Question

Requirement 1. What is the opportunity cost of interest forgone from purchasing all 240,000 units at the start of the year instead of in 12

Requirement 1. What is the opportunity cost of interest forgone from purchasing all

240,000 units at the start of the year instead of in 12 monthly purchases of 20,000 units per order? Let's begin the calculation for the opportunity cost of interest forgone by first determining the formula, then calculate the opportunity cost.

Difference in average investment | x | Investment percentage | = | Opportunity cost | |||||||

Requirement 2. Would this opportunity cost be recorded in the accounting system? Why?

The opportunity cost would not be recorded in the accountingsystem, due to

no actual transaction being recorded in the accounting system.

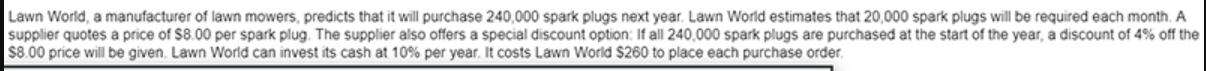

Lawn World, a manufacturer of lawn mowers, predicts that it will purchase 240,000 spark plugs next year. Lawn World estimates that 20,000 spark plugs will be required each month. A supplier quotes a price of $8.00 per spark plug. The supplier also offers a special discount option: If all 240,000 spark plugs are purchased at the start of the year, a discount of 4% off the $8.00 price will be given. Lawn World can invest its cash at 10% per year. It costs Lawn World $260 to place each purchase order.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Requirement 1 To calculate the opportunity cost of interest forgone we need to determine the differe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started