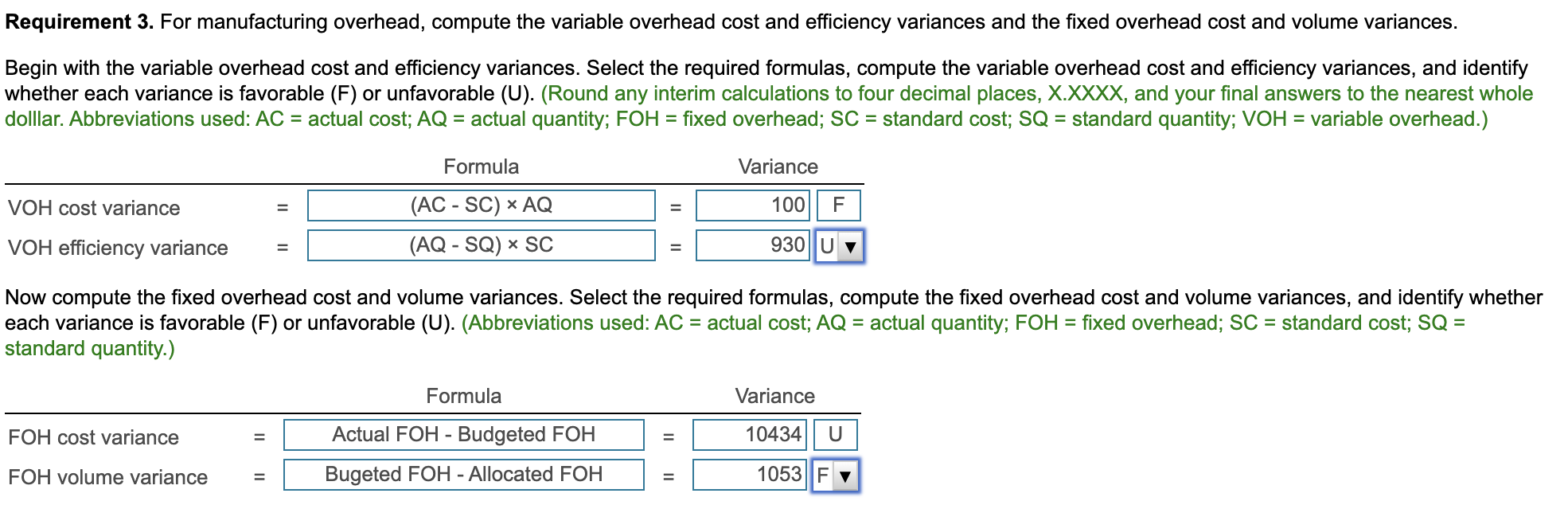

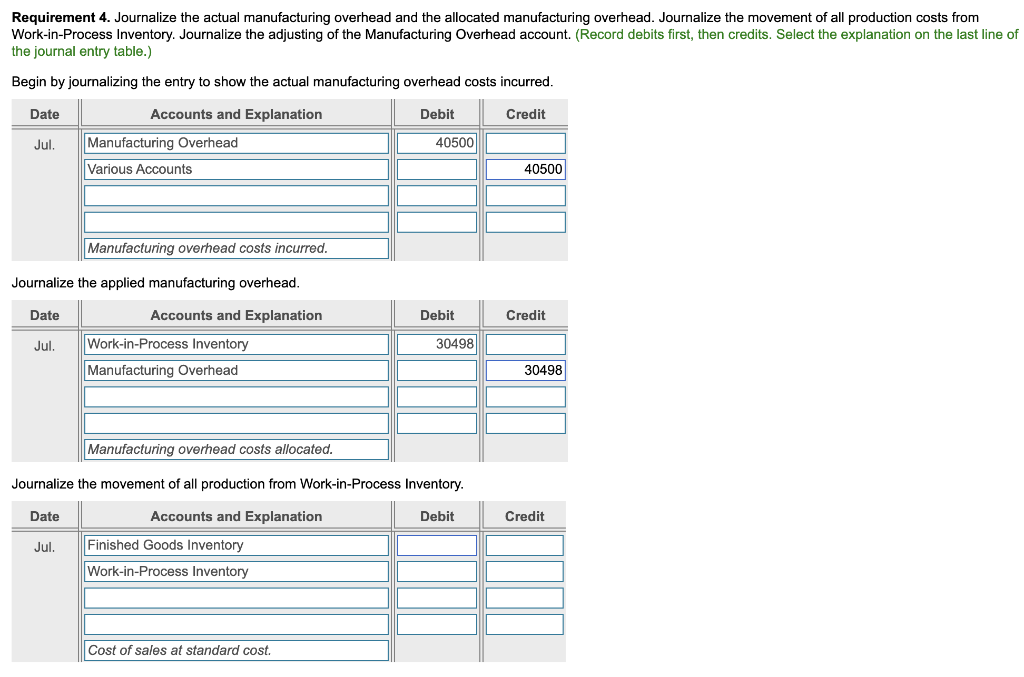

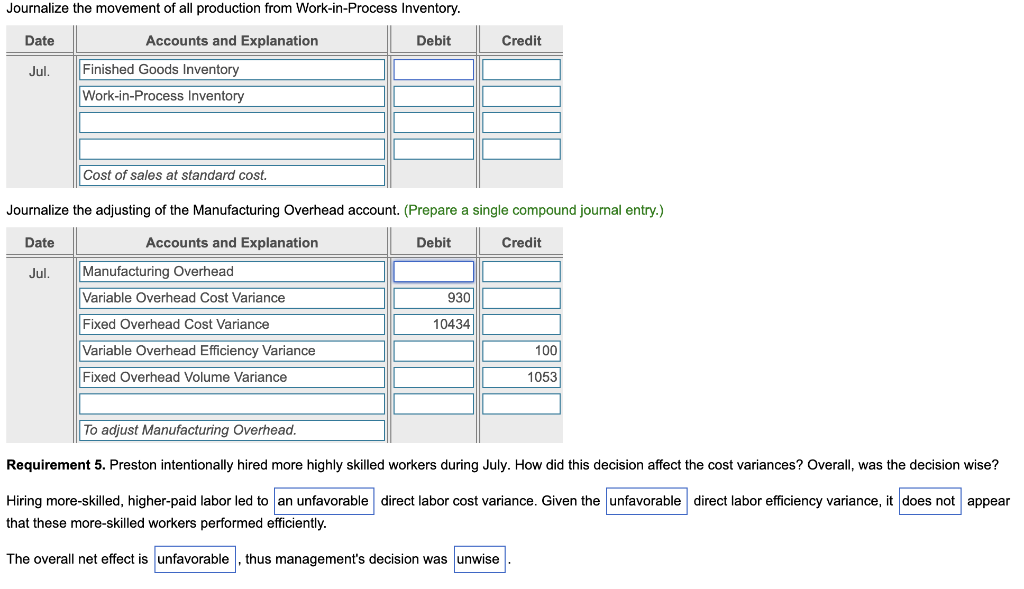

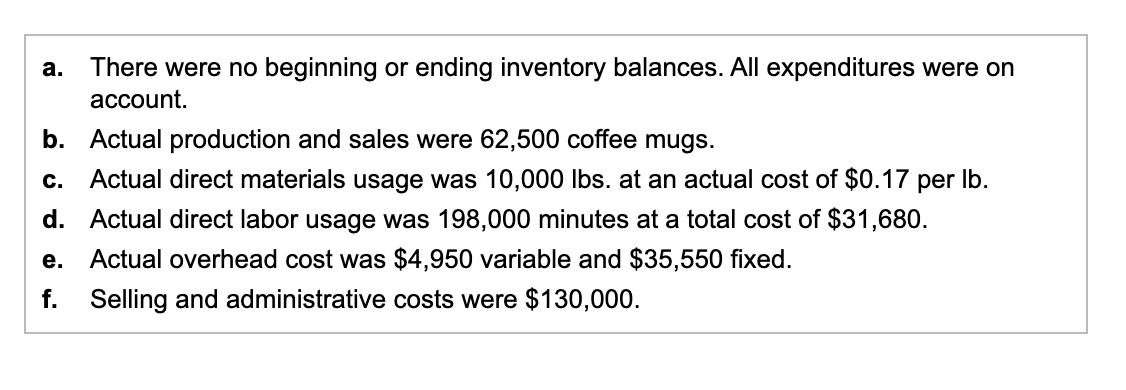

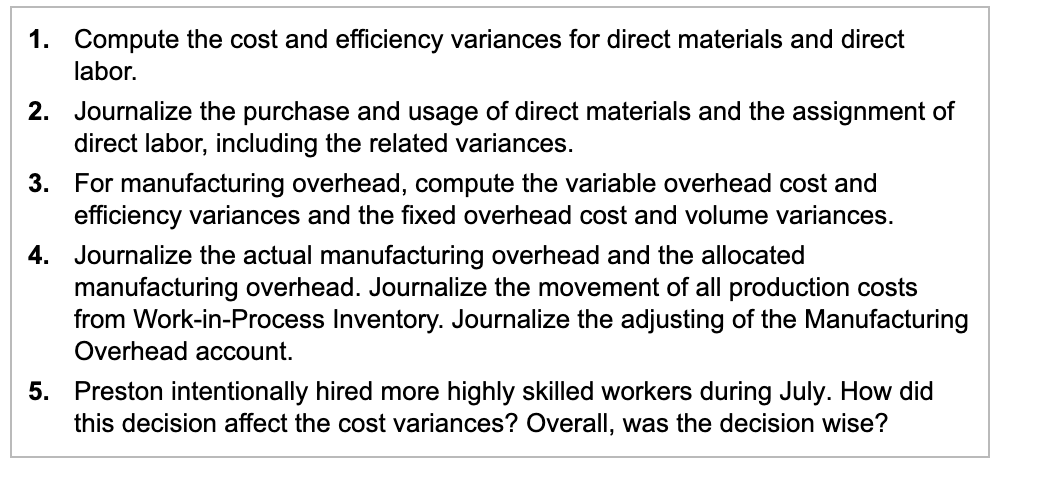

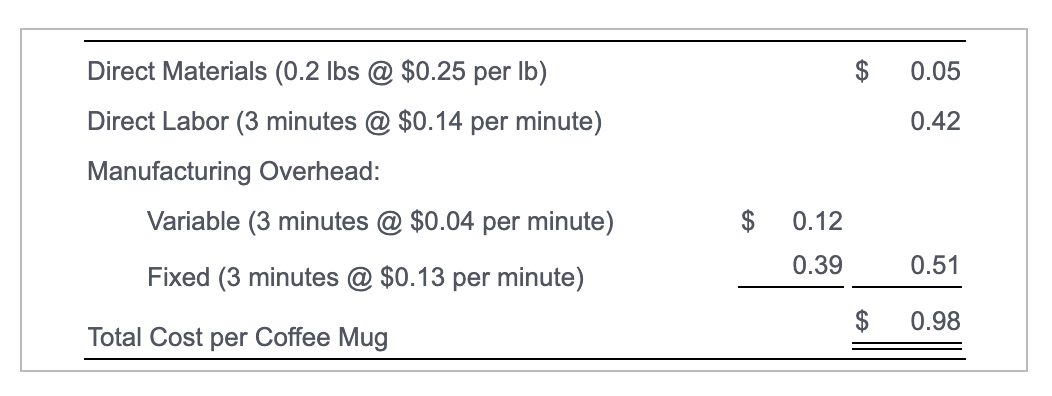

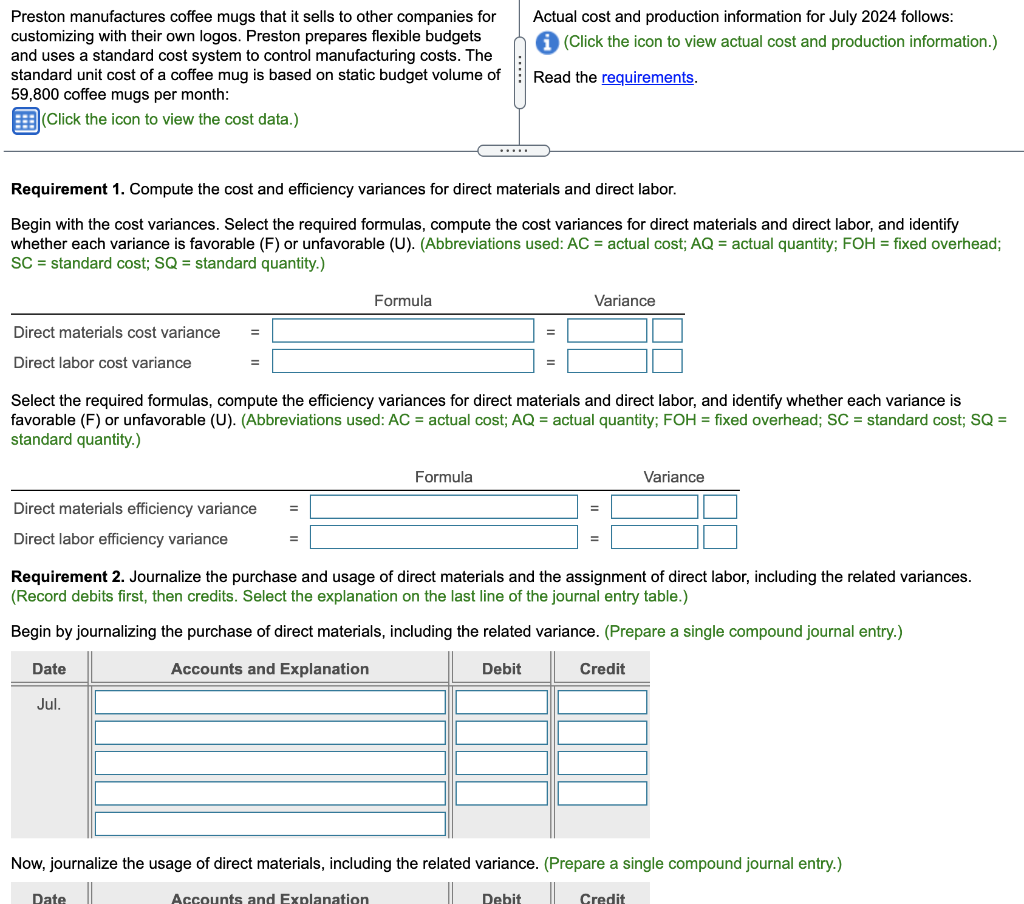

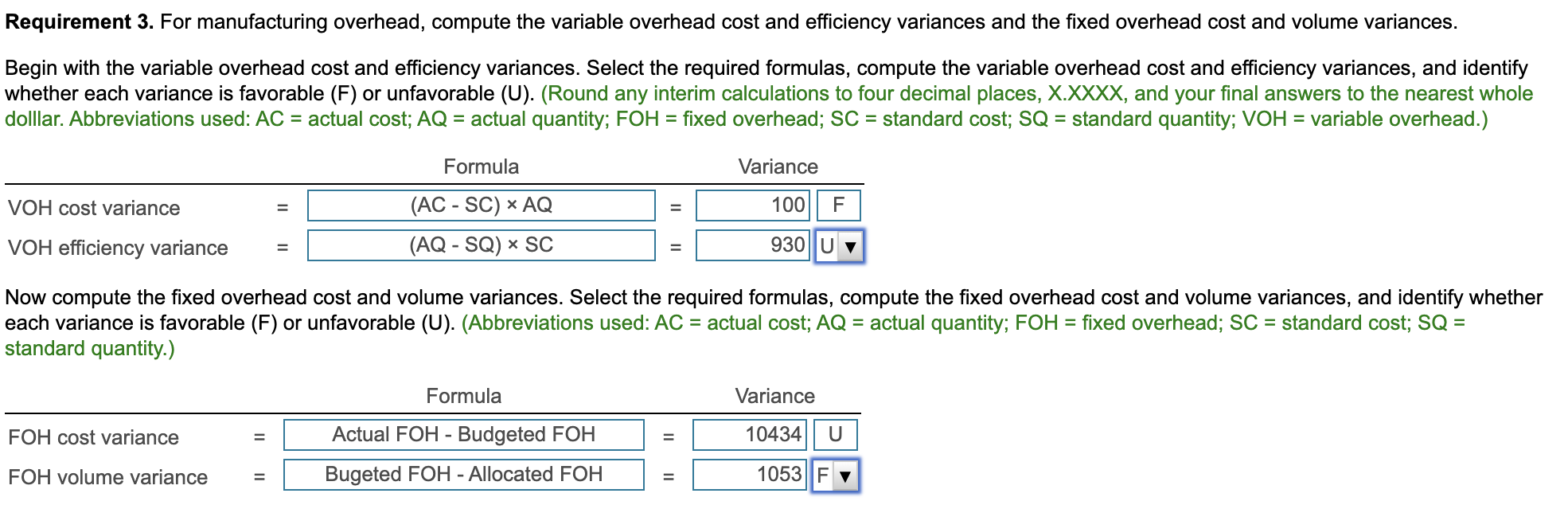

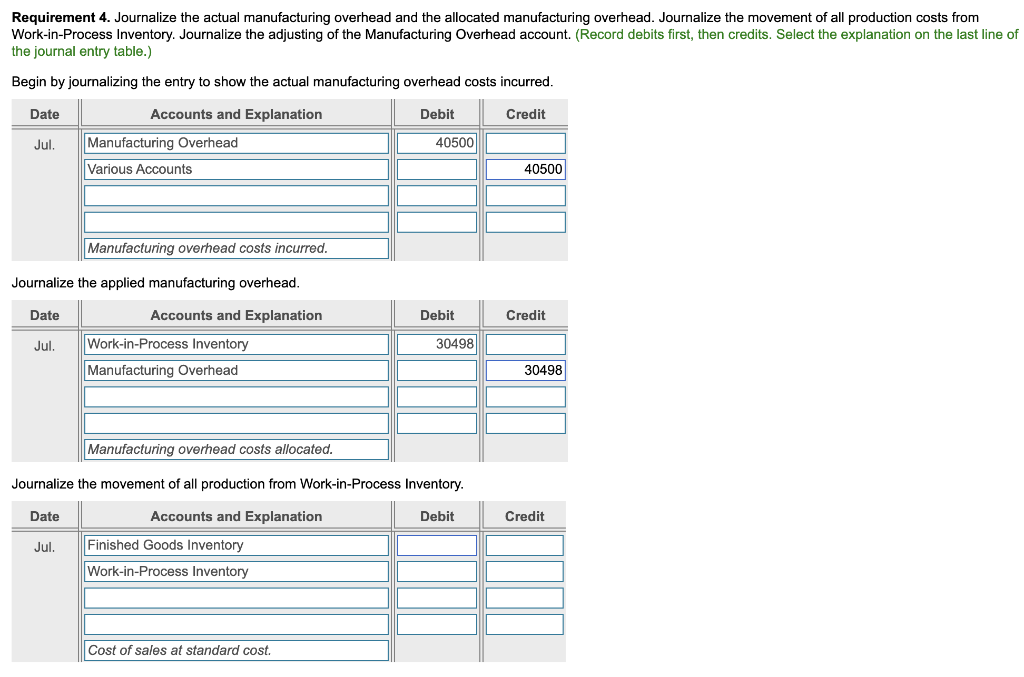

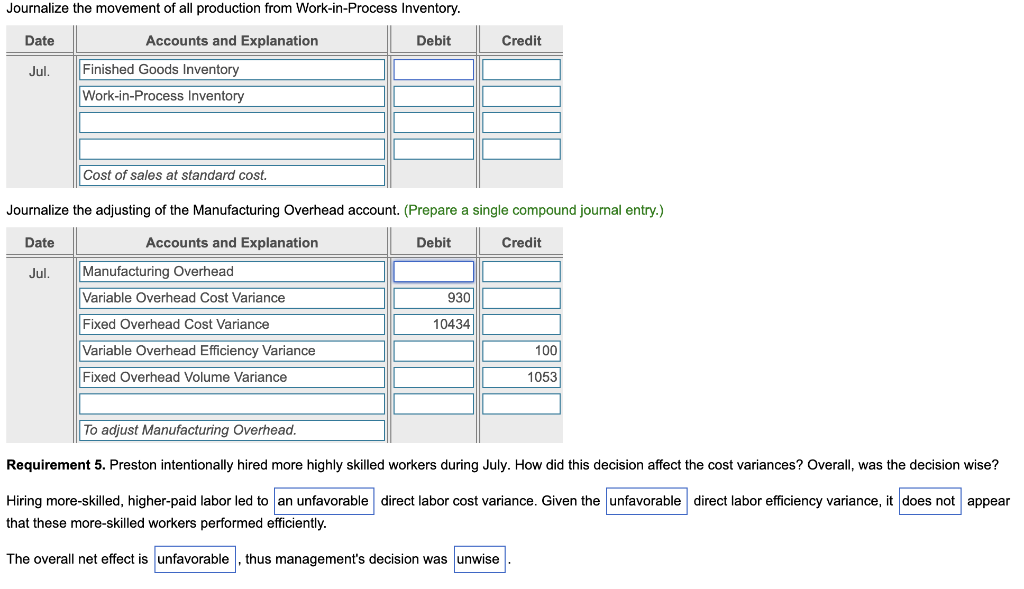

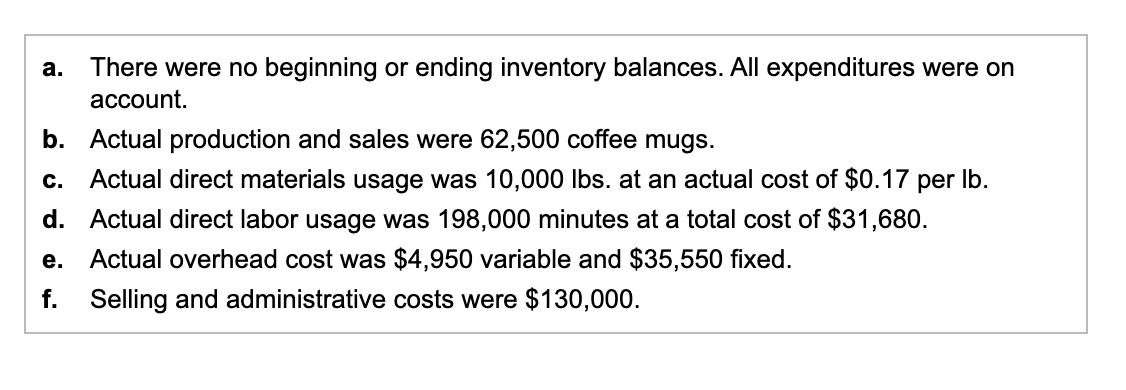

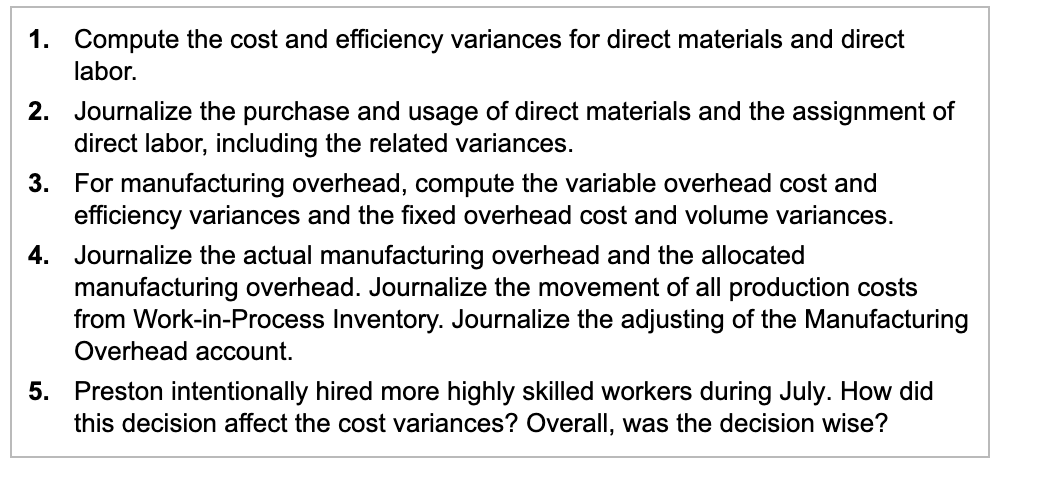

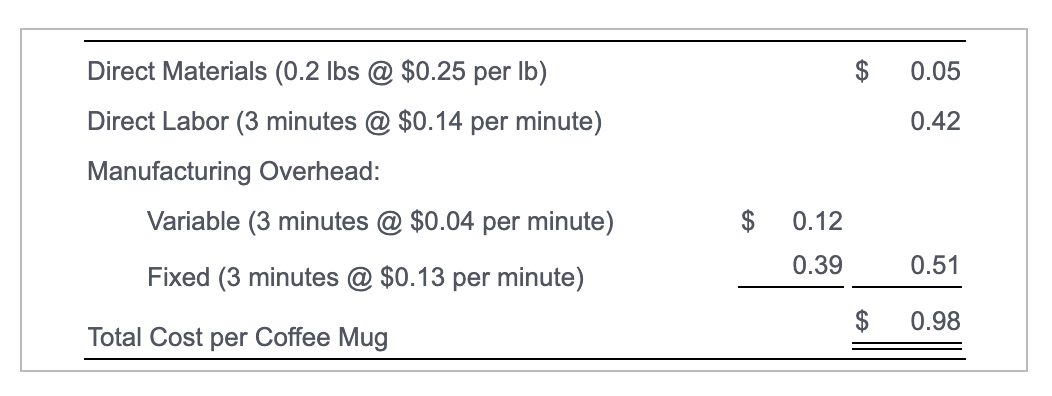

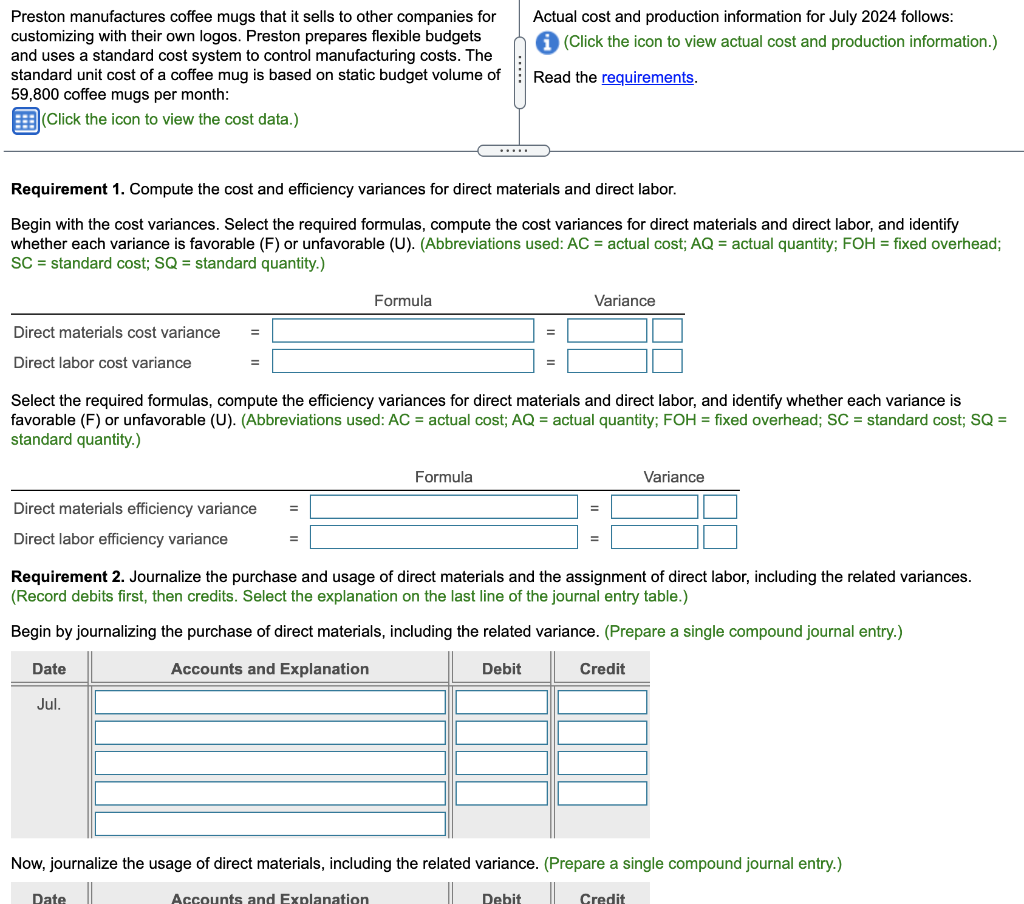

Requirement 3. For manufacturing overhead, compute the variable overhead cost and efficiency variances and the fixed overhead cost and volume variances. Begin with the variable overhead cost and efficiency variances. Select the required formulas, compute the variable overhead cost and efficiency variances, and identify whether each variance is favorable (F) or unfavorable (U). (Round any interim calculations to four decimal places, X.XXXX, and your final answers to the nearest whole dolllar. Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standard cost; SQ = standard quantity; VOH = variable overhead.) Formula Variance VOH cost variance = 100 F (AC - SC) AQ (AQ - SQ) > SC VOH efficiency variance = 930|U v Now compute the fixed overhead cost and volume variances. Select the required formulas, compute the fixed overhead cost and volume variances, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standard cost; SQ = standard quantity.) Formula Variance FOH cost variance Actual FOH - Budgeted FOH II 10434 U FOH volume variance = Bugeted FOH - Allocated FOH 1053 F v II Requirement 4. Journalize the actual manufacturing overhead and the allocated manufacturing overhead. Journalize the movement of all production costs from Work-in-Process Inventory. Journalize the adjusting of the Manufacturing Overhead account. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing the entry to show the actual manufacturing overhead costs incurred. Date Debit Credit Jul. Accounts and Explanation Manufacturing Overhead Various Accounts 40500 40500 Manufacturing overhead costs incurred. Journalize the applied manufacturing overhead. Date Debit Credit Jul. Accounts and Explanation Work-in-Process Inventory Manufacturing Overhead 30498 30498 Manufacturing overhead costs allocated. Journalize the movement of all production from Work-in-Process Inventory. Date Debit Credit Jul. Accounts and Explanation Finished Goods Inventory Work-in-Process Inventory Cost of sales at standard cost. Journalize the movement of all production from Work-in-Process Inventory. Date Accounts and Explanation Debit Credit Jul Finished Goods Inventory Work-in-Process Inventory Cost of sales at standard cost. Journalize the adjusting of the Manufacturing Overhead account. (Prepare a single compound journal entry.) Date Debit Credit Jul. Accounts and Explanation Manufacturing Overhead Variable Overhead Cost Variance 930 10434 Fixed Overhead Cost Variance Variable Overhead Efficiency Variance Fixed Overhead Volume Variance 100 1053 To adjust Manufacturing Overhead. Requirement 5. Preston intentionally hired more highly skilled workers during July. How did this decision affect the cost variances? Overall, was the decision wise? Hiring more-skilled, higher-paid labor led to an unfavorable direct labor cost variance. Given the unfavorable direct labor efficiency variance, it does not appear that these more-skilled workers performed efficiently. The overall net effect is unfavorable, thus management's decision was unwise a. There were no beginning or ending inventory balances. All expenditures were on account. b. Actual production and sales were 62,500 coffee mugs. Actual direct materials usage was 10,000 lbs. at an actual cost of $0.17 per lb. d. Actual direct labor usage was 198,000 minutes at a total cost of $31,680. Actual overhead cost was $4,950 variable and $35,550 fixed. f. Selling and administrative costs were $130,000. C. e. 1. Compute the cost and efficiency variances for direct materials and direct labor. 2. Journalize the purchase and usage of direct materials and the assignment of direct labor, including the related variances. 3. For manufacturing overhead, compute the variable overhead cost and efficiency variances and the fixed overhead cost and volume variances. 4. Journalize the actual manufacturing overhead and the allocated manufacturing overhead. Journalize the movement of all production costs from Work-in-Process Inventory. Journalize the adjusting of the Manufacturing Overhead account. 5. Preston intentionally hired more highly skilled workers during July. How did this decision affect the cost variances? Overall, was the decision wise? $ 0.05 0.42 Direct Materials (0.2 lbs @ $0.25 per lb) Direct Labor (3 minutes @ $0.14 per minute) Manufacturing Overhead: Variable (3 minutes @ $0.04 per minute) $ $ 0.12 Fixed (3 minutes @ $0.13 per minute) 0.39 0.51 $ 0.98 Total Cost per Coffee Mug Actual cost and production information for July 2024 follows: (Click the icon to view actual cost and production information.) Preston manufactures coffee mugs that it sells to other companies for customizing with their own logos. Preston prepares flexible budgets and uses a standard cost system to control manufacturing costs. The standard unit cost of a coffee mug is based on static budget volume of 59,800 coffee mugs per month: Click the icon to view the cost data.) Read the requirements. Requirement 1. Compute the cost and efficiency variances for direct materials and direct labor. Begin with the cost variances. Select the required formulas, compute the cost variances for direct materials and direct labor, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standard cost; SQ = standard quantity.) Formula Variance Direct materials cost variance Direct labor cost variance Select the required formulas, compute the efficiency variances for direct materials and direct labor, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standard cost; SQ = standard quantity.) Formula Variance = Direct materials efficiency variance Direct labor efficiency variance Requirement 2. Journalize the purchase and usage of direct materials and the assignment of direct labor, including the related variances. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing the purchase of direct materials, including the related variance. (Prepare a single compound journal entry.) Date Accounts and Explanation Debit Credit Jul. Now, journalize the usage of direct materials, including the related variance. (Prepare a single compound journal entry.) Date Accounts and Explanation Debit Credit