Answered step by step

Verified Expert Solution

Question

1 Approved Answer

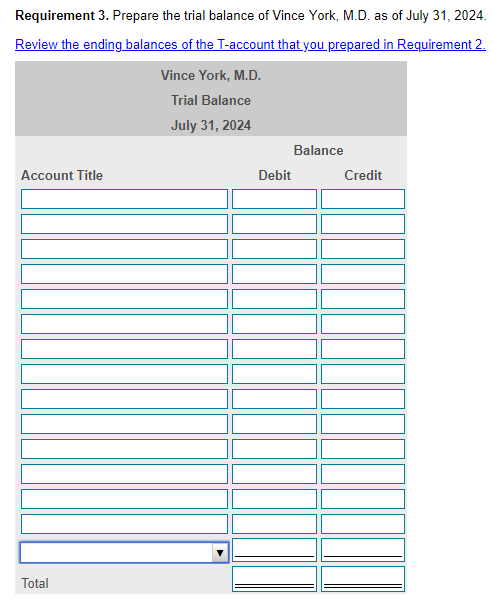

Requirement 3. Prepare the trial balance of Vince York, M.D. as of July 31, 2024. Review the ending balances of the T-account that you prepared

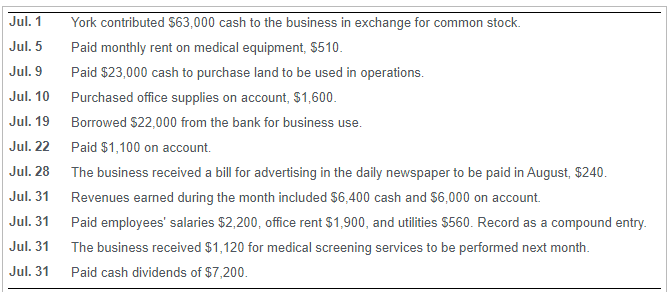

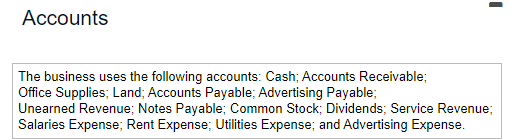

Requirement 3. Prepare the trial balance of Vince York, M.D. as of July 31, 2024. Review the ending balances of the T-account that you prepared in Requirement 2. \begin{tabular}{ll} \hline Jul. 1 & York contributed $63,000 cash to the business in exchange for common stock. \\ Jul. 5 & Paid monthly rent on medical equipment, $510. \\ Jul. 9 & Paid $23,000 cash to purchase land to be used in operations. \\ Jul. 10 & Purchased office supplies on account, $1,600. \\ Jul. 19 & Borrowed $22,000 from the bank for business use. \\ Jul. 22 & Paid $1,100 on account. \\ Jul. 28 & The business received a bill for advertising in the daily newspaper to be paid in August, $240. \\ Jul. 31 & Revenues earned during the month included $6,400 cash and $6,000 on account. \\ Jul. 31 & Paid employees' salaries $2,200, office rent $1,900, and utilities $560. Record as a compound entry. \\ Jul. 31 & The business received $1,120 for medical screening services to be performed next month. \\ Jul. 31 & Paid cash dividends of $7,200. \\ \hline \end{tabular} Accounts The business uses the following accounts: Cash; Accounts Receivable; Office Supplies; Land; Accounts Payable; Advertising Payable; Unearned Revenue; Notes Payable; Common Stock; Dividends; Service Revenue; Salaries Expense; Rent Expense; Utilities Expense; and Advertising Expense

Requirement 3. Prepare the trial balance of Vince York, M.D. as of July 31, 2024. Review the ending balances of the T-account that you prepared in Requirement 2. \begin{tabular}{ll} \hline Jul. 1 & York contributed $63,000 cash to the business in exchange for common stock. \\ Jul. 5 & Paid monthly rent on medical equipment, $510. \\ Jul. 9 & Paid $23,000 cash to purchase land to be used in operations. \\ Jul. 10 & Purchased office supplies on account, $1,600. \\ Jul. 19 & Borrowed $22,000 from the bank for business use. \\ Jul. 22 & Paid $1,100 on account. \\ Jul. 28 & The business received a bill for advertising in the daily newspaper to be paid in August, $240. \\ Jul. 31 & Revenues earned during the month included $6,400 cash and $6,000 on account. \\ Jul. 31 & Paid employees' salaries $2,200, office rent $1,900, and utilities $560. Record as a compound entry. \\ Jul. 31 & The business received $1,120 for medical screening services to be performed next month. \\ Jul. 31 & Paid cash dividends of $7,200. \\ \hline \end{tabular} Accounts The business uses the following accounts: Cash; Accounts Receivable; Office Supplies; Land; Accounts Payable; Advertising Payable; Unearned Revenue; Notes Payable; Common Stock; Dividends; Service Revenue; Salaries Expense; Rent Expense; Utilities Expense; and Advertising Expense Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started