Question

REQUIREMENT 1: Using First-in-First-Out (FIFO) inventory cost method: (1) Provide Ending Inventory in Units on 6/30/19, (2) Provide Ending Inventory Account Balance on 6/30/19, and

REQUIREMENT 1: Using First-in-First-Out (FIFO) inventory cost method: (1)Provide Ending Inventory in Units on 6/30/19, (2)Provide Ending Inventory Account Balance on 6/30/19, and (3)June 2019 Cost of Goods Sold. LABEL & SHOW YOUR WORK

REQUIREMENT 2: Using Last-in-First-Out (LIFO) inventory cost method: (1)Provide Ending Inventory in Units on 6/30/19, (2)Provide Ending Inventory Account Balance on 6/30/19, and (3)June 2019 Cost of Goods Sold. LABEL & SHOW YOUR WORK

REQUIREMENT 3: Prepare the journal entry to record June sales and cost of goods sold assuming Brushy used the LIFO inventory cost method.

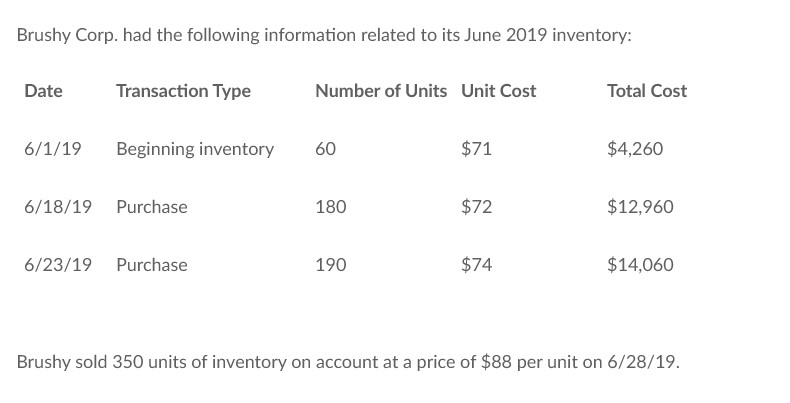

Brushy Corp. had the following information related to its June 2019 inventory: Date Transaction Type Number of Units Unit Cost Total Cost 6/1/19 Beginning inventory 60 $71 $4,260 6/18/19 Purchase 180 $72 $12,960 6/23/19 Purchase 190 $74 $14,060 Brushy sold 350 units of inventory on account at a price of $88 per unit on 6/28/19Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started