Question

Requirement 2. Requirement 2 will present in 2 parts. The schedule is to present information for 2 months, by completing this schedule one month at

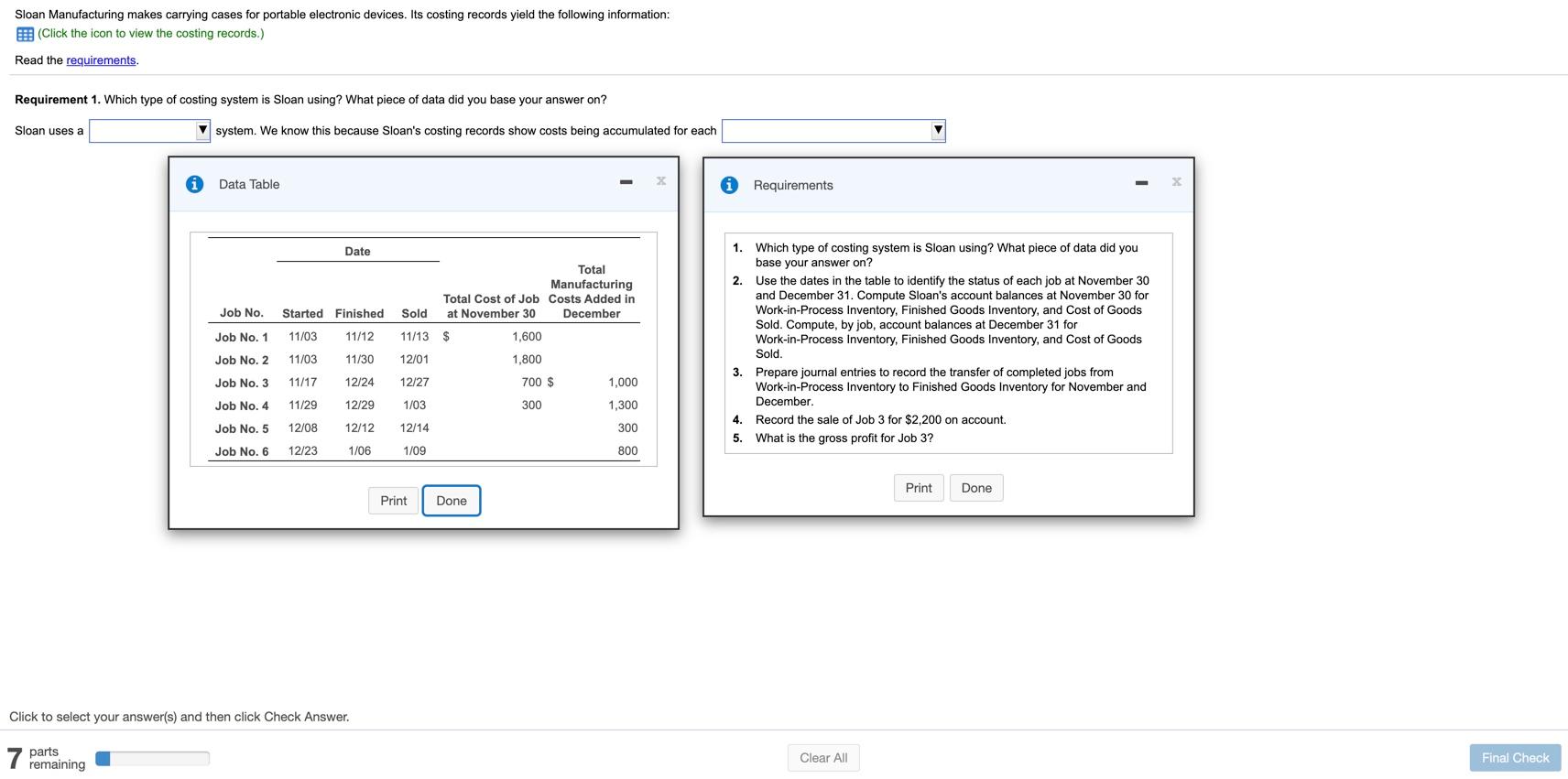

Requirement 2. Requirement 2 will present in 2 parts. The schedule is to present information for 2 months, by completing this schedule one month at a time. FIRST to fill in information for ONLY THE FIRST MONTH. What was the status of the jobs at the end of the FIRST month. Hint: If a job was not started, finished, nor sold in the first month, then do NOT put it in the first part where you are filling in what happened for the first month only. THEN in the 2nd part of requirement 2 you can fill in the schedule for what happened IN the 2nd month. Hint: Some Jobs may be started and/or completed in the first month and transferred to the next job status category in the second month. When a job goes to the next status it does not lose (leave behind) the costs already put into

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started