Answered step by step

Verified Expert Solution

Question

1 Approved Answer

REQUIREMENT 1: What should be the 12/31/19 balance in the Allowance for Uncollectible Accounts? REQUIREMENT 2: Record the 12/31/19 adjusting journal entry needed to adjust

REQUIREMENT 1: What should be the 12/31/19 balance in the Allowance for Uncollectible Accounts?

REQUIREMENT 2: Record the 12/31/19 adjusting journal entry needed to adjust the Allowance for Uncollectible Accounts to its required balance.

REQUIREMENT 3: Calculate the 12/31/19 net realizable value of Accounts Receivable.

REQUIREMENT 4: On April 3, 2020, a customers account balance of $450 is written off as uncollectible. Record the journal entry for this write-off.

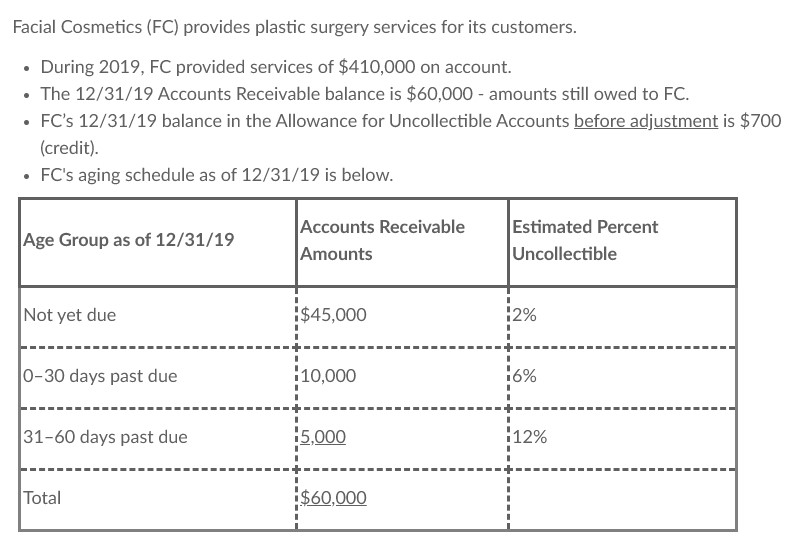

Facial Cosmetics (FC) provides plastic surgery services for its customers. During 2019, FC provided services of $410,000 on account. The 12/31/19 Accounts Receivable balance is $60,000 - amounts still owed to FC. FC's 12/31/19 balance in the Allowance for Uncollectible Accounts before adjustment is $700 (credit). FC's aging schedule as of 12/31/19 is below. Age Group as of 12/31/19 Accounts Receivable Amounts Estimated Percent Uncollectible Not yet due $45,000 12% 0-30 days past due 110,000 16% 31-60 days past 15,000 112% Total $60,000 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started