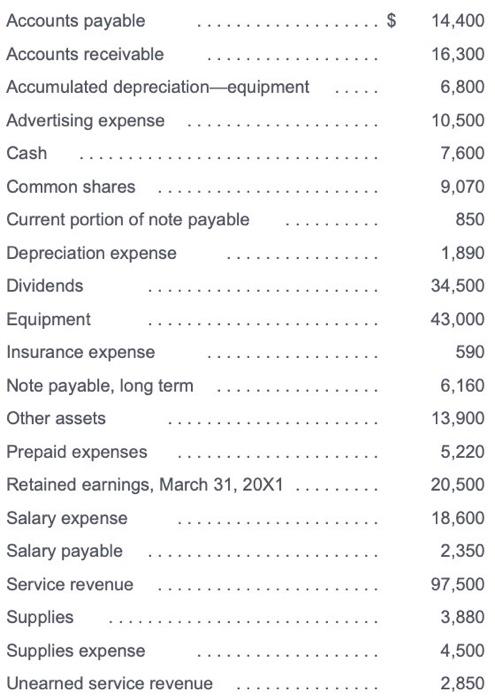

\begin{tabular}{|c|c|c|c|} \hline Date & Accouint Tries and Explanatien & Debit & Credit \\ \hline \multicolumn{4}{|l|}{ (t) Merch 31} \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Actount Tutes and Eaptanation & Detill & crede \\ \hline \multicolumn{4}{|l|}{ (2) Maroh at } \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Aceount Tities and Explanation & Dobit & Credt \\ \hline \multicolumn{4}{|l|}{ (3) Uareh 31} \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} In wis step, post the closing entries so Resained Earnings in a T-acosunt, and determine the ending balance. (Only complete the necessary input fields.) Next, determine the eet income for the yoar. Vew the doeing journat enties. Net income for the year: Now, debermine tre ending balance of the Pletained Eamings acosent. Ending balance of Petained Eawings: Requirement 3. Dd Petained farnings increase or decrease furing the year? What caused the increase or decrease? Petained Eamings buring 2002 because \begin{tabular}{|c|c|} \hline Accounts payable & 14,400 \\ \hline Accounts receivable & 16,300 \\ \hline Accumulated depreciation-equipment & 6,800 \\ \hline Advertising expense & 10,500 \\ \hline Cash & 7,600 \\ \hline Common shares ... & 9,070 \\ \hline Current portion of note payable & 850 \\ \hline Depreciation expense & 1,890 \\ \hline Dividends & 34,500 \\ \hline Equipment & 43,000 \\ \hline Insurance expense & 590 \\ \hline Note payable, long term & 6,160 \\ \hline Other assets & 13,900 \\ \hline Prepaid expenses & 5,220 \\ \hline Retained earnings, March 31,201 & 20,500 \\ \hline Salary expense & 18,600 \\ \hline Salary payable & 2,350 \\ \hline Service revenue & 97,500 \\ \hline Supplies & 3,880 \\ \hline upplies expense & 4,500 \\ \hline Inearned service revenue & 2,850 \\ \hline \end{tabular} Next, determine the net income for the year. View the closing journal entries. Net income for the year: Now, determine the ending balance of the Retained Earnings account. Ending balance of Retained Earnings: Requirement 3. Did Retained Eamings increase or decrease during the year? What caused the increase or decrease? Retained Earnings during 202 because