*Requirement 6 is not needed* Also so sorry this is a long question! I understand how to do the income statement and statement of owners equity so if you are unable to do those, its okay!

*Requirement 6 is not needed* Also so sorry this is a long question! I understand how to do the income statement and statement of owners equity so if you are unable to do those, its okay!

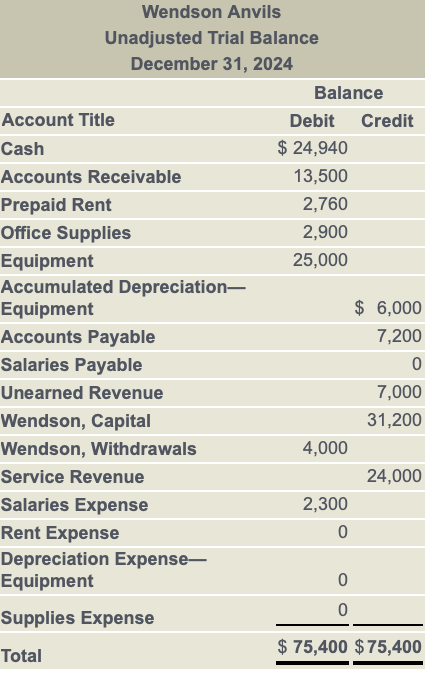

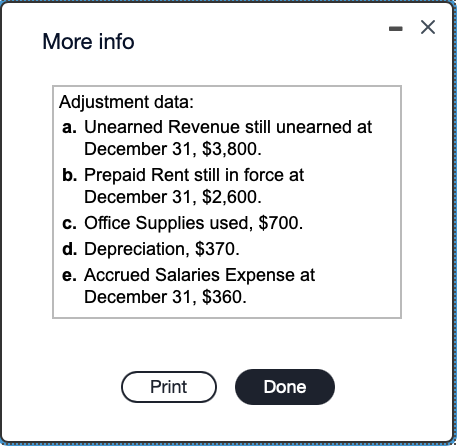

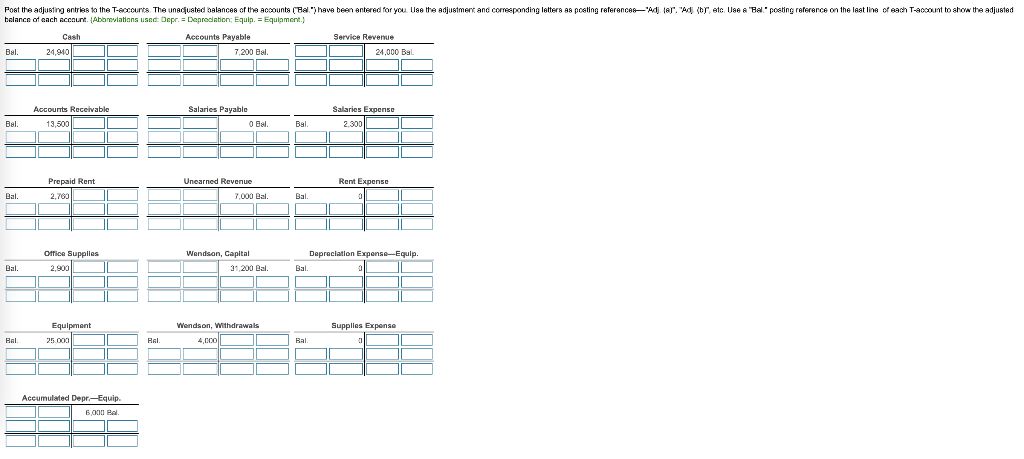

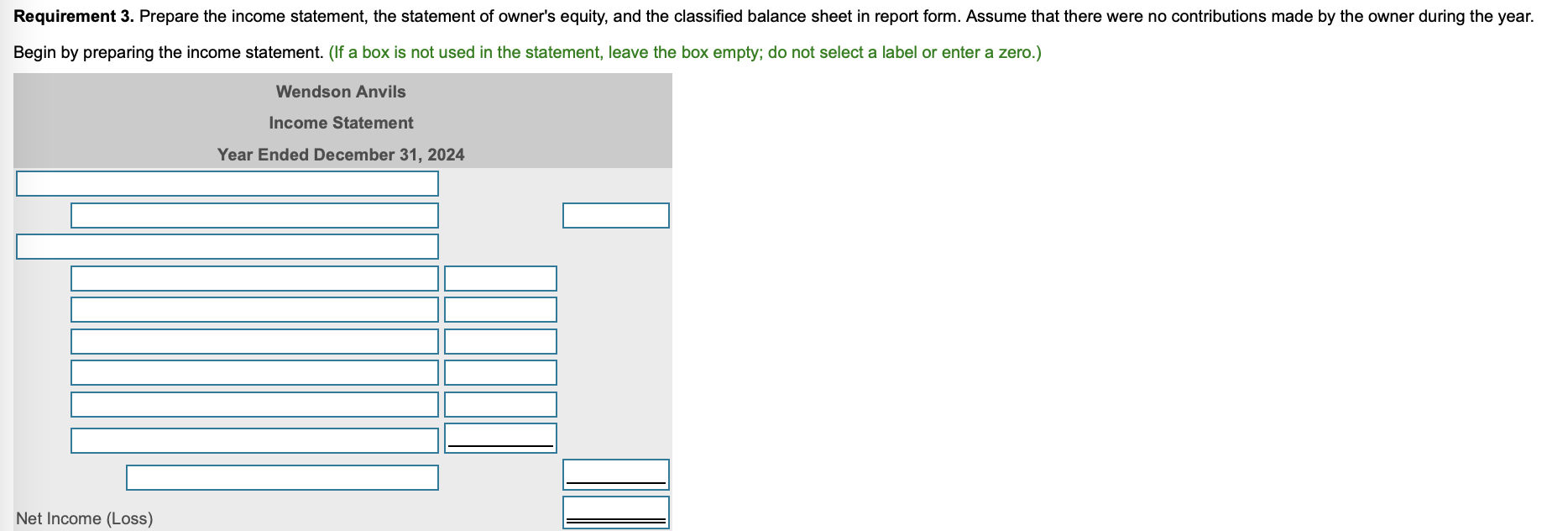

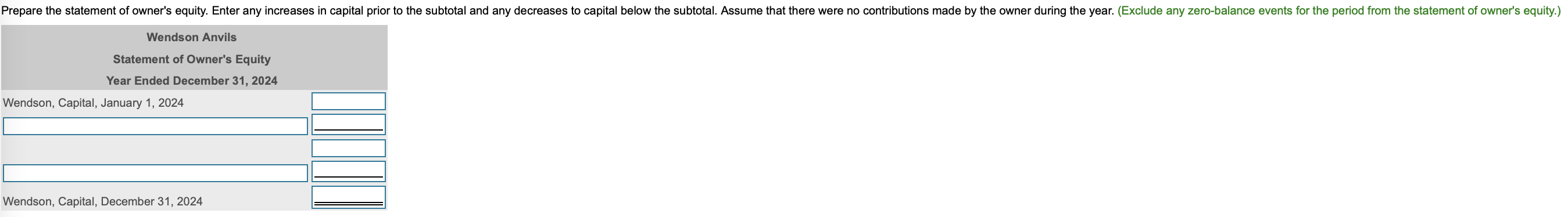

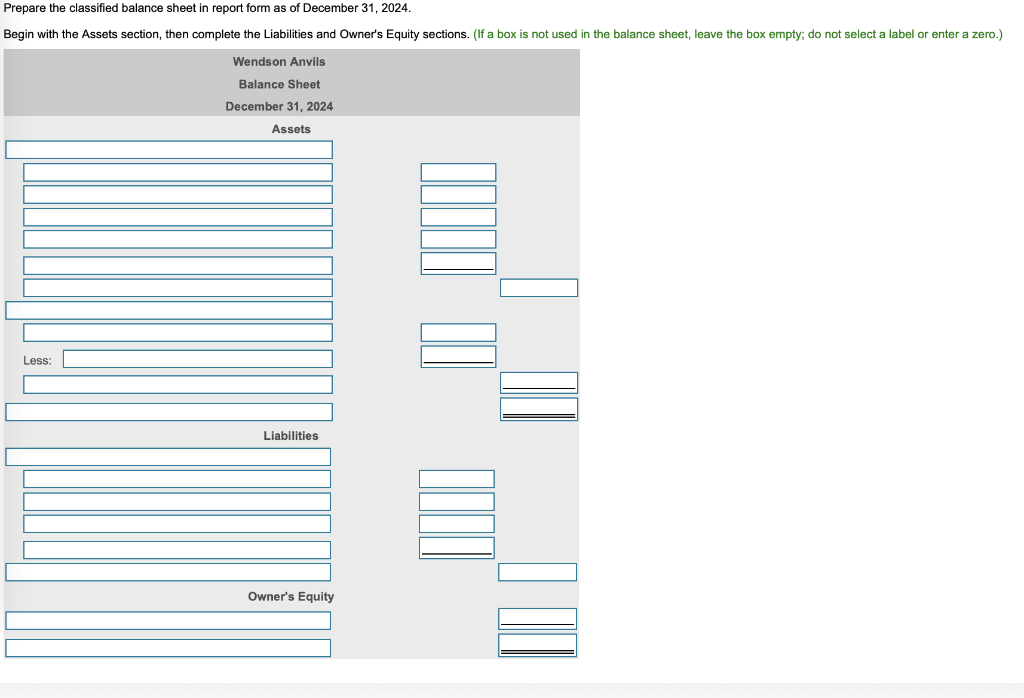

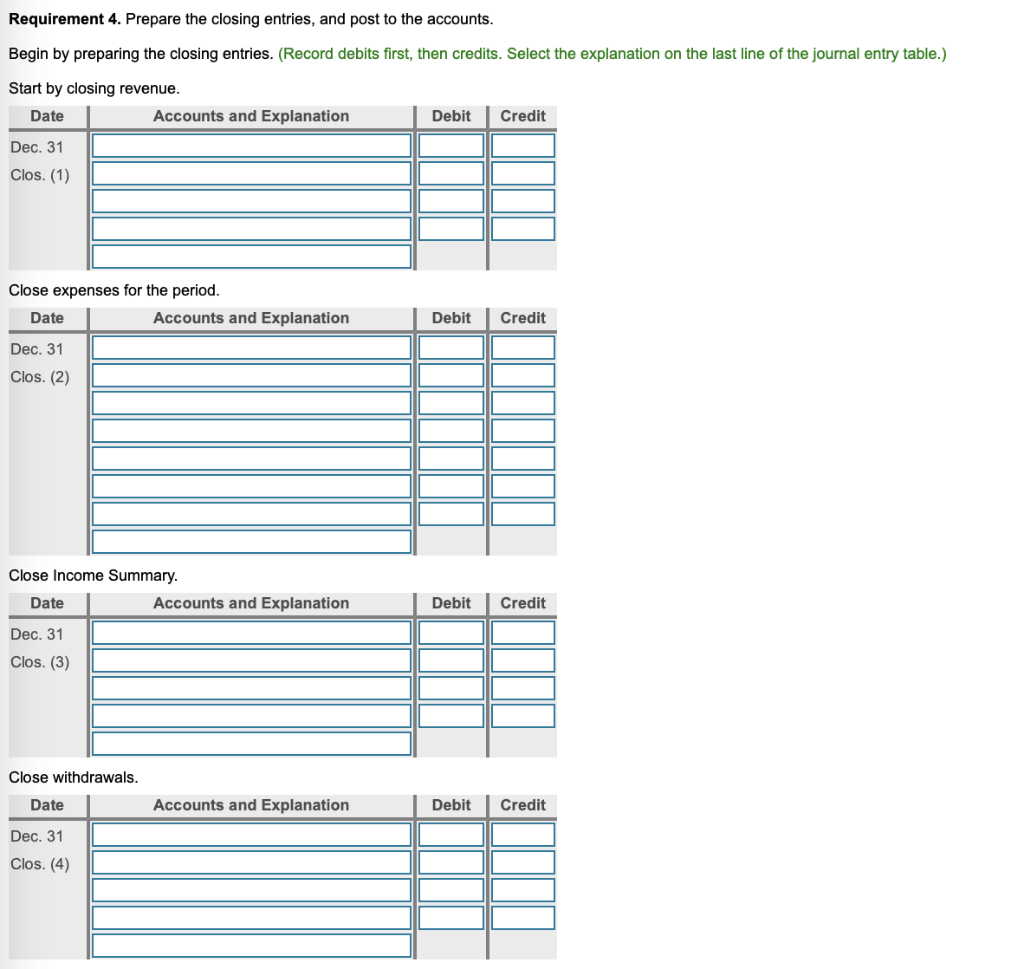

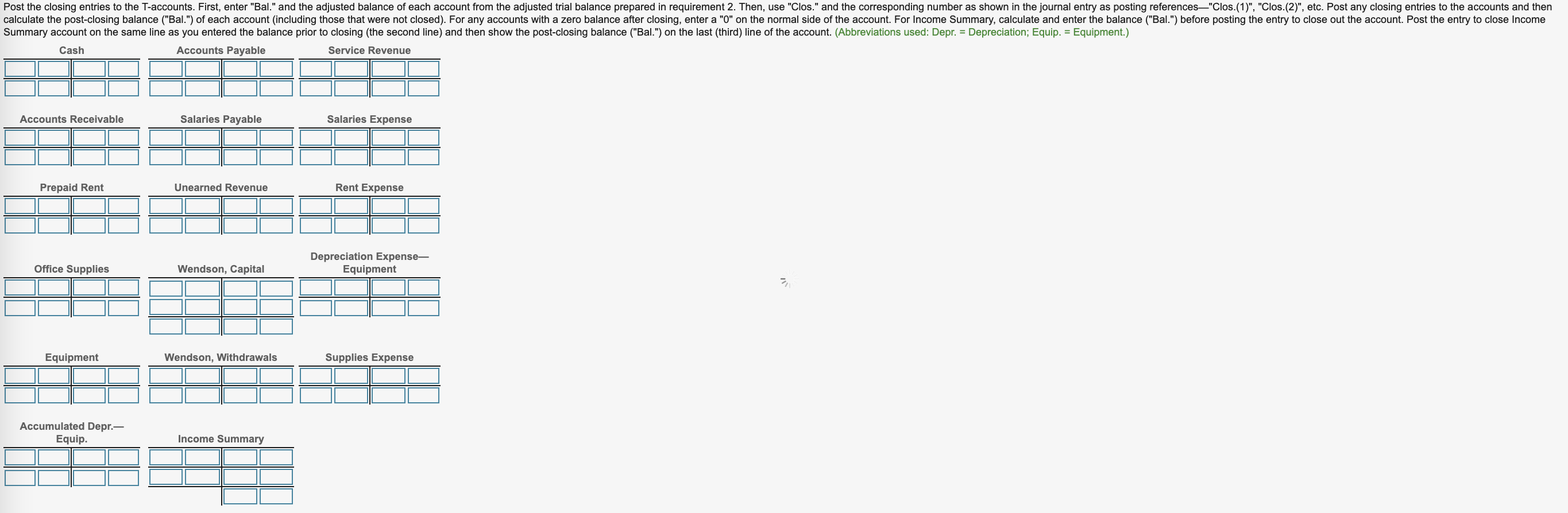

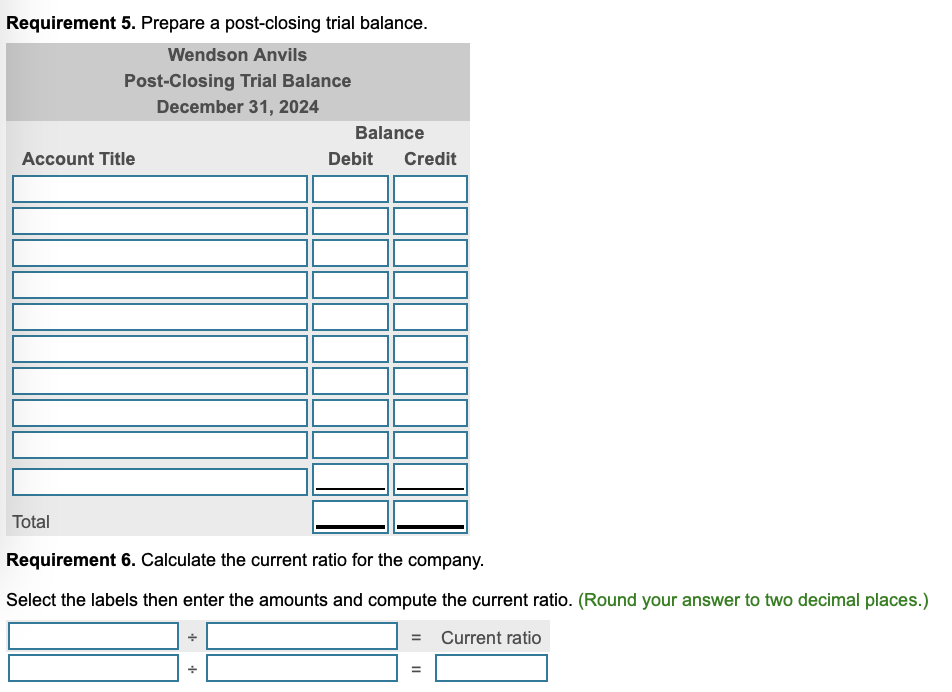

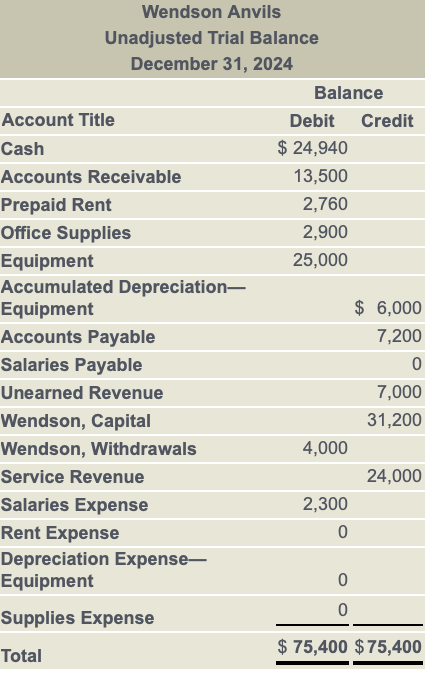

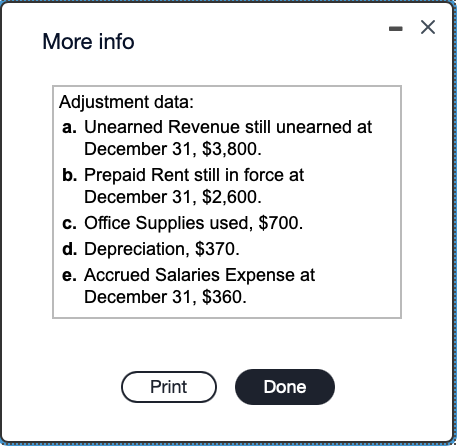

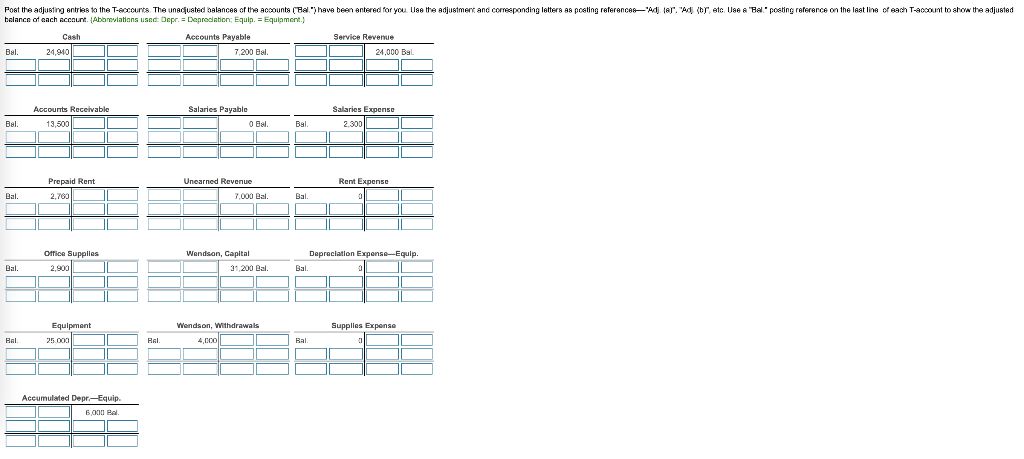

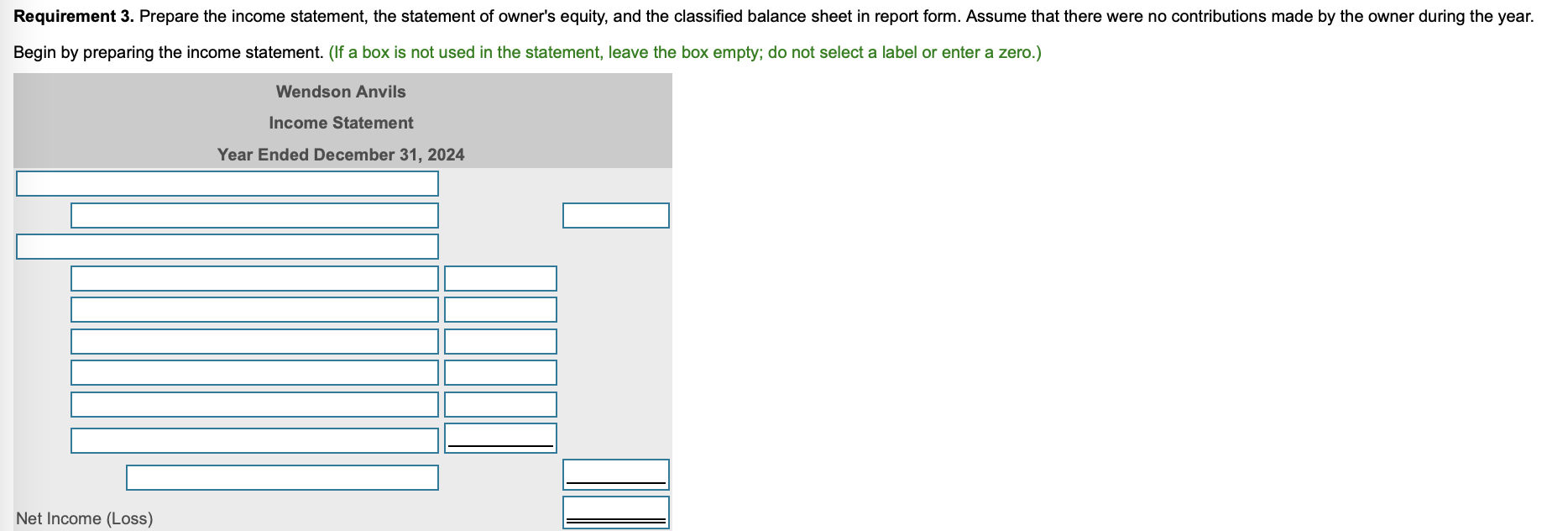

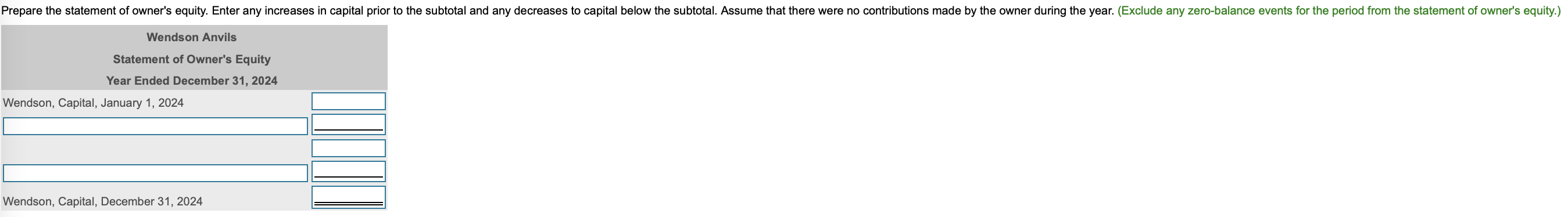

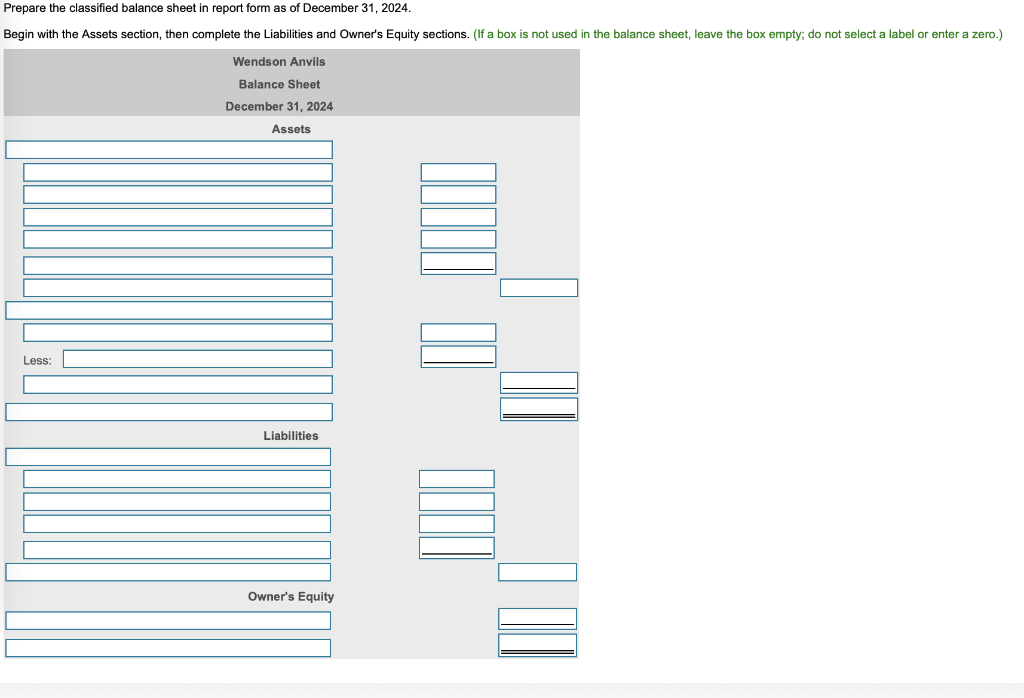

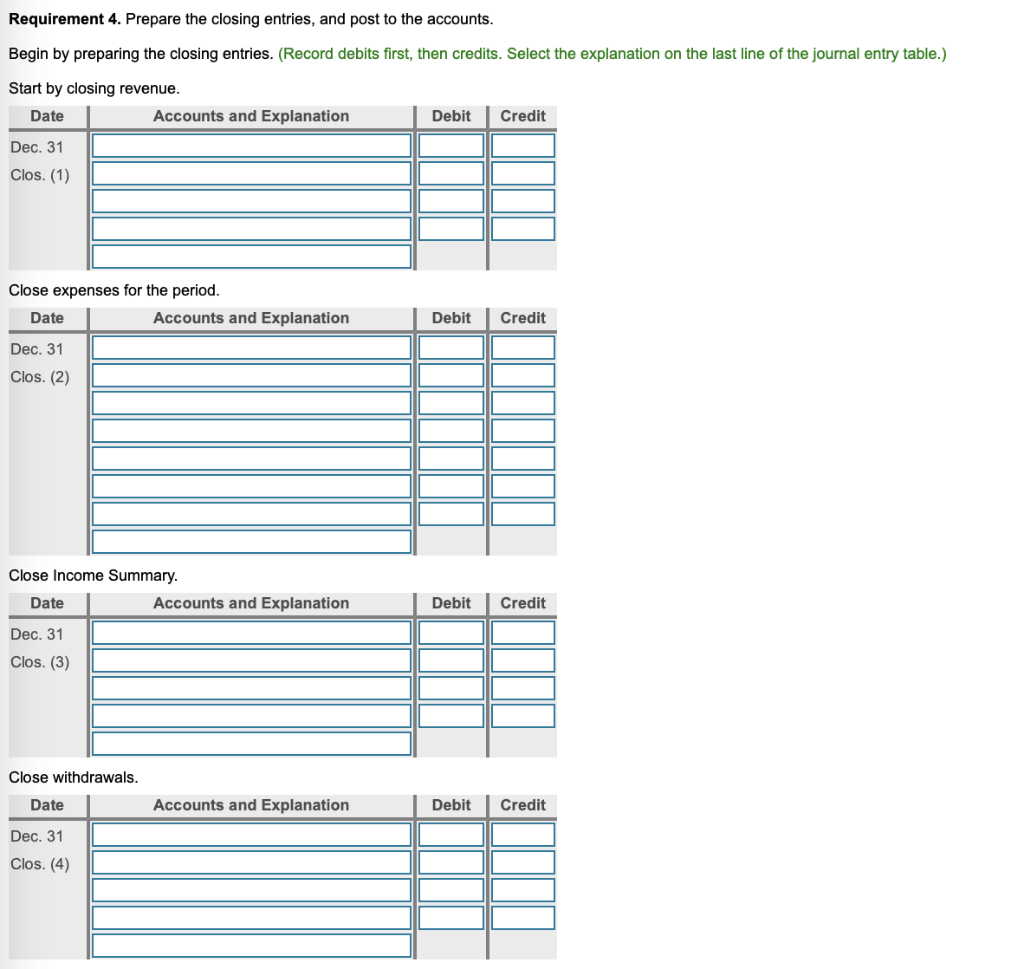

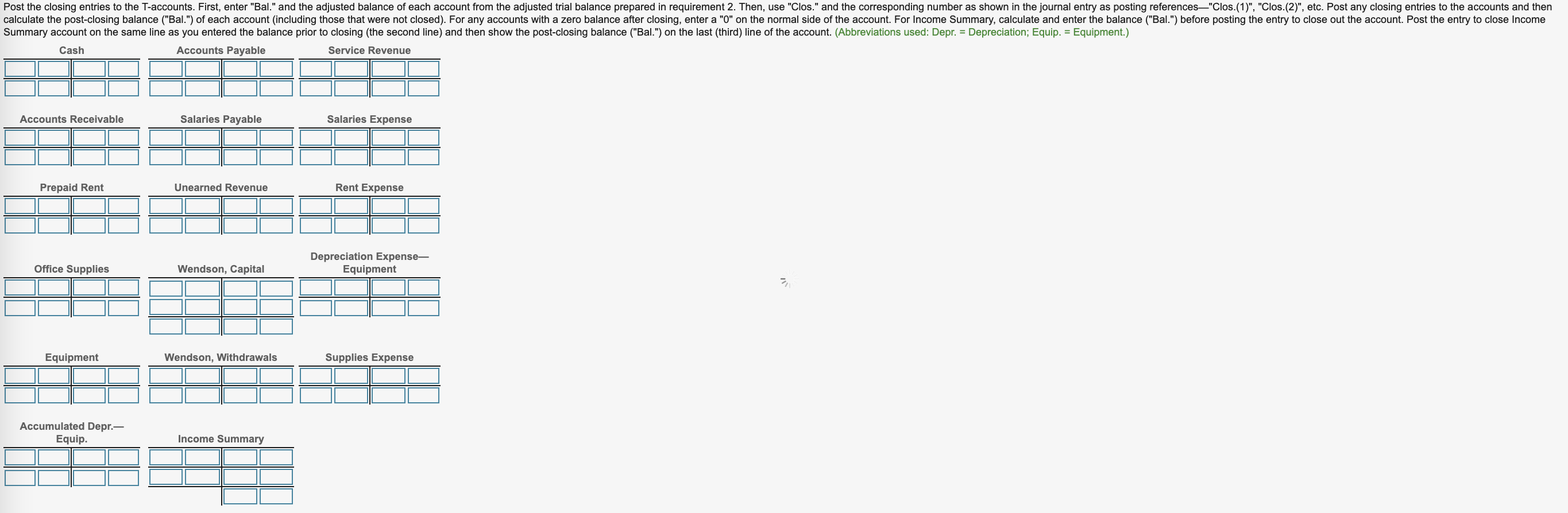

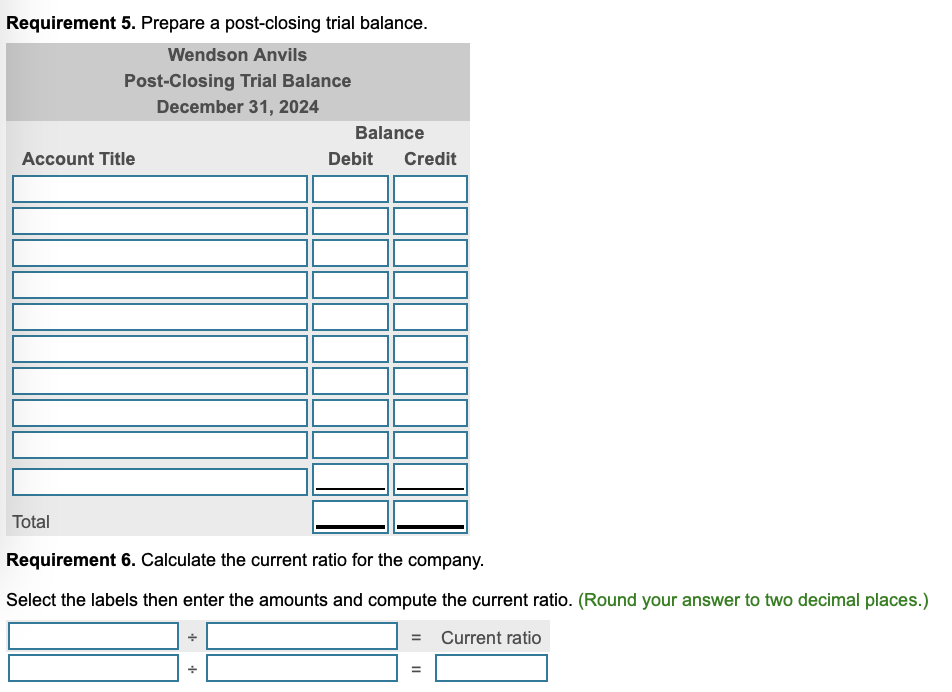

Wendson Anvils Unadjusted Trial Balance December 31, 2024 Balance Account Title Debit Credit Cash $ 24,940 Accounts Receivable 13,500 Prepaid Rent 2,760 Office Supplies 2,900 Equipment 25,000 Accumulated Depreciation- Equipment $ 6,000 Accounts Payable 7,200 Salaries Payable 0 Unearned Revenue 7,000 Wendson, Capital 31,200 Wendson, Withdrawals 4,000 Service Revenue 24,000 Salaries Expense 2,300 Rent Expense 0 Depreciation Expense- Equipment 0 0 Supplies Expense $ 75,400 $ 75,400 Total - X More info Adjustment data: a. Unearned Revenue still unearned at December 31, $3,800. b. Prepaid Rent still in force at December 31, $2,600. c. Office Supplies used, $700. d. Depreciation, $370. e. Accrued Salaries Expense at December 31, $360. Print Done Post the adjusting entries to the T-accounts. The unadjusted balances of the accounts (Bal") have been entered for you. Use the adjustment and corresponding letters as posting references"Adilar. "Adi (br. etc Use a "Bal" posting reference on the last line of each T-account to show the adjusted balance of each account. (Abbreviations used: Depr. Depreciation Equin. = Equlament Cash Accounts Payable Service Revenue 24.9101 7,200 Bal. 24,000 Bal Salaries Expense Accounts Receivable 13,5001 Salaries Payable O Bal. RAI 2.300 Rent Expense Prepaid Rent 2.760 Unearned Revenue 7,000 Bal. Bal. Bal. 0 II Depreciation Expanse-Equip Office Supplies 2,9001 Wendson, Capital 31,200 Bal Bal. Bal. Wendson, Withdrawals Supplies Expense Equipment 25.000 HAI 4,000 Bal Accumulated Depr-Equip 6,00 B Requirement 3. Prepare the income statement, the statement of owner's equity, and the classified balance sheet in report form. Assume that there were no contributions made by the owner during the year. Begin by preparing the income statement. (If a box is not used in the statement, leave the box empty; do not select a label or enter a zero.) Wendson Anvils Income Statement Year Ended December 31, 2024 Net Income (Loss) Prepare the statement of owner's equity. Enter any increases in capital prior to the subtotal and any decreases to capital below the subtotal. Assume that there were no contributions made by the owner during the year. (Exclude any zero-balance events for the period from the statement of owner's equity.) Wendson Anvils Statement of Owner's Equity Year Ended December 31, 2024 Wendson, Capital, January 1, 2024 Wendson, Capital, December 31, 2024 Prepare the classified balance sheet in report form as of December 31, 2024. Begin with the Assets section, then complete the Liabilities and Owner's Equity sections. (If a box is not used in the balance sheet, leave the box empty; do not select a label or enter a zero.) Wendson Anvils Balance Sheet December 31, 2024 Assets Less: Liabilities Owner's Equity Requirement 4. Prepare the closing entries, and post to the accounts. Begin by preparing the closing entries. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Start by closing revenue. Date Accounts and Explanation Debit Credit Dec. 31 Clos. (1) Close expenses for the period. Date Accounts and Explanation Debit Credit Dec. 31 Clos. (2) Close Income Summary. Date Accounts and Explanation Debit Credit Dec. 31 Clos. (3) Close withdrawals. Date Accounts and Explanation Debit Credit Dec. 31 Clos. (4) Post the closing entries to the T-accounts. First, enter "Bal." and the adjusted balance of each account from the adjusted trial balance prepared in requirement 2. Then, use "Clos." and the corresponding number as shown in the journal entry as posting references"Clos. (1)", "Clos.(2)", etc. Post any closing entries to the accounts and then calculate the post-closing balance ("Bal.") of each account (including those that were not closed). For any accounts with a zero balance after closing, enter a "0" on the normal side of the account. For Income Summary, calculate and enter the balance ("Bal.") before posting the entry to close out the account. Post the entry to close Income Summary account on the same line as you entered the balance prior to closing the second line) and then show the post-closing balance ("Bal.") on the last (third) line of the account. (Abbreviations used: Depr. = Depreciation, Equip. = Equipment.) Cash Accounts Payable Service Revenue Accounts Receivable Salaries Payable Salaries Expense Prepaid Rent Unearned Revenue Rent Expense Office Supplies Wendson, Capital Depreciation Expense- Equipment Equipment Wendson, Withdrawals Supplies Expense Accumulated Depr.- Equip. Income Summary Requirement 5. Prepare a post-closing trial balance. Wendson Anvils Post-Closing Trial Balance December 31, 2024 Balance Account Title Debit Credit Total Requirement 6. Calculate the current ratio for the company. Select the labels then enter the amounts and compute the current ratio. (Round your answer to two decimal places.) = Current ratio

*Requirement 6 is not needed* Also so sorry this is a long question! I understand how to do the income statement and statement of owners equity so if you are unable to do those, its okay!

*Requirement 6 is not needed* Also so sorry this is a long question! I understand how to do the income statement and statement of owners equity so if you are unable to do those, its okay!