Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Requirement 2. James has heard that capital assets cannot be depreciated until they are considered available for use. Explain the available for use rules

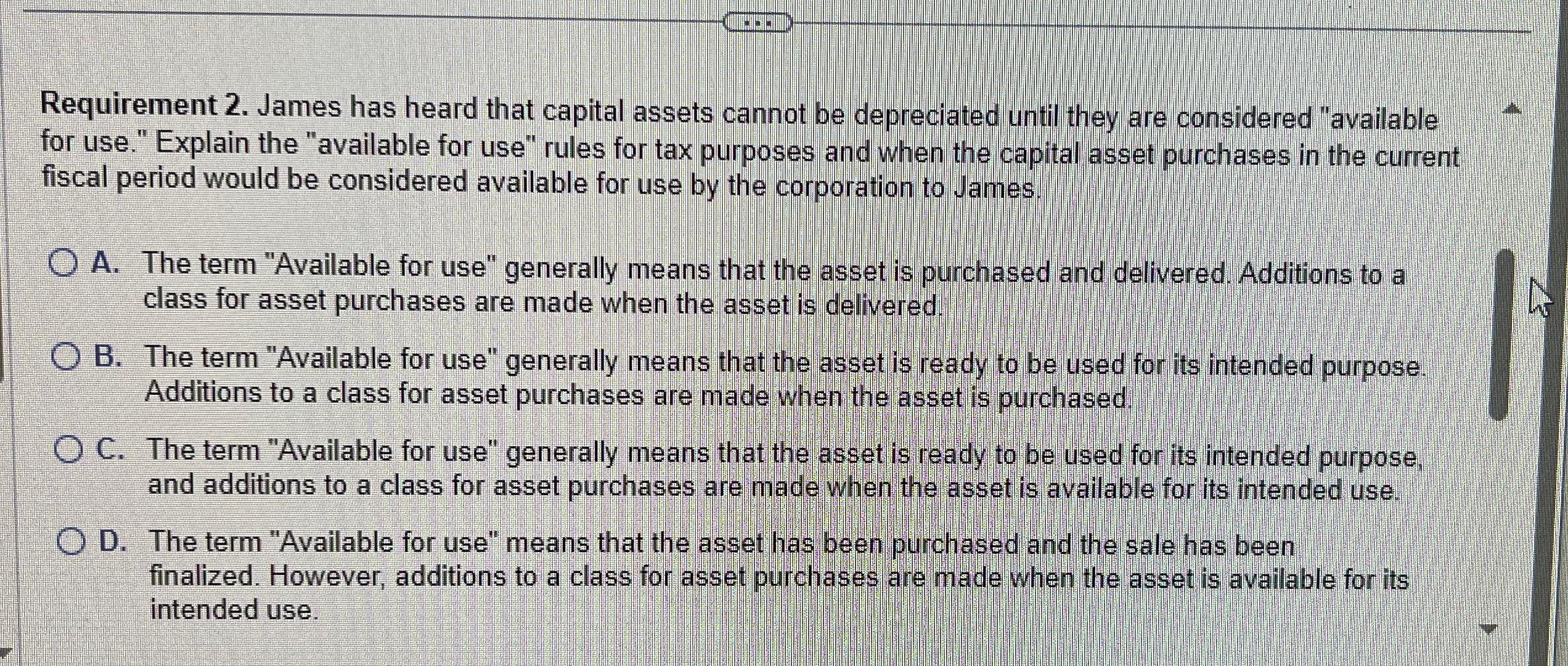

Requirement 2. James has heard that capital assets cannot be depreciated until they are considered "available for use." Explain the "available for use" rules for tax purposes and when the capital asset purchases in the current fiscal period would be considered available for use by the corporation to James OA. The term "Available for use" generally means that the asset is purchased and delivered. Additions to a class for asset purchases are made when the asset is delivered. OB. The term "Available for use" generally means that the asset is ready to be used for its intended purpose. Additions to a class for asset purchases are made when the asset is purchased. OC. The term "Available for use" generally means that the asset is ready to be used for its intended purpose, and additions to a class for asset purchases are made when the asset is available for its intended use. OD. The term "Available for use" means that the asset has been purchased and the sale has been finalized. However, additions to a class for asset purchases are made when the asset is available for its intended use.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The correct answer would be C The term Available for use generally means that the asset is ready to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started