Answered step by step

Verified Expert Solution

Question

1 Approved Answer

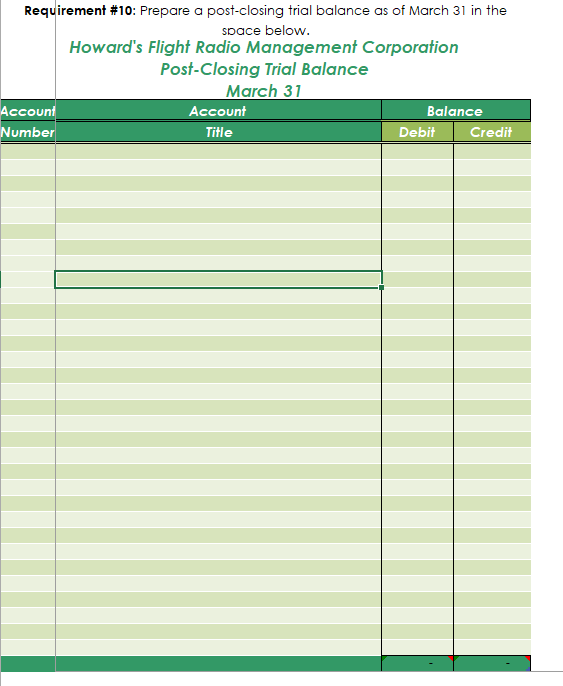

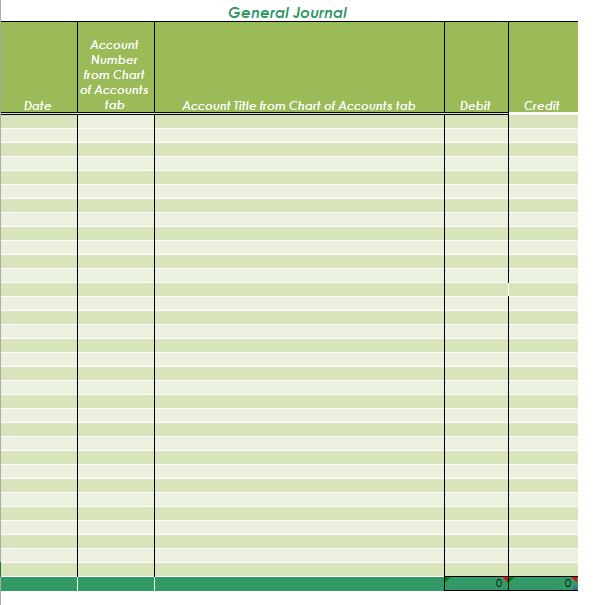

Requirement #10: Prepare a post-closing trial balance as of March 31 in the General Journal begin{tabular}{|c|c|c|c|c|} hline Date & AccountNumberfromChantofAccountstab & Account Tille from Chart

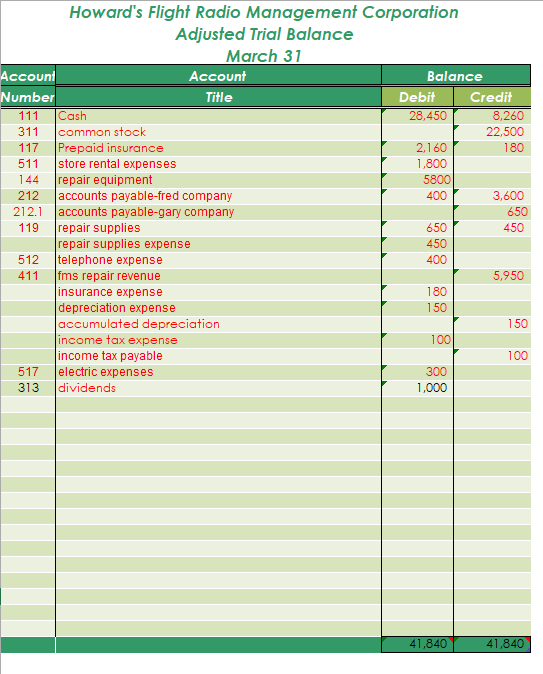

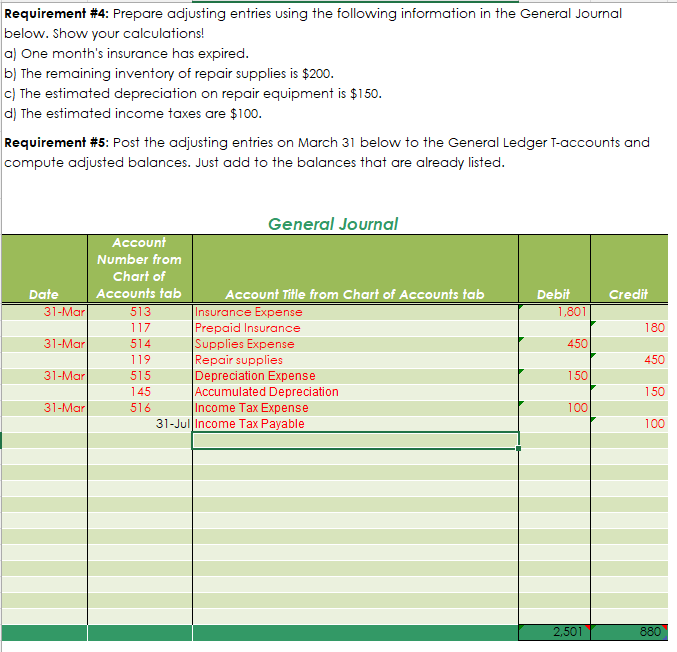

Requirement \#10: Prepare a post-closing trial balance as of March 31 in the General Journal \begin{tabular}{|c|c|c|c|c|} \hline Date & AccountNumberfromChantofAccountstab & Account Tille from Chart of Accounts tab & Debit & Credit \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} Requirement \#4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The remaining inventory of repair supplies is $200. c) The estimated depreciation on repair equipment is $150. d) The estimated income taxes are $100. Requirement \#5: Post the adjusting entries on March 31 below to the General Ledger T-accounts and compute adjusted balances. Just add to the balances that are already listed. General Iniurnal Howard's Flight Radio Management Corporation Adjusted Trial Balance March 31 \begin{tabular}{|c|c|c|c|} \hline \multirow{2}{*}{AccountNumber} & \multirow{2}{*}{AccountTitle} & \multicolumn{2}{|c|}{ Balance } \\ \hline & & Debit & Credit \\ \hline 111 & Cash & 28,450 & 8,260 \\ \hline 311 & common stock & & 22,500 \\ \hline 117 & Prepaid insurance & 2,160 & 180 \\ \hline 511 & store rental expenses & 1,800 & \\ \hline 144 & repair equipment & 5800 & \\ \hline 212 & accounts payable-fred company & 400 & 3,600 \\ \hline 212.1 & accounts payable-gary company & & 650 \\ \hline \multirow[t]{2}{*}{119} & repair supplies & 650 & 450 \\ \hline & repair supplies expense & 450 & \\ \hline 512 & telephone expense & 400 & \\ \hline \multirow[t]{6}{*}{411} & fms repair revenue & & 5,950 \\ \hline & insurance expense & 180 & \\ \hline & depreciation expense & 150 & \\ \hline & accumulated depreciation & & 150 \\ \hline & income tax expense & 100 & \\ \hline & income tax payable & & 100 \\ \hline 517 & electric expenses & 300 & \\ \hline 313 & dividends & 1,000 & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & 41,840 & 41,840 \\ \hline \end{tabular}

Requirement \#10: Prepare a post-closing trial balance as of March 31 in the General Journal \begin{tabular}{|c|c|c|c|c|} \hline Date & AccountNumberfromChantofAccountstab & Account Tille from Chart of Accounts tab & Debit & Credit \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} Requirement \#4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The remaining inventory of repair supplies is $200. c) The estimated depreciation on repair equipment is $150. d) The estimated income taxes are $100. Requirement \#5: Post the adjusting entries on March 31 below to the General Ledger T-accounts and compute adjusted balances. Just add to the balances that are already listed. General Iniurnal Howard's Flight Radio Management Corporation Adjusted Trial Balance March 31 \begin{tabular}{|c|c|c|c|} \hline \multirow{2}{*}{AccountNumber} & \multirow{2}{*}{AccountTitle} & \multicolumn{2}{|c|}{ Balance } \\ \hline & & Debit & Credit \\ \hline 111 & Cash & 28,450 & 8,260 \\ \hline 311 & common stock & & 22,500 \\ \hline 117 & Prepaid insurance & 2,160 & 180 \\ \hline 511 & store rental expenses & 1,800 & \\ \hline 144 & repair equipment & 5800 & \\ \hline 212 & accounts payable-fred company & 400 & 3,600 \\ \hline 212.1 & accounts payable-gary company & & 650 \\ \hline \multirow[t]{2}{*}{119} & repair supplies & 650 & 450 \\ \hline & repair supplies expense & 450 & \\ \hline 512 & telephone expense & 400 & \\ \hline \multirow[t]{6}{*}{411} & fms repair revenue & & 5,950 \\ \hline & insurance expense & 180 & \\ \hline & depreciation expense & 150 & \\ \hline & accumulated depreciation & & 150 \\ \hline & income tax expense & 100 & \\ \hline & income tax payable & & 100 \\ \hline 517 & electric expenses & 300 & \\ \hline 313 & dividends & 1,000 & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & 41,840 & 41,840 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started