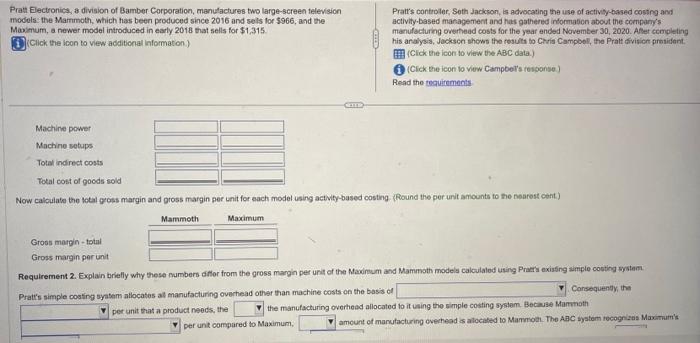

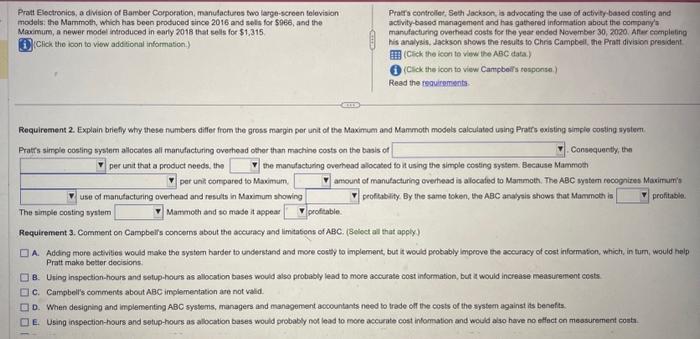

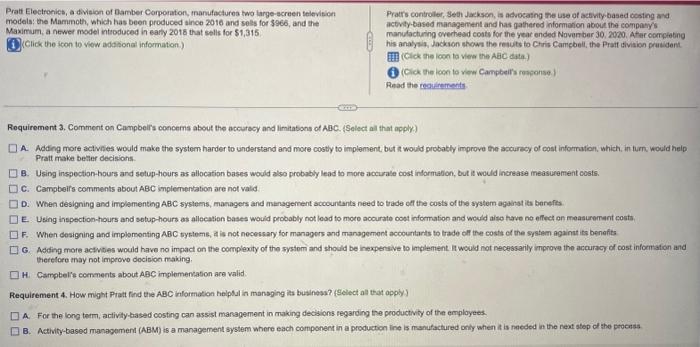

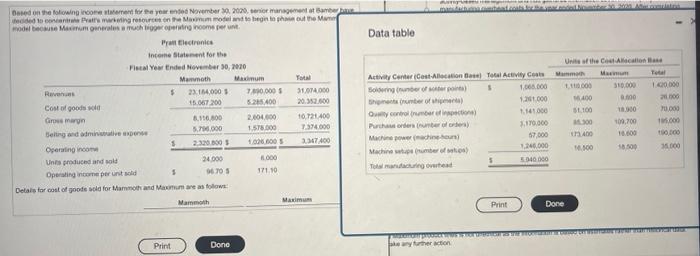

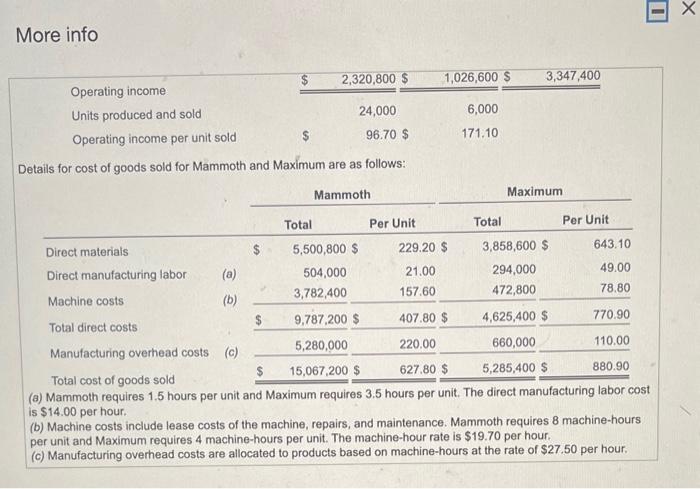

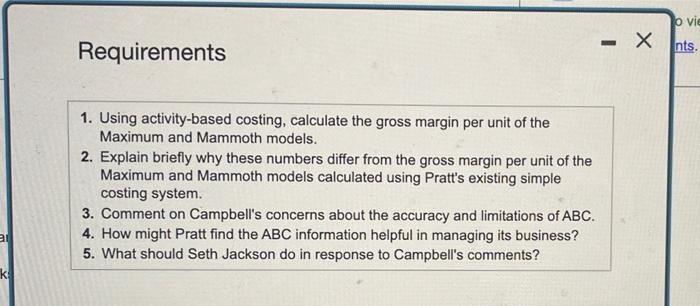

Requirement 1. Using activity based coating, caiculate the gross margin per unt of the Macinum and Mammots medels. Begin by casculating the total cost of goods soid for each modet. (Round invornediary cakcuations to the nearest cant.) Now calculate the tetal gross margin and gross margin per unit for each model using actity-based costing (Roound the per unit amounts to the nearest cent) Requirement 2. Explain brielly why these numbers diflor from the gross margin per unat of the Mawimum and Mammoth models calculaled using Praets exising simple cootiog syitent Pratts simple costing syatem allocates al manufacturing overhead other than machine costs on the basis of Consequenty the per unit that a product needs, the the manutacturing overheed allocated to it uaing the simple costing system. Beciese Marmoth per unt compared to Maximum, Requirement 2. Explain briefy why these numbers differ from the gross macgin por unit of the Maximum and Manmoth models calculatid using Pratrs existing simplo costing systemt. Pratfs simple costing system alocales all manufacturing ovechead othor than machine costs on the basis of Consequentby, the per unit that a product needs, the the manutacturing overhead alocatod to it using use of manutacturing overiead and resuls in Maximum showing The simple costing system Requirement 3. Comment on Campbelis concerns about the accuracy and limtabons of ABC. (Seloct all that apply). peoftablity. By the A. Adding more activities would make the system harder to understand and more cossy to implement, but it would protably ienprove the accuracy of cost informaton, which, in turn, would help Pratt make better decisions. B. Uriog inspection-hours and setup-hours as allocation bases would also probably lead to more accurate cost information, but a would increase measurement costs. c. Carribeil's comments about ABC implamentation are not vald. D. When designing and implementing ABC systems, managers and management accountants need to trade of the costs of the system against its benefts. E. Using inspectian-hours and setup-hours as alocation bases would probaby not lead to more accurnte cost infomation and would also have no elfact on measurement costa. Requirement 3. Comment on Campbelis concems about the acourscy and limitatons of ABC. (Select all that apply) A. Adding more activies would make the system harder to understand and more costly to implement, but it would probatly improve the ascuracy of cost information, which, in tum would help Pratt make betaer decisions. B. Using inspectionhours and setup-hours as allocation bases would also probably lead to more accurale cost information, but it would increase measurement costs. C. Campbeifs comments about ABC inplementation are not vald. D. When designing and implamenting ABC systens, managers and menagenent sccountants need to trade cel the costs of the system againat its benefts. E. Using inspection-hours and sotup-hours as allecation bases would probobly not load to more acourato coet information and would aiso have no elfiect on measuremant costa F. When designing and implomonting ABC tybtems, at is not necessary for managors and management accourtarts to trade of the coste of the system Against its benefits G. Adding more actvites would have no impact on the complexity of the systom and should be inexpensive to implement in would not necessarily improve the accuracy of cost information and therefore may not improvo docision making. H. Camptel's comments about ABC implemencason are valid. Requirement 4. How might Pratt fond the ABC information helptal in mansging its businass? (gelect all that apply) A. For the long term, activity-tiased costing can assist management in making decisions regarding the productivity of the emplayees. B. Activity-based managoment (ABM) is a management system where each component in a production ine is manufactured only when it is needed in the next stop of the prociss Requirement 4. How might Pratt find the ABC insomation helpful in managing its business? (Belect at that apply) A. For the long term, activity-based costing can assist management in making deciuions regarding the productity of the employees. B. Actily-based management (ABM) is a manugement system where each component in a production ine is manufactured onty when it is needed in the reat step of the prectas c. Activity-based management is an integrative phiosophy of management for continuously improving the quality of products and processea by focusing prirnarly on the diect labor cotti. D. As a whole-compary philosophy. AEM focuses on strategic, as well as tactical and operational activities of the compari. E. ABM is an integrated approach that focuses management's attention on analyzing the direct costs incurred in the manutacturing process with the utimate ain of cost reduction. F. ABM highlights possible improvaments, including reduction or eiminasion of nonvake-added activities, solocting lower cost activities, sharing activities with other products, and elimitialing waste. c. Netivity-based management (ABM) is the use of information from activity-based costing to make improvements in a firm. H. For the long term, activity-based costing can assist management in making decisions regarding the viablily of product ines, dismbution channeis, manketing strasoges, elt. 1. ABM is an integrased approach that focuses managemant's attention on activites with the ultimate aim of consimous improvement Requirement 5. What should seth jackson do in response to Campteils comments? (Select all that apply) In assessing the situation, fint convider the 'Standards of Ethical Conduct for Managoment Accountants' that could potentaly be vielated in thes skuation A. Confidentalty B. Competence c. Crediblity D. Intogrity E. None of the standerds are potentely volated in this situation. A. Confidenalalty B. Competence C. Crediblity D. Integray E. Nene of the standards are potentaly violated in this situston. What should Seth Jackson do in response to Campbells commerts? A. Incoerect reporting of AaC cosis with the goal of retaining both the Mammoch and Maximum product lines is othical. Jackson has the obligation to follow the wistes of his imimediate frupervisor. Raising tho mattor with one of Campoolfs superion would be unethical. B. Incocrect reporing of ABC costs with the goal of retaining both the Mammoth and Mawimum product ines is unethical Jeckson should indicate to Camptell that the product cost colculabens ace, indeed, espropriate. Hy Campbell stil insists on modifying the product cost numbers. Jackson shodid rase the matter with one of Campoeli's superiars. if, after taking al these stept. there is continued pressure to modity product cost numbers, Jackson sheuld consider resigning from the company rather than engage in uneblical behavior c. Incorrect reporting of ABC costs with the goal of retaining both the Mammoth and Maximum product lines is unethical, Jacksen should indicate to Campboll that the product ceat ealeulstions are, indeod, appropriate. if Campbell still insiats on moditying the product cost numbers, Jackson is not oblgated to take any further action because Campbell is his superice. D. Incorrect reporting of ABC costs with the goal of retaining both the Mammoth and Maximum product lines is not unethical as the information is based on estimates rathor than histoncal datis. Once the information is communicated to Campbelt, Jackson is not obligated to take any furteter action. Data table Detal More info Details for cost of goods sold for Mammoth and Maximum are as follows: (a) Mammoth requires 1.5 hours per unit and Maximum requires 3.5 hours per unit. The direct manutacturing apor cost is $14.00 per hour. (b) Machine costs include lease costs of the machine, repairs, and maintenance. Mammoth requires 8 machine-hours per unit and Maximum requires 4 machine-hours per unit. The machine-hour rate is $19.70 per hour. (c) Manufacturing overhead costs are allocated to products based on machine-hours at the rate of $27.50 per hour. Requirements 1. Using activity-based costing, calculate the gross margin per unit of the Maximum and Mammoth models. 2. Explain briefly why these numbers differ from the gross margin per unit of the Maximum and Mammoth models calculated using Pratt's existing simple costing system. 3. Comment on Campbell's concerns about the accuracy and limitations of ABC. 4. How might Pratt find the ABC information helpful in managing its business? 5. What should Seth Jackson do in response to Campbell's comments? Requirement 1. Using activity based coating, caiculate the gross margin per unt of the Macinum and Mammots medels. Begin by casculating the total cost of goods soid for each modet. (Round invornediary cakcuations to the nearest cant.) Now calculate the tetal gross margin and gross margin per unit for each model using actity-based costing (Roound the per unit amounts to the nearest cent) Requirement 2. Explain brielly why these numbers diflor from the gross margin per unat of the Mawimum and Mammoth models calculaled using Praets exising simple cootiog syitent Pratts simple costing syatem allocates al manufacturing overhead other than machine costs on the basis of Consequenty the per unit that a product needs, the the manutacturing overheed allocated to it uaing the simple costing system. Beciese Marmoth per unt compared to Maximum, Requirement 2. Explain briefy why these numbers differ from the gross macgin por unit of the Maximum and Manmoth models calculatid using Pratrs existing simplo costing systemt. Pratfs simple costing system alocales all manufacturing ovechead othor than machine costs on the basis of Consequentby, the per unit that a product needs, the the manutacturing overhead alocatod to it using use of manutacturing overiead and resuls in Maximum showing The simple costing system Requirement 3. Comment on Campbelis concerns about the accuracy and limtabons of ABC. (Seloct all that apply). peoftablity. By the A. Adding more activities would make the system harder to understand and more cossy to implement, but it would protably ienprove the accuracy of cost informaton, which, in turn, would help Pratt make better decisions. B. Uriog inspection-hours and setup-hours as allocation bases would also probably lead to more accurate cost information, but a would increase measurement costs. c. Carribeil's comments about ABC implamentation are not vald. D. When designing and implementing ABC systems, managers and management accountants need to trade of the costs of the system against its benefts. E. Using inspectian-hours and setup-hours as alocation bases would probaby not lead to more accurnte cost infomation and would also have no elfact on measurement costa. Requirement 3. Comment on Campbelis concems about the acourscy and limitatons of ABC. (Select all that apply) A. Adding more activies would make the system harder to understand and more costly to implement, but it would probatly improve the ascuracy of cost information, which, in tum would help Pratt make betaer decisions. B. Using inspectionhours and setup-hours as allocation bases would also probably lead to more accurale cost information, but it would increase measurement costs. C. Campbeifs comments about ABC inplementation are not vald. D. When designing and implamenting ABC systens, managers and menagenent sccountants need to trade cel the costs of the system againat its benefts. E. Using inspection-hours and sotup-hours as allecation bases would probobly not load to more acourato coet information and would aiso have no elfiect on measuremant costa F. When designing and implomonting ABC tybtems, at is not necessary for managors and management accourtarts to trade of the coste of the system Against its benefits G. Adding more actvites would have no impact on the complexity of the systom and should be inexpensive to implement in would not necessarily improve the accuracy of cost information and therefore may not improvo docision making. H. Camptel's comments about ABC implemencason are valid. Requirement 4. How might Pratt fond the ABC information helptal in mansging its businass? (gelect all that apply) A. For the long term, activity-tiased costing can assist management in making decisions regarding the productivity of the emplayees. B. Activity-based managoment (ABM) is a management system where each component in a production ine is manufactured only when it is needed in the next stop of the prociss Requirement 4. How might Pratt find the ABC insomation helpful in managing its business? (Belect at that apply) A. For the long term, activity-based costing can assist management in making deciuions regarding the productity of the employees. B. Actily-based management (ABM) is a manugement system where each component in a production ine is manufactured onty when it is needed in the reat step of the prectas c. Activity-based management is an integrative phiosophy of management for continuously improving the quality of products and processea by focusing prirnarly on the diect labor cotti. D. As a whole-compary philosophy. AEM focuses on strategic, as well as tactical and operational activities of the compari. E. ABM is an integrated approach that focuses management's attention on analyzing the direct costs incurred in the manutacturing process with the utimate ain of cost reduction. F. ABM highlights possible improvaments, including reduction or eiminasion of nonvake-added activities, solocting lower cost activities, sharing activities with other products, and elimitialing waste. c. Netivity-based management (ABM) is the use of information from activity-based costing to make improvements in a firm. H. For the long term, activity-based costing can assist management in making decisions regarding the viablily of product ines, dismbution channeis, manketing strasoges, elt. 1. ABM is an integrased approach that focuses managemant's attention on activites with the ultimate aim of consimous improvement Requirement 5. What should seth jackson do in response to Campteils comments? (Select all that apply) In assessing the situation, fint convider the 'Standards of Ethical Conduct for Managoment Accountants' that could potentaly be vielated in thes skuation A. Confidentalty B. Competence c. Crediblity D. Intogrity E. None of the standerds are potentely volated in this situation. A. Confidenalalty B. Competence C. Crediblity D. Integray E. Nene of the standards are potentaly violated in this situston. What should Seth Jackson do in response to Campbells commerts? A. Incoerect reporting of AaC cosis with the goal of retaining both the Mammoch and Maximum product lines is othical. Jackson has the obligation to follow the wistes of his imimediate frupervisor. Raising tho mattor with one of Campoolfs superion would be unethical. B. Incocrect reporing of ABC costs with the goal of retaining both the Mammoth and Mawimum product ines is unethical Jeckson should indicate to Camptell that the product cost colculabens ace, indeed, espropriate. Hy Campbell stil insists on modifying the product cost numbers. Jackson shodid rase the matter with one of Campoeli's superiars. if, after taking al these stept. there is continued pressure to modity product cost numbers, Jackson sheuld consider resigning from the company rather than engage in uneblical behavior c. Incorrect reporting of ABC costs with the goal of retaining both the Mammoth and Maximum product lines is unethical, Jacksen should indicate to Campboll that the product ceat ealeulstions are, indeod, appropriate. if Campbell still insiats on moditying the product cost numbers, Jackson is not oblgated to take any further action because Campbell is his superice. D. Incorrect reporting of ABC costs with the goal of retaining both the Mammoth and Maximum product lines is not unethical as the information is based on estimates rathor than histoncal datis. Once the information is communicated to Campbelt, Jackson is not obligated to take any furteter action. Data table Detal More info Details for cost of goods sold for Mammoth and Maximum are as follows: (a) Mammoth requires 1.5 hours per unit and Maximum requires 3.5 hours per unit. The direct manutacturing apor cost is $14.00 per hour. (b) Machine costs include lease costs of the machine, repairs, and maintenance. Mammoth requires 8 machine-hours per unit and Maximum requires 4 machine-hours per unit. The machine-hour rate is $19.70 per hour. (c) Manufacturing overhead costs are allocated to products based on machine-hours at the rate of $27.50 per hour. Requirements 1. Using activity-based costing, calculate the gross margin per unit of the Maximum and Mammoth models. 2. Explain briefly why these numbers differ from the gross margin per unit of the Maximum and Mammoth models calculated using Pratt's existing simple costing system. 3. Comment on Campbell's concerns about the accuracy and limitations of ABC. 4. How might Pratt find the ABC information helpful in managing its business? 5. What should Seth Jackson do in response to Campbell's comments