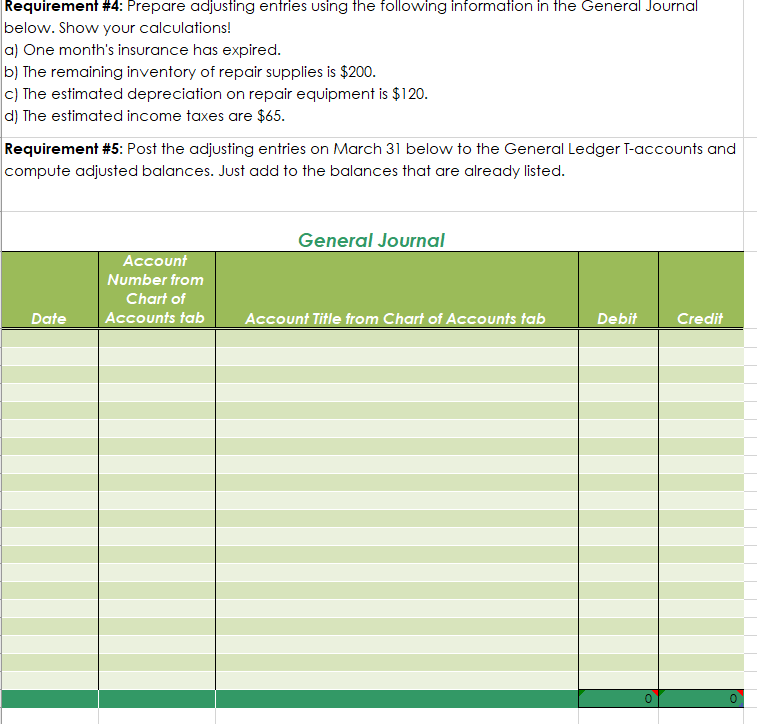

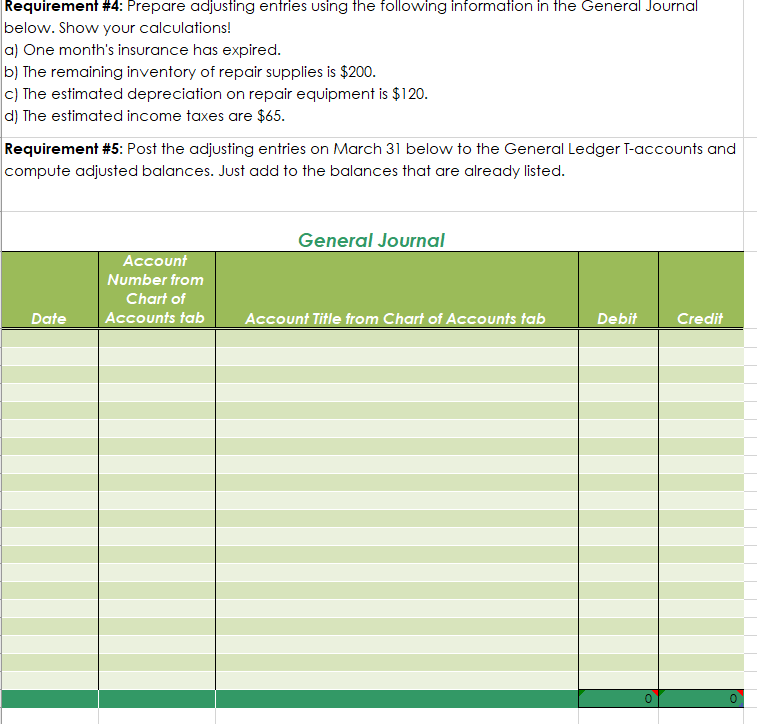

Requirement #4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The remaining inventory of repair supplies is $200. c) The estimated depreciation on repair equipment is $120. d) The estimated income taxes are $65.

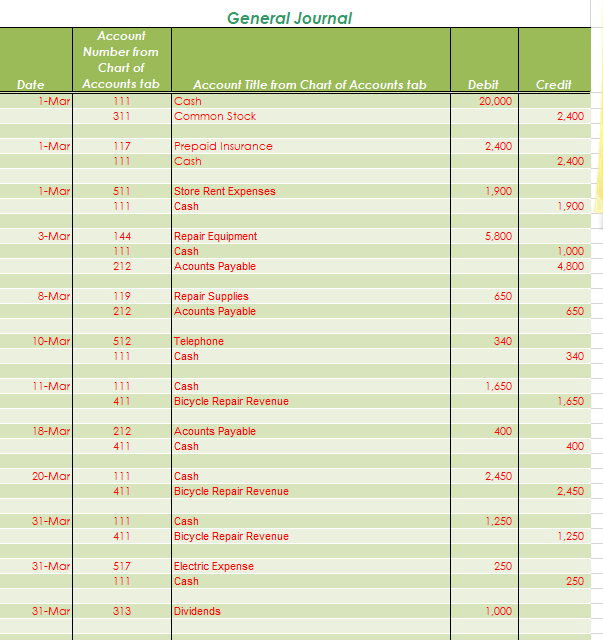

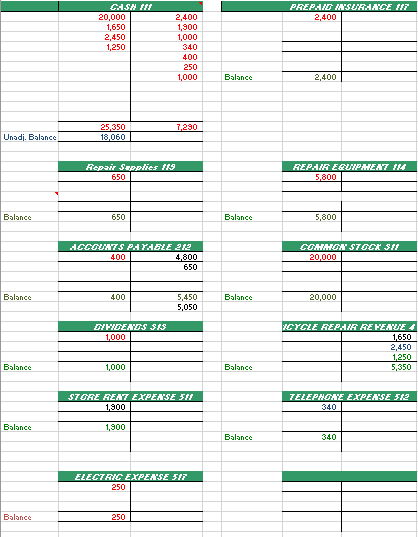

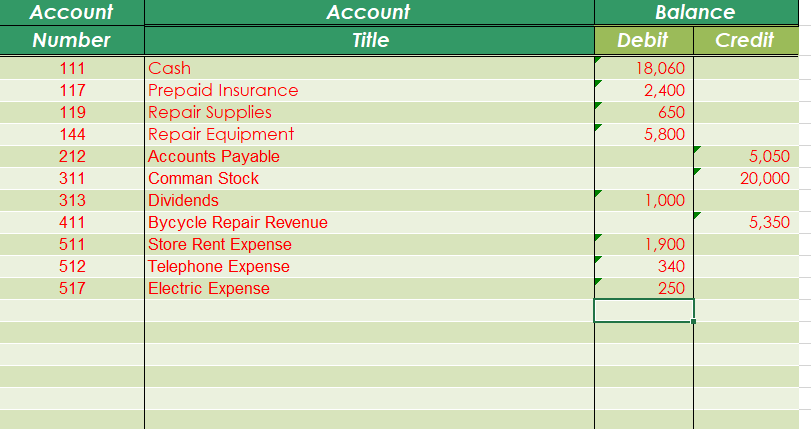

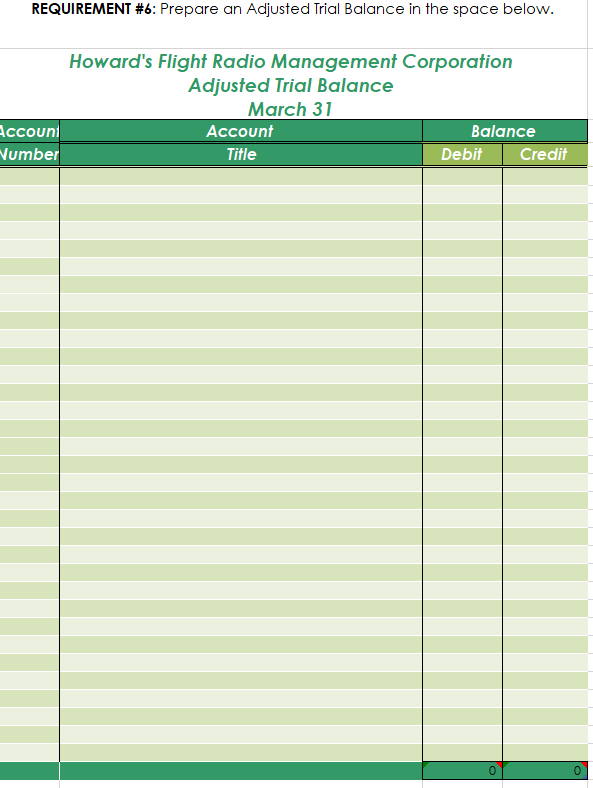

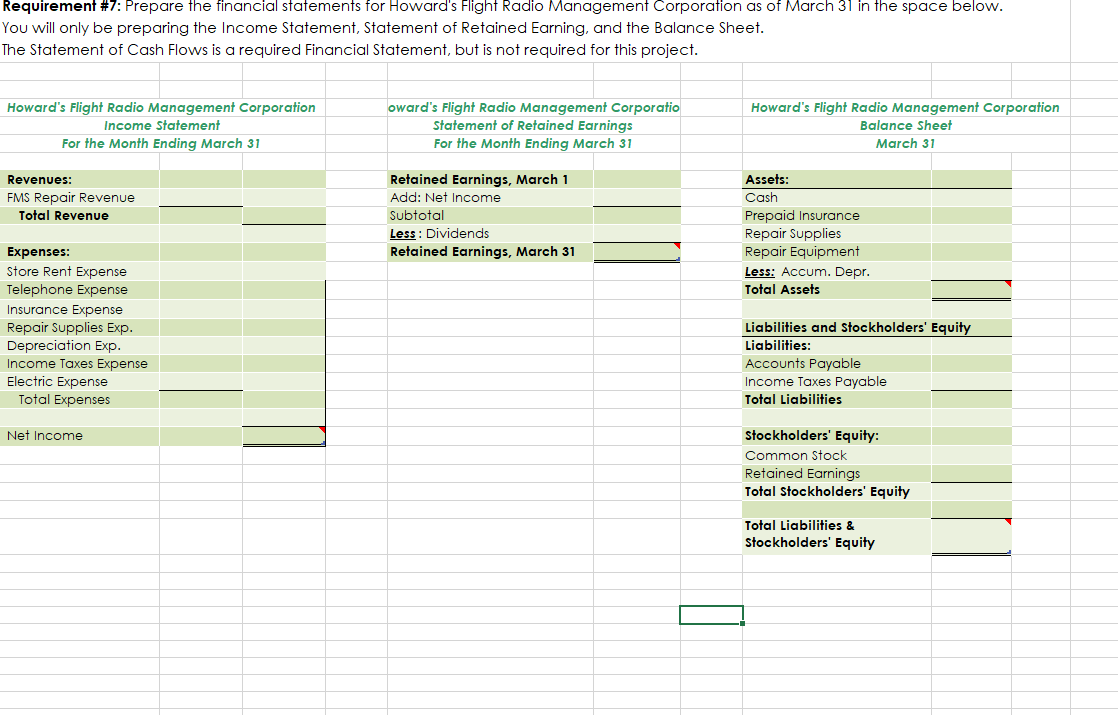

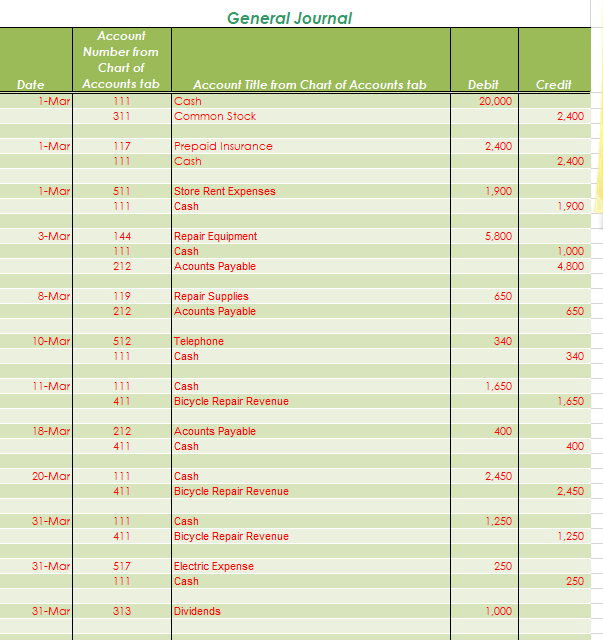

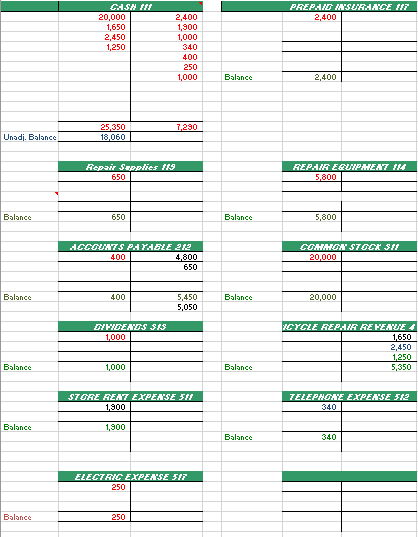

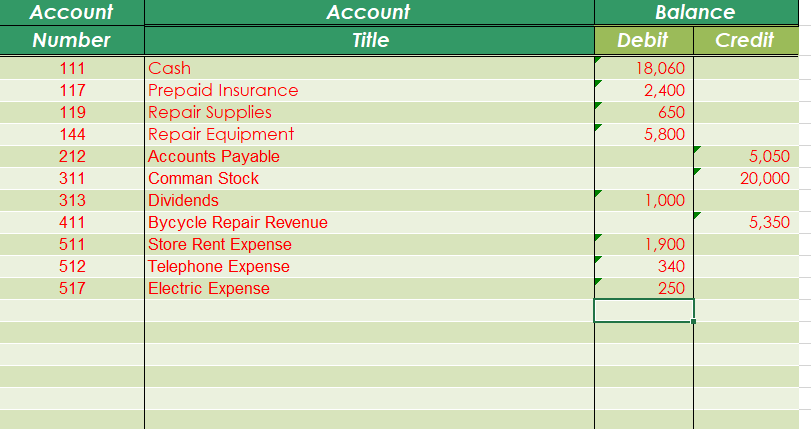

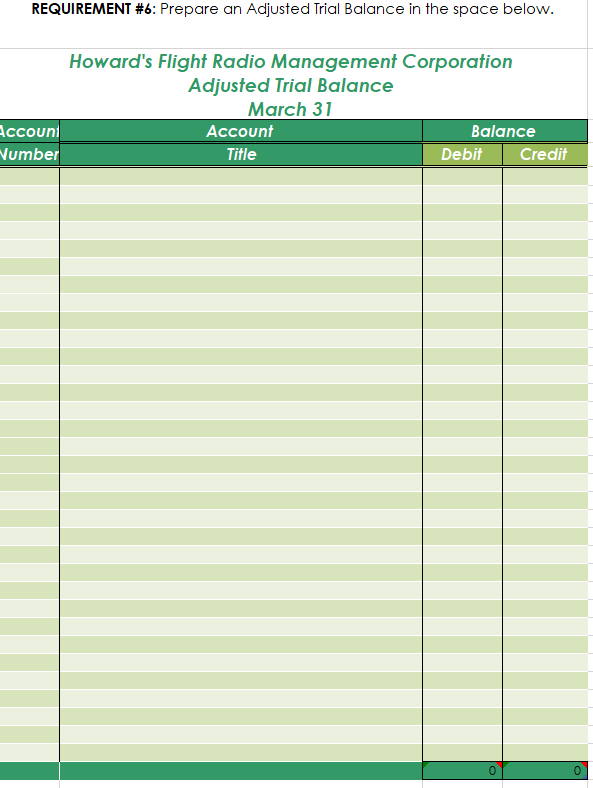

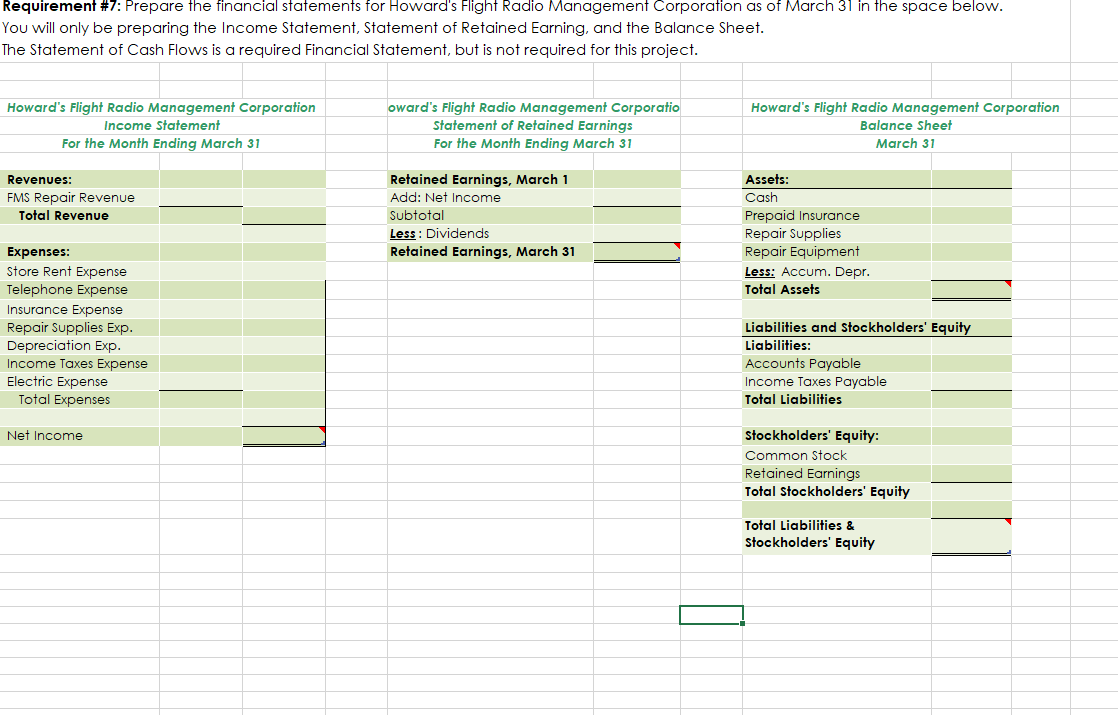

General Journal Account Number from Chart of Accounts tab 111 311 Credit Date 1-Mar Account Title from Chart of Accounts tab Cash Common Stock Debit 20,000 2.400 1-Mar 117 111 Prepaid Insurance 2,400 Cash 2,400 1-Mar 1,900 511 111 Store Rent Expenses Cash 1.900 3-Mar 5,800 144 111 Repair Equipment Cash Acounts Payable 1,000 4,800 212 8-Mar 650 119 212 Repair Supplies Acounts Payable 650 10-Mar 340 512 111 Telephone Cash 340 11-Mar 1.650 111 411 Cash Bicycle Repair Revenue 1,650 18-Mar 400 212 411 Acounts Payable Cash 400 20-Mar 111 411 2.450 Cash Bicycle Repair Revenue 2,450 31-Mar 1.250 111 411 Cash Bicycle Repair Revenue 1,250 31-Mar 250 517 111 Electric Expense Cash 250 31-Mar 313 Dividends 1,000 PREPAID MASUALACE 117 2,400 CASH 111 20,000 1,650 2,450 1,250 2,400 1,900 1,000 340 400 250 1,000 Balance 2,400 7.280 Unadi. Balance 25,350 18,060 Repair Supplies 119 650 AEP.4/A EQUPHEAT 114 5.800 Balance 650 Balance 5,800 ACCOUNTS PAYABLE 212 400 4.800 650 COMMON STOCK SI 20,000 Balance 400 Balance 20,000 5,450 5,050 DYFDEAUS SIS 1,000 XCYCLE REPAIR RE HEAVE 1,650 2,450 1250 5,350 Balance 1,000 Balance S7 GAE AEAT EXPEASE 511 1.900 TELEPHONE EXPEASE 512 340 Balance 1,300 Balance 340 ELECTAC EXPEA'SE 517 250 Balance 250 Account Number 111 117 119 144 212 311 313 411 511 512 517 Account Title Cash Prepaid Insurance Repair Supplies Repair Equipment Accounts Payable Comman Stock Dividends Bycycle Repair Revenue Store Rent Expense Telephone Expense Electric Expense Balance Debit Credit 18,060 2,400 650 5,800 5,050 20,000 1,000 5,350 1,900 340 250 Requirement #4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The remaining inventory of repair supplies is $200. c) The estimated depreciation on repair equipment is $120. d) The estimated income taxes are $65. Requirement #5: Post the adjusting entries on March 31 below to the General Ledger T-accounts and compute adjusted balances. Just add to the balances that are already listed. General Journal Account Number from Chart of Accounts tab Date Account Title from Chart of Accounts tab Debit Credit 0 0 REQUIREMENT #6: Prepare an Adjusted Trial Balance in the space below. Howard's Flight Radio Management Corporation Adjusted Trial Balance March 31 Accoun Account Balance Number Title Debit Credit 0 Requirement #7: Prepare the financial statements for Howard's Flight Radio Management Corporation as of March 31 in the space below. You will only be preparing the Income Statement, Statement of Retained Earning, and the Balance Sheet. The Statement of Cash Flows is a required Financial Statement, but is not required for this project. Howard's Flight Radio Management Corporation Income Statement For the Month Ending March 31 oward's Flight Radio Management Corporatio Statement of Retained Earnings For the Month Ending March 31 Howard's Flight Radio Management Corporation Balance Sheet March 31 Revenues: FMS Repair Revenue Total Revenue Retained Earnings, March 1 Add: Net Income Subtotal Less : Dividends Retained Earnings, March 31 Assets: Cash Prepaid Insurance Repair Supplies Repair Equipment Less: Accum. Depr. Total Assets Expenses: Store Rent Expense Telephone Expense Insurance Expense Repair Supplies Exp. Depreciation Exp. Income Taxes Expense Electric Expense Total Expenses Liabilities and Stockholders' Equity Liabilities: Accounts Payable Income Taxes Payable Total Liabilities Net Income Stockholders' Equity: Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities & Stockholders' Equity