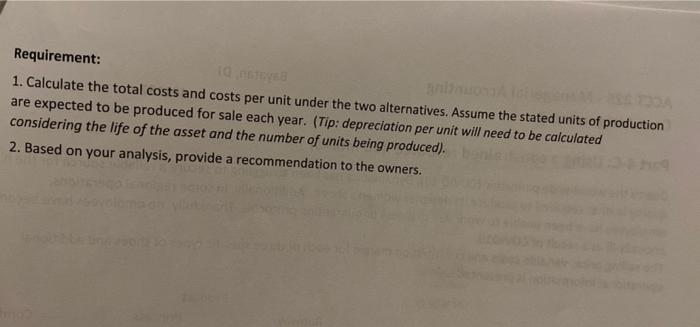

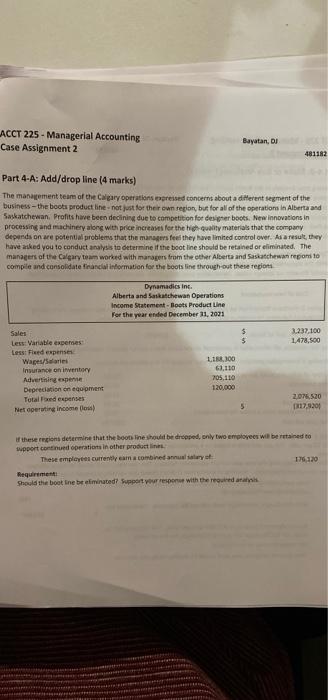

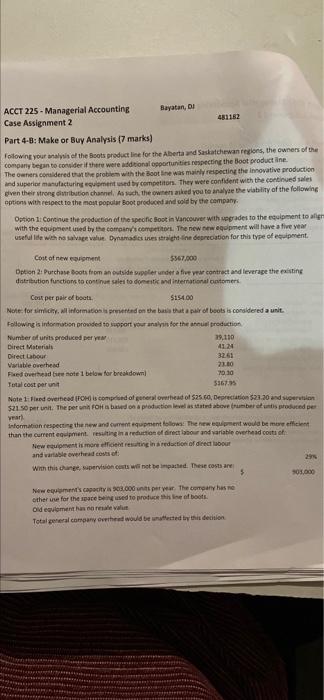

Requirement: 10 1. Calculate the total costs and costs per unit under the two alternatives. Assume the stated units of production are expected to be produced for sale each year. (Tip: depreciation per unit will need to be calculated considering the life of the asset and the number of units being produced). 2. Based on your analysis, provide a recommendation to the owners. ACCT 225 - Managerial Accounting Case Assignment 2 Bayatan, DI 481182 Part 4-A: Add/drop line (4 marks) The management team of the Calgary operations expressed concerns about a different segment of the business - the boots product line not just for their own region, but for all of the operations in Alberta and Saskatchewan Profits have been declining due to competition for designer boots New innovations in processing and machinery along with price increases for the high quality materials that the company depends on are potential problems that the managers feel they have limited control over. As a result they have asked you to conduct analysis to determine if the bootine should be retained or eliminated. The managers of the Calgary team worked with managers from the other Alberta and Saskatchewan repond to compile and consolidate francia information for the boots line throughout these regioni Dynamadics Inc. Alberta and Saskatchewan Operations Income Statement Boots Product Line For the year ended December 11, 2031 $ 23.100 147.500 Sales Less: Variable experes Less Fixed expenses Wapeu/les Insurance on inventory Advertisingepee Depreciation on eve Total Fedexpenses Net operating income (los) LIN100 61,110 705.110 120,000 201520 17.9201 If there regions determine that the boots hould be dropped, only two employees wilbertined to support continued operations in other product These employees currently in a combined annually 176170 Requirement Should the boot inebriminated Support your respon with the more att ACCT 225 - Managerial Accounting Bayatan, Case Assignment 2 Part 4-8: Make or Buy Analysis 17 marks) Following your walise the Boots product line for the Abertawed Saskatchewan regions, the owners of the company began to consider if there were additional opportunities respecting the Boot product ine. The owners considered that the problem with the Bootline was mainly respecting the innovative production and superior manufacturing equipment used by competition. They were confident with the continued sales even their strong tribution channel As such, the ownen asked you to analyze the viability of the following options with respect to the most popular Boot produced and sold by the company. Option 1. Continue the production of the specific Boot in Vancouver with grades to the equipment to with the equipment used by the company's competitor. The new wpment will have a five year useful life with a salvague Dynamics were depreciation for this type of eviment Cost of new comment 5367.000 Option 2: Purchase Boots from an outside poter under a five your contract and leverage the existing distribution functions to continut sales to do international intomers Cost per pair of boots $154.00 Note: for similliformation speed on the basis that a pair of boots is considered a unit. Following information provided to support your analys for the suproduction Number of units produced pery 29.110 Direct Materials 412 Direct Labour 3261 Varuste Overhead 21.00 Fedehead note 1 below for breakdown 70.10 Total cost per un 53675 Note tied overhead Tod is comprised of generowhead of $25.60 Depreciation $21.30 und in $2150 per unit. The per FOH bados a production levelstated abovember untis produced per Information respecting the new and entert follow The went would be more efficient than the current equipment resulting in a reduction of direct labour and variable overhead couts of New even more eficient resting in reduction of director and wartale overhead counset: 29 with this care, supervision costs will not be acted. These costs are 01.000 Neweguments capacity 0.00 per year. The company has e other for the space bed to produce the of boots Ordevements are Total general company that would be rected by this decision