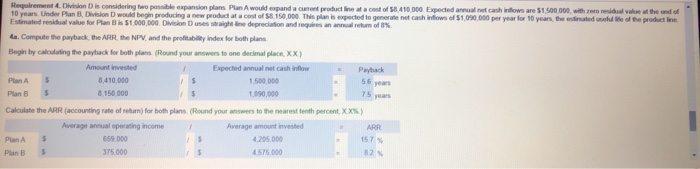

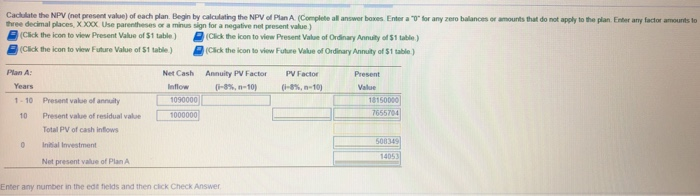

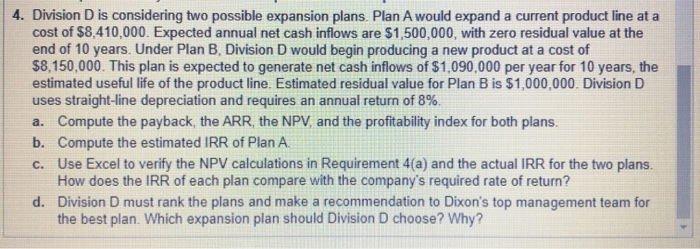

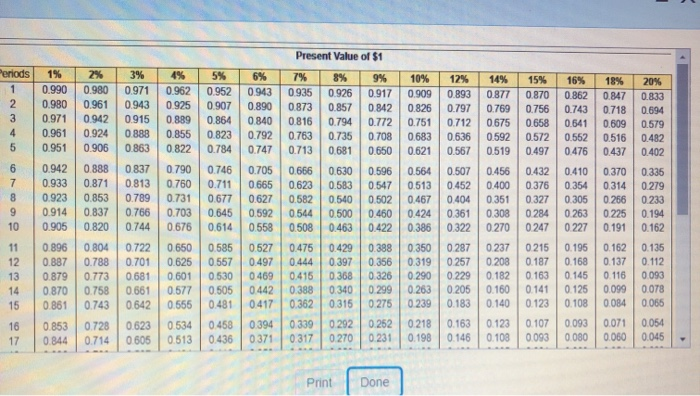

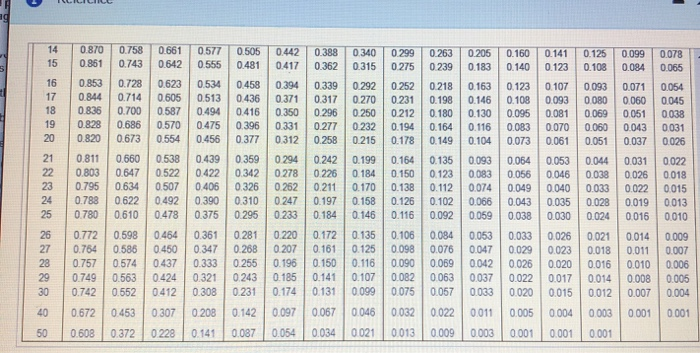

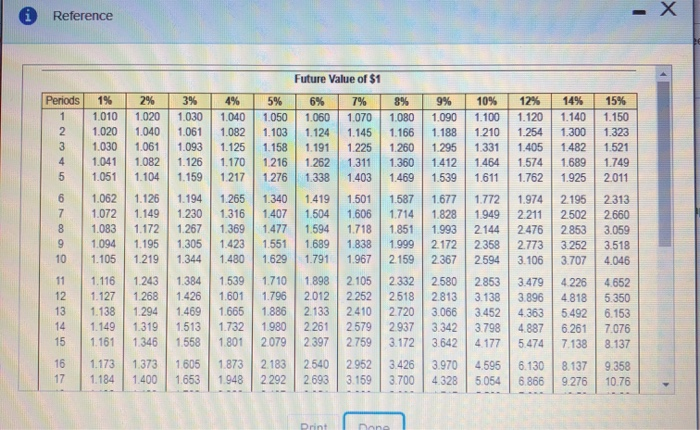

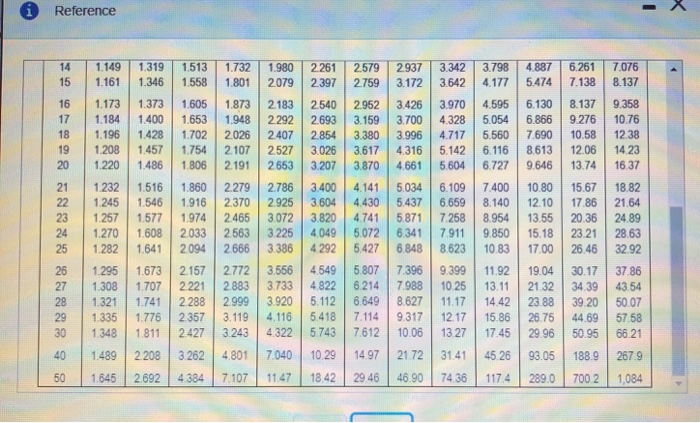

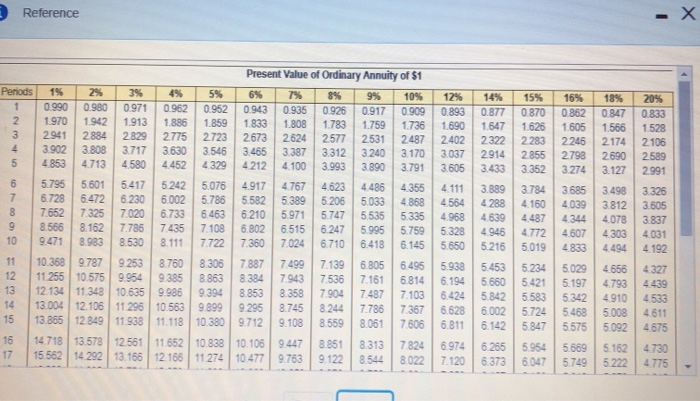

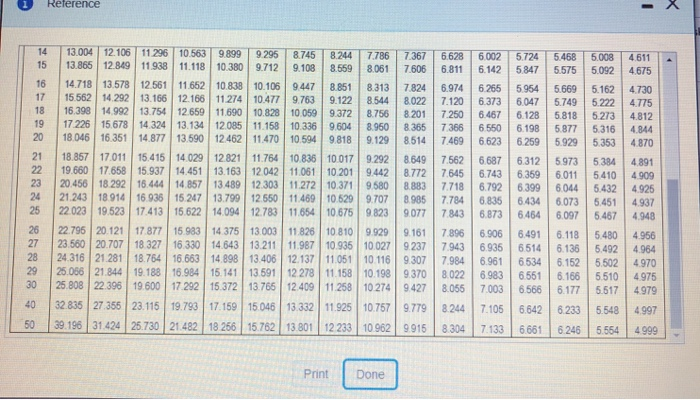

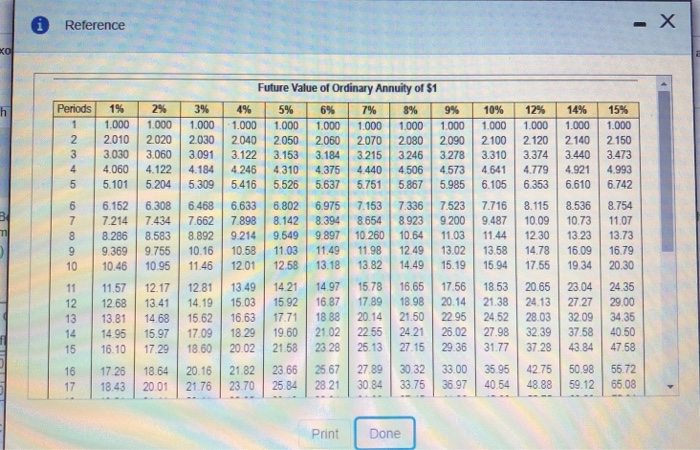

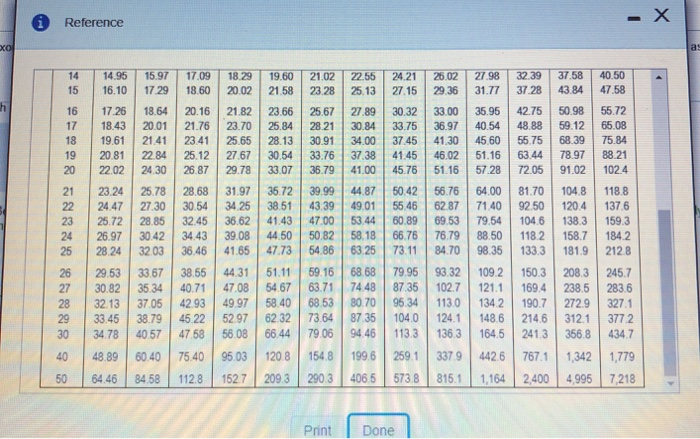

Requirement 4. Division is considering two posible expansion plans Plan A would expand a current product line at a cost of $8.410.000 Expected annual net cash inflows are $1.500.000, with rato residual value at the end of 10 years Under Plan B, Division would begin producing a new product at a cost of 8.150.000. This plan is expected to generate net cash inflows of 51,090,000 per year for 10 years, the estimated selle of the product line Estimated residual value for Plan 3 51.000.000. Division Desighline depreciation and requires an annual return of 8% 4a. Compute the payback, the ARR the NPV and the profitability Index for both plans Begin by calculating the payback for both plans (Round your answers to one decimal place XX) Amount invested Expected annual net cash inflow Payback Plan 5 8.410,000 15 1,500,000 Plan B $ 8.150.000 1.090,000 Calculate the ARR (accounting rate of rem) for both plans (Round your answer to the nearest percent XX) Average annual operating income Average amount invested ARR Plan 5 559.000 4 205,000 Plan B 5 375.000 4.575.000 82 15 y Caciulate the NPV (not present value) of each plan. Begin by calculating the NPV of Plan A (Complete all answer boxes Enter a "for any zer balances or amounts that do not apply to the plan. Enter any factor amounts to three decimal places, XXX Use parentheses or a minus sign for a negative nel present value) (Click the icon to view Present Value of $1 table) (Click the icon to view Present Value of Ordinary Annuity of $1 table) (Click the icon to view Future Value of 51 table) (Click the icon to view Future Value of Ordinary Annuity of S1 table) Plan A: PV Factor Annuity PV Factor 01-8%, n-101 Years 1 - 10 Present value of annuity 10 Present value of residual value Total PV of cash inflows Net Cash Inflow 1090000 1000000 Present Value 18150000 7655704 0 Initial Investment 508349 14053 Net present value of Plan A Enter any number in the edt elds and then click Check Answer 4. Division D is considering two possible expansion plans. Plan A would expand a current product line at a cost of $8,410,000. Expected annual net cash inflows are $1,500,000, with zero residual value at the end of 10 years. Under Plan B, Division D would begin producing a new product at a cost of $8,150,000. This plan is expected to generate net cash inflows of $1,090,000 per year for 10 years, the estimated useful life of the product line. Estimated residual value for Plan B is $1,000,000. Division D uses straight-line depreciation and requires an annual return of 8%. a. Compute the payback, the ARR, the NPV, and the profitability index for both plans. b. Compute the estimated IRR of Plan A. C. Use Excel to verify the NPV calculations in Requirement 4(a) and the actual IRR for the two plans. How does the IRR of each plan compare with the company's required rate of return? d. Division D must rank the plans and make a recommendation to Dixon's top management team for the best plan. Which expansion plan should Division D choose? Why? Present Value of $1 Periods 1 2 3 4 5 1% 0.990 0.980 0.971 0.961 0.951 2% 0.980 0.961 0942 0.924 0.906 3% 0.971 0.943 0.915 0888 0.863 4% 0.962 0.925 0.889 0.855 0.822 5% 0.952 0.907 0.864 0.823 0.784 6% 0943 0.890 0.840 0.792 0.747 7% 0.935 0873 0.816 0.763 0.713 8% 0.926 0.857 0.794 0.735 0.681 9% 0.917 0.842 0.772 0.708 0.650 10% 0909 0.826 0.751 0.683 0.621 12% 0.893 0.797 0.712 0.636 0.567 14% 0.877 0.769 0.675 0.592 0519 15% 0.870 0.756 0.658 0572 0.497 16% 0.862 0.743 0.641 0.552 0.476 18% 0.847 0718 0.609 0.516 0437 20% 0.833 0.694 0.579 0.482 0.402 6 7 8 9 10 0.942 0.933 0.923 0.914 0.905 0.888 0.871 0.853 0.837 0.820 0.837 0.813 0.789 0.766 0.744 0.790 0.760 0.731 0.703 0.676 0.746 0.711 0.677 0.645 0.614 0.705 0.665 0.627 0.592 0.558 0.666 0.623 0.582 0.544 0.508 0.630 0.583 0.540 0.500 0.463 0.596 0.547 0.502 0.460 0.422 0.564 0.513 0.467 0.424 0.386 0.507 0.452 0.404 0.361 0.322 0.432 0.376 0.327 0284 0247 0.410 0.354 0.305 0.263 0.227 0.370 0.314 0.266 0.225 0.191 0.336 0.279 0.233 0.194 0.162 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 0.140 11 12 13 14 15 0.896 0.887 0.879 0.870 0.861 0.804 0.788 0.773 0.758 0.743 0.722 0.701 0.681 0.661 0.642 0.650 0.625 0.601 0.577 0.555 0.585 0.557 0.530 0.505 0.481 0.527 0.497 0469 0.442 0.417 0394 0.371 0.475 0.444 0.415 0.388 0.362 0.429 0.397 0.368 0.340 0315 0292 0.270 0.388 0.356 0.326 0 299 0 275 0.350 0.319 0.290 0.263 0.239 0.287 0.257 0.229 0.205 0.183 0.215 0.187 0.163 0.141 0.123 0.195 0.168 0.145 0.125 0.108 0.162 0.137 0.116 0.099 0.084 0.135 0.112 0 093 0.078 0.065 16 17 0.853 0.844 0.728 0.714 0.623 0 605 0.534 0.513 0.458 0.436 0.339 0.317 0.252 0.231 0.218 0.198 0.163 0.146 0.123 0.108 0.107 0.093 0.093 0.080 0.071 0.060 0.054 0.045 Print Done - 19 14 5 0.80 051 0758 0743 0661 0642 057 0555 1072 0505 0481 0442 0417 0.388 0.362 0340 0.315 0299 0275 0263 02.39 0206 013 0.160 0 140 0 141 0123 115 010 0099 004 | 0065 16 17 16 19 20 0.853 0844 0826 0828 0.820 0.28 0714 0.700 0.686 067 0623 0605 0567 0570 0554 05.4 053 0494 0475 0.455 0458 04.36 0416 0.396 0377 0394 0371 0350 0331 0312 0339 0.317 0.296 0277 0.256 0292 0270 0250 0232 0215 0252 0231 0212 0194 0478 0218 0.196 010 0 164 0.149 0123 0 108 0.095 0.03 0073 010 0093 0 08 0.070 0.051 0003 0 080 0 069 0060 0.051 0.071 0060 0 0.51 0043 000/ 0.054 0045 003E 0031 0026 0 153 0.146 0130 0.116 0104 093 0063 0074 0066 008 21 22 3 24 25 0.31 0803 0.795 07 0780 0.560 0647 0.634 0622 0.610 0538 0522 0.507 0492 0478 0.439 0422 0406 0390 0375 0359 0.342 0.326 0310 0295 0794 0278 0262 0247 0233 0242 0225 021] 0 197 0 184 0.199 018 0170 0.158 146 0164 1150 0.136 0126 016 0.135 0123 0.112 0.102 0.092 0 0EA 0066 0049 0.043 0038 0053 0046 0.040 0.025 0.030 0044 0023 0033 0028 0024 0031 0.026 0.022 0019 0015 0022 0018 0015 0013 0010 26 27 23 0772 0.764 0757 0749 0742 0.598 0.585 0574 0563 0.552 ( 46- 0450 047 0424 0412 0.36] 0347 0.333 032] 0302 0281 0266 0265 0243 0231 0220 0207 0 196 1185 0174 1172 061 0 150 0.141 013 0 135 0125 0116 0 107 009 0.106 008 0000 002 0075 0084 0076 0069 0063 0.057 0053 0047 0042 0037 003 0.033 009 0026 0022 0020 0026 0023 0020 0017 0015 0021 0.013 0.016 0014 0012 0014 0.011 0.010 0.008 0.007 0009 2007 0.006 0005 000- 20 0 0672 0453 10307 0208 1142 0097 0067 0045 00cc 0022 1011 0006 0004 0002 000] 0 001 50 0606 0372 0222 14 0087 0.054 0034 0021 003 0000 0003 000 0001 0 001 Reference Future Value of $1 Periods 1 2 3 4 5 1% 1.010 1.020 1.030 1.041 1.051 2% 1.020 1.040 1.061 1.082 1.104 3% 1.030 1.061 1.093 1.126 1.159 4% 1.040 1.082 1.125 1.170 1.217 5% 1.050 1.103 1.158 1.216 1.276 6% 1.060 1.124 1.191 1.262 1.338 7% 1.070 1.145 1.225 1.311 1.403 8% 1.080 1.166 1.260 1.360 1.469 9% 1.090 1.188 1.295 1.412 1.539 10% 1.100 1.210 1.331 1.464 1.611 12% 1.120 1.254 1.405 1.574 1.762 14% 1.140 1.300 1.482 1.689 1.925 15% 1.150 1.323 1.521 1.749 2011 6 7 1.062 1.072 1.083 1.094 1.105 1.126 1.149 1.172 1.195 1.219 1.194 1.230 1.267 1.305 1.344 1.265 1.316 1.369 1.423 1.480 1.340 1.407 1.477 1.551 1.629 1.419 1.504 1.594 1.689 1.791 1.501 1.606 1.718 1.838 1.967 1.587 1.714 1 851 1.999 2.159 1.677 1.828 1.993 2.172 2.367 1.772 1.949 2144 2.358 2.594 1.974 2.211 2476 2.773 3.106 2.195 2502 2.853 3.252 3.707 2313 2660 3.059 3.518 4.046 9 10 11 12 13 14 15 1.116 1.127 1.138 1.149 1.161 1.243 1.268 1.294 1.319 1.346 1.384 1.426 1.469 1.513 1.558 1.539 1.601 1.665 1.732 1.801 1.710 1.796 1.886 1.980 2.079 1 898 2012 2.133 2.261 2397 2.105 2.252 2.410 2.579 2.759 2332 2.518 2.720 2.937 3.172 2.580 2.813 3.066 3.342 3.642 2.853 3.138 3.452 3.798 4 177 3.479 3.896 4.363 4.887 5.474 4226 4.818 5.492 6.261 7.138 4.652 5.350 6.153 7.076 8.137 16 17 1.173 1.184 1.373 1.400 1.605 1.653 1.873 1.948 2.183 2 292 2540 2693 2.952 3.159 3426 3.700 3.970 4328 4.595 5054 6.130 6.866 8.137 9.276 9.358 10.76 Drint one X Reference 14 15 1149 1.161 1319 1.346 1513 1559 1.732 1.801 1980 2079 2261 2397 2579 2759 2937 3172 3.342 342 3798 441TT 487 5474 6261 7139 7076 8 137 16 17 18 19 20 1.173 1184 1. 196 1208 1.220 1.373 1400 1.428 1.457 1.486 1.605 1.653 1702 1754 1806 1.873 1948 2026 2107 2191 2183 2292 2407 2527 2653 2540 2693 2854 3026 3207 2952 3.159 3.380 3.517 3870 3426 3700 3996 4316 4661 3970 44.328 4.717 5.142 5604 4.595 5.054 5.560 515 6727 6. 130 6.866 7690 8613 9646 2137 9276 10.58 12.06 13.74 9.358 1076 12.38 143 16.37 21 22 23 24 25 1232 1.245 1257 1270 1282 1516 1.546 1577 1608 1 64] 1360 1916 1974 2.033 2094 2279 2370 2465 256 2666 2786 2925 3072 3226 3336 3400 36CM 3820 4. 049 4 292 4.141 4.430 4741 5072 5427 5.034 5437 5871 6341 6 848 6 109 6.659 7258 7911 8623 7400 3.140 3954 9.850 083 080 12 10 13.55 15.18 1700 15.67 17.86 20 36 23.21 26.46 1882 21.64 24.89 2363 3292 26 27 28 29 30 1296 1308 1321 1335 1343 1673 1.707 174 1776 1811 2157 2221 228 2357 2427 2772 2833 2999 3.119 3243 3.556 333 3920 4116 322 454g 4822 5. 112 5418 5.743 507 6214 6649 114 7612 7396 7988 8627 9317 006 9399 10 25 11.17 12.17 1327 11.92 13.11 14.42 15.86 1745 19.04 21.32 22.33 2675 296 30 34.39 20 4.69 05 37.86 354 5007 57 58 56 21 0 1489 2208 3262 480] 7040 10 28 1497 212 341 45 26 2015 1882 2679 50 1.646 2682 4324 107 114 1642 29 46 4600 74 36 1174 2390 002 1064 x Reference 14 15 6.628 6.811 6002 6.142 5.468 5.575 5.008 5.092 4.611 4675 16 17 18 19 20 6.265 6.373 6.467 6.550 6.623 5.724 5 847 5954 6047 6.128 6.198 6.259 5.162 5.222 5273 5.316 5.353 13.004 12.106 11 296 10.563 9 899 9.295 8 745 8.244 7.786 7.367 13.865 12.849 11.938 11.118 10.380 9712 9.108 8.559 8,061 7606 14 718 13.57812561 11.652 10.838 10.106 9447 8.851 8.313 7824 15.562 14.292 13.166 12.166 11 274 10.477 9.763 9.122 8.544 8.022 16.399 14.992 13.754 1265911690 10.828 10.0599.372 8.756 8.201 17 226 15.678 14 32413.13412085 11.15810.336 9.604 8 950 8.365 18.046 16.351 14.877 13.590 12462 11.470 10.594 9818 9.129 8.514 18.857 17.011 15.415 14.029 12821 11.764 10.836 10.017 9.292 8.649 19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.2019.442 8.772 20.456 18 292 16.444 14.857 13.489 12.303 11.272 10.371 9580 8.883 21.243 18 914 16.936 15 247 13.799 12.550 11.469 10.529 9.707 8.985 22.023 19.52317.413 16.622 14.094 1278311654 10.675 9.823 9.077 22.796 20.12117.877 15 98314 375 13.003 11.826 10.8109.929 9.161 23.560 20.70718 32716.330 14.643 13.211 11.987 10.936 10.027 9237 24.316 21.28118.764 16.663 14.898 13.406 12.137 11.05110 116 9.307 25.066 21.844 19.188 16.984 15.141 13.591 12 278 11.158 10.1989.370 25.808 2239819.600 17.292 15.372 13.765 12.409 11.258 10 274 9.427 32.835 27356 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 39.196 31.424 25.730 21.482 18 256 15.762 13.801 12 233 10.962 9.915 6.974 7.120 7.250 7.366 7.469 7.562 7.645 7.718 7.784 7.843 21 22 23 24 25 5669 5.749 5.818 5.877 5.929 5.973 6.011 6.044 6,073 6.097 4730 4.775 4.812 4.844 4870 4.891 4909 4.925 4.937 4.948 6687 6.743 6.792 6.835 6.873 6.312 6.359 6.399 6.434 6.464 26 27 28 29 30 7.896 7.943 7.984 8.022 8.055 6.906 6.935 6.961 6.983 7.003 6.491 6.514 6.534 6.561 6.566 6.118 6.136 6.152 6.166 6.177 5 384 5.410 5.432 5.451 5.467 5.480 5.492 5.502 5.510 5.617 5.548 4.956 4.964 4970 4975 4.979 4.997 4999 40 7.105 6.642 6.233 50 8.244 8.304 7.133 6.661 6.246 5.554 Print Done Reference - X xo Periods 2% 1.000 2010 3.030 4.060 5.101 1.000 2020 3.060 4.122 5.204 3% 1.000 2.030 3.091 4.184 5.309 10% 1.000 2.100 3.310 4.641 6.105 12% 1.000 2.120 3.374 4.779 6.353 14% 1.000 2140 3.440 4.921 6.610 15% 1.000 2.150 3.473 4.993 6.742 7 8 9 10 6.152 7.214 8.286 9.369 10.46 6.308 7.434 8.583 9.755 10.95 6.468 7.662 8.892 10.16 11.46 Future Value of Ordinary Annuity of $1 4% 5% 6% 7% 8% 9% 1.000 1.000 1.000 1.000 1.000 1.000 2.040 2050 2060 2070 2080 2.090 3.122 3.153 3.184 3.215 3.246 3.278 4.246 4.310 4.375 4.440 4.506 4.573 5.416 5.526 5.637 5.751 5.867 5.985 6.633 6.802 6.975 7.153 7.336 7.523 7.898 8.142 8.394 8.654 8.923 9 200 9.214 9.549 9.897 10.260 10.64 11.03 10.58 11.03 11.49 11.98 12.49 13.02 12.01 12.58 13.18 13.82 14.49 15.19 13.49 14 21 14.97 15.78 16.65 17.56 15.03 15.92 16.87 17.89 18.98 20.14 16.63 17.71 18 88 20.14 21.50 22.95 18.29 19.60 21.02 22.55 24.21 26.02 20.02 21.58 23 28 25.13 27.15 29.36 8.536 10.73 13.23 16.09 19.34 8.754 11.07 13.73 16.79 20.30 7.716 9.487 11.44 13.58 15.94 18.53 21.38 24.52 27.98 31.77 8.115 10.09 12.30 14.78 17.55 20.65 24.13 28.03 32.39 37.28 11 12 13 14 15 11.57 12.68 13.81 14.95 16.10 12.17 13.41 14.68 15.97 17.29 12.81 14.19 15.62 17.09 18.60 23.04 27.27 32.09 37.58 43.84 24.35 29.00 34 35 40.50 47.58 16 17 17.26 18.43 18.64 20.01 20.16 21.76 21.82 23.70 23.66 25.84 25 67 28 21 27.89 30.84 30.32 33.75 33.00 36.97 35.95 40.54 42.75 48.88 50.98 59.12 55.72 65.08 Print Done Reference -X xol as > 14 15 14.95 16.10 15.97 1729 17.09 18.60 18.29 20.02 19.60 21.58 21.02 23.28 22.55 25.13 25.02 29 36 32.39 37.28 37.58 43.84 40.50 47.58 16 17 18 19 20 17.26 18.43 19.61 20.81 22.02 18.64 20.01 21.41 22 84 24.30 20.16 21.76 23.41 25.12 26.87 21.82 23.70 25.65 27.67 29.78 23.66 25.84 28.13 30.54 33.07 25.67 28 21 30.91 33.76 36.79 27.89 30.84 34.00 37.38 41.00 24.21 27.15 30.32 33.75 37.45 41.45 45.76 27.98 31.77 35.95 40.54 45.60 51.16 57.28 42.75 48.88 55.75 63.44 72.05 50.98 59.12 68.39 78.97 91.02 55.72 65.08 75.84 88.21 102.4 33.00 36.97 41.30 46.02 51.16 56.76 62.87 69.53 76.79 84.70 21 22 23 24 25 23.24 24.47 25.72 26.97 28.24 25.78 27.30 28.85 30.42 32.03 28.68 30.54 32.45 34.43 36.46 31.97 34.25 36.62 39.08 41.65 35.72 38.51 41.43 44.50 47.73 39.99 43.39 47.00 50.82 64.86 44.87 49.01 53.44 58.18 63.25 50.42 55.46 60.89 66.76 73.11 64.00 71.40 79.54 88.50 98.35 81.70 92.50 104.6 1182 133.3 104.8 120.4 138.3 158.7 181.9 118.8 1376 159.3 1842 2128 26 27 28 29 30 29.53 30.82 32.13 33.45 34.78 33.67 35.34 37.05 38.79 40.57 38.55 40.71 42.93 45.22 47.58 44.31 47.08 49.97 52.97 56.08 51.11 54.67 58.40 62.32 66.44 59.16 63.71 68 53 73.64 79.06 68.68 74.48 80.70 87.35 94.46 79.95 87.35 96.34 1040 113.3 93.32 102.7 113.0 124.1 136.3 1092 121.1 1342 148.6 164.5 150.3 169.4 190.7 214,6 241.3 208.3 238.5 272.9 312.1 3568 245.7 283.6 327.1 3772 434.7 40 48.89 60.40 75.40 120.8 1548 1996 3379 4426 767.1 95.03 152.7 2591 573.8 1,342 4,995 1,779 7,218 50 64.46 84.58 112.8 209.3 290.3 406.5 815.1 1,164 2.400 Print Done