Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sales for the first five months of 20x7 were P150,000. Raw materials purchased were P50,000. Freight on purchases was P50,000. Direct labor for the

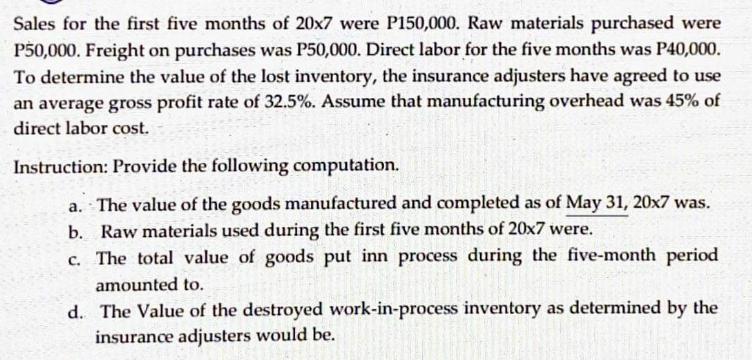

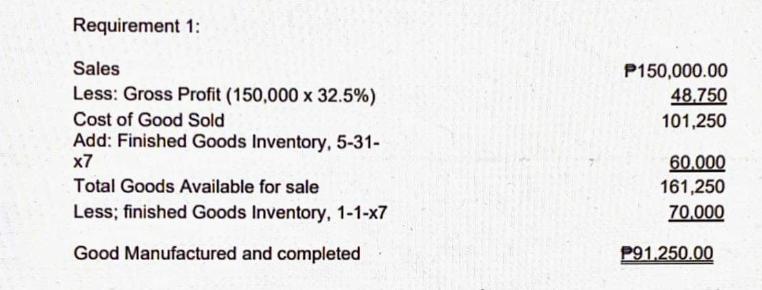

Sales for the first five months of 20x7 were P150,000. Raw materials purchased were P50,000. Freight on purchases was P50,000. Direct labor for the five months was P40,000. To determine the value of the lost inventory, the insurance adjusters have agreed to use an average gross profit rate of 32.5%. Assume that manufacturing overhead was 45% of direct labor cost. Instruction: Provide the following computation. a. The value of the goods manufactured and completed as of May 31, 20x7 was. b. Raw materials used during the first five months of 20x7 were. c. The total value of goods put inn process during the five-month period amounted to. d. The Value of the destroyed work-in-process inventory as determined by the insurance adjusters would be. Requirement 1: Sales Less: Gross Profit (150,000 x 32.5%) Cost of Good Sold Add: Finished Goods Inventory, 5-31- x7 Total Goods Available for sale Less; finished Goods Inventory, 1-1-x7 Good Manufactured and completed P150,000.00 48,750 101,250 60,000 161,250 70,000 P91.250.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Value of Goods Manufactured and Completed as of May 31 20x7 textSales textGross ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started